Source: www.TheChartStore.com

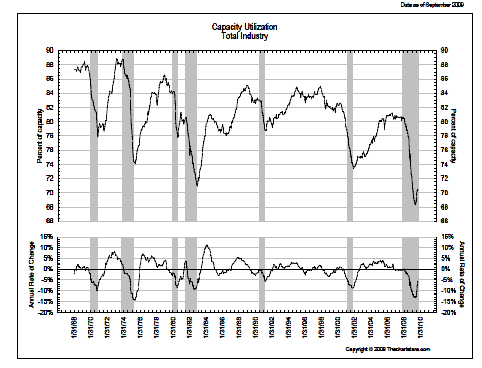

Now if you had 30% idle capacity, no way to increase sales or prices, and were facing rising input (raw material) costs, what would do that to your margins? Exactly.

How could capacity utilization increase?

- Demand and hence production goes up (unlikely, given the state of the US consumer)

- Capacity gets “destroyed” (bankruptcy or plant closures): government interferes (bail-out of large companies)

Again, not a good outlook for equities.

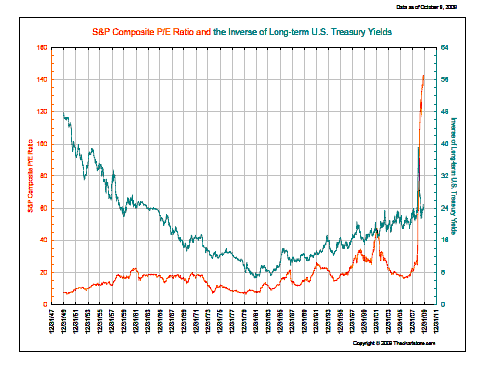

You would think that, under these circumstances, equities were cheap. Not according to this graph:

Source: www.TheChartStore.com

Looking at this chart it becomes evident that equities are not cheap, but three times more expensive relative to earnings since more than 60 years.

Interest rates are low (= high inverse yield in this chart), but there is no point in the last 60 years which could act as a reference for the current dissonance. This suggests something will have to give.