What are CP’s? They are unsecured “promissory notes”, sold by large companies and banks with excellent credit ratings to finance short-term needs. They mature within 1 to 270 days (35 on average). Unsecured means there is no collateral (except asset-backed CPs). If the issuer goes belly-up while you hold a CD the joke’s on you. Who buys them? Money market funds and other large institutional investors who want to park short-term liquidity.

The volume of CP’s outstanding has been shrinking considerably since 2006 (from more than $2 trn, especially Asset Backed CP’s). Recently the volume of non-financial (industrial issuers) CP’s has been recovering, but look at the financial CP’s outstanding (red line) – no recovery in sight.

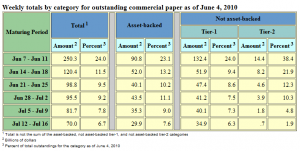

If rating agencies downgrade US banks (due to the end of assumed government support) they would be excluded from issuing any more CP’s. Within the next 6 weeks $720bn of CP’s mature.

If a company has a large CP program financing problems will show up quickly in case of a rating downgrade of just a lack of buyers for its paper in the market. This could, for example, happen to BP (although they could probably live without CP issuance due to their constant cash-flow. Different story for a bank, where the leverage ratio between debt and equity is usually much higher than in an industrial company).