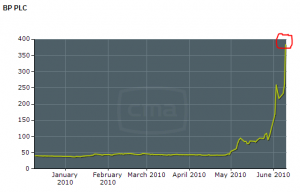

Take a look at CDS (credit default swap) for BP (British Petroleum): because of the possible clean-up costs for the Gulf of Mexico oil spill (especially after a hurricane) insurance costs against bankruptcy today increased by almost 50% to 383bps (basis points). That means it would cost $38,300 annually to insure $1,000,000 of debt against default within the next 5 years.

Equity is the risk-bearing capital, so if there is increasing doubt even the debt could not be paid back the stock price will obviously drop. Since the accident the stock went from $60 to $30, now yielding more than 9% (if dividend will be kept). At worst, the stock could be reduced to what amounts to a pure option value (the company could, for example, file for bankruptcy to escape penalties etc).

Some “industry experts” are apparently suggesting BP will have to file for bankruptcy within a month. But this could also be scare tactics of people related to hedge funds (who are eager to buy a “most hated” stock at cheap levels).

I would personally wait to see the devastating effects a potential hurricane would have on the environment (oil booms etc would be rendered useless). Usually these kind of situations get worse, and worse, and worse (and the damage is always greater than initially thought).

What’s the larger significance of all this? Stock investors should look more on where the debt side of the company is priced at. The whole could be said for countries. A government close to default might confiscate the remaining (still standing and most profitable) companies to get access to the cash flow.