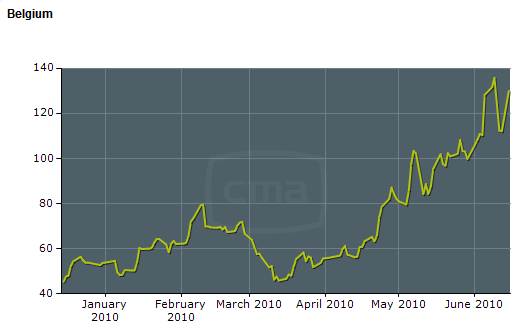

Decent move in Belgian CDS (credit default swaps) today (+16% to 130bps) after Flemish separatists emerged as strongest party in Sunday’s elections. After elections in 2007 it took nine months to form an unstable five-party coalition (leading to three governments in as many years). Fears are the highly indebted country might break up leaving the French speaking southern part with a level of debt it will find itself unable to service.

CDS levels are still surprisingly mild compared to Spain (233bps +8%) and Italy (192bps +8%).

Meanwhile, Moody’s finally had a mind spark and decided to downgrade Greece from A3 (A-) to BA1 (BB+, which is “junk”) with a stable outlook. Among the major rating agencies only European-based Fitch does not yet see the need to downgrade Greece to junk “in the immediate future”.