Another day in the bond market, another day of sovereign spread widening. 10yr Greeks now (June 16) yield 9.34% (+0.26), Spanish 4.88% (+0.14), compared to German 2.66% (unch.). On Thursday, Spain will try to sell EUR 3.5bn in new 10yr and 30yr bonds. Good luck. We won’t even know if the auction failed or not because the ECB might buy the whole issue directly (instead of buying in the secondary market later).

Is corporate debt safer than government debt?

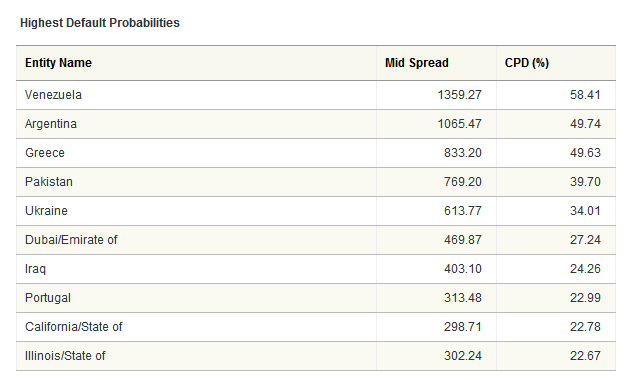

Until now rating agencies have mostly worked with the assumption that a corporation cannot have a better rating than the country it is based in. Which, in other words, means the country is the last one to go bankrupt (the state has the authority to tax revenue and/or profits at will, so it would help itself to the corporations’ cash flow before running out of cash itself). But credit default swaps (CDS) prices do not seem to follow this thesis. Many countries now have a higher perceived risk of default (bankruptcy) than some of the companies they host. Below is a table showing the top 10 bond issuers by likelihood of bankruptcy, based on where their CDS are currently trading. Look at no 9+10: State of California and State of Illinois. Meanwhile Sun Microsystems CDS are trading at 18bps (less than half the level of the US and Germany). By pushing private debt up to the government level the latter now is more likely to default than some of the companies it is entitled to tax. Schizophrenic, but we might have to live with this phenomenon for the foreseeable future.