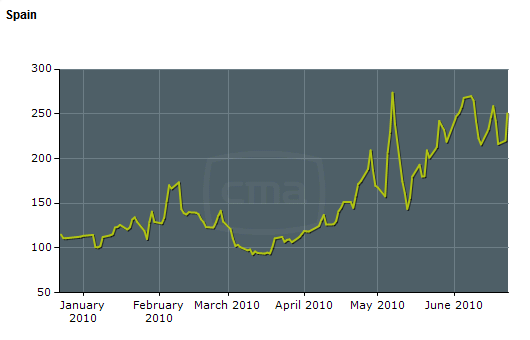

The love affair with Spanish debt (after recent auction) was short – the 5yr CDS (credit default swap) rate short up to 250bps (+30) today (see chart).

Meanwhile Greek 10yr bonds widened to 9.77% (+0.29) compared to Germany’s 2.69% (-0.07). This crisis is not going away, and the market does not seem to expect anything good to come out of the upcoming G20 meeting. Now that French banks have unloaded their holdings of Greek government bonds to the ECB (European Central Bank) at inflated prices it would be a good opportunity to allow Greece to default.