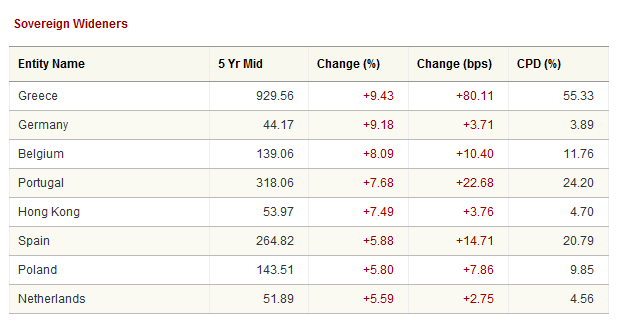

Greek 10yr government bond yields today reached 10.37% (+0.60) as credit default swaps (cost of insuring against bankruptcy of the Greek government) rose 85bps to 940. Even 2yr bonds yield 9.78% (+0.57) – a time period presumably covered by the European bail-out package. Spain (10yr 4.52% +0.07), Italy (4.04% +0.07) and Portugal traded wider compared to Germany (2.64% -0.04). Brazil and Mexico (4.73%, 4.62%) continue to widen against the US (3.12%, -0.05).

It is not clear how all this will end, but it will not end well. The most likely outcome is that Central Banks will continue to print money, thereby turning it into worthless paper. This would speak for investments in gold.