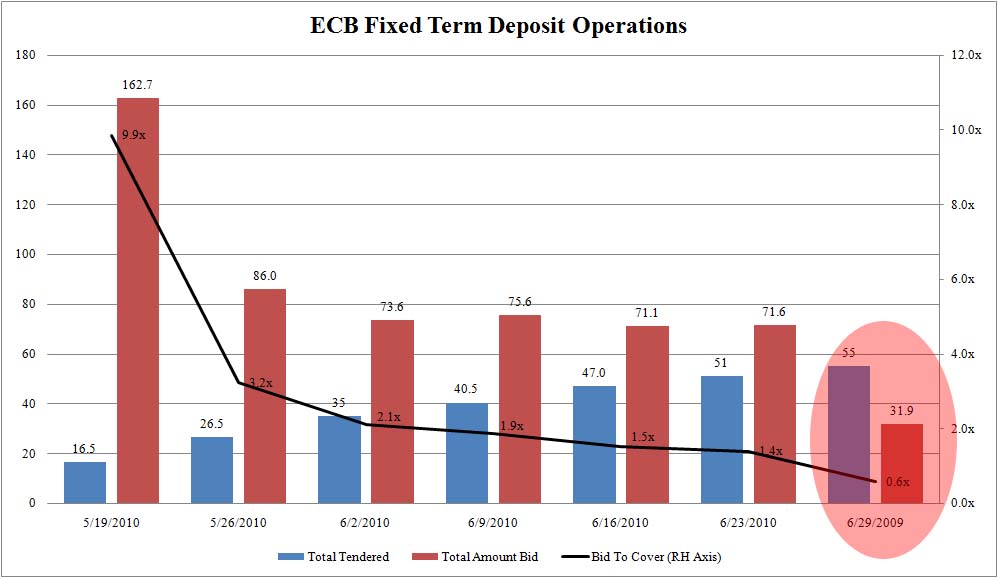

The European Central Bank just experienced a failed auction. A failed auction means that you did not achieve to sell a predetermined amount of securities to the market. Here, the ECB wanted to mop up EUR 55bn in liquidity (to “sterilize” a similar amount of European government bonds they bought) and received bids for less than 32bn (see chart below). This indicates a failure of monetary policy. European banks prefer to keep their cash as they fear needing it in the future.

Meanwhile European banks are selling off by 5-6%, the Swiss Franc soaring, and the comedy around European bank stress tests continuing. Tomorrow is the end of the first semester (important reporting date for companies, and especially banks). Doesn’t look like the usual end-of-quarter upwards manipulation will have any chance in these markets.