FOMC (Federal Open Market Committee) met today, announced the reinvestment of maturing mortgage-backed securities into longer-dated Treasury bonds (2-10yr). Fed language unchanged (“to keep interest rates low for an extended period”), but economic outlook a bit gloomier. Bonds rallied, with US 10yr yield down to 2.78%, but stocks closer lower. This is logical, as no new money will be printed (yet). With higher taxes and higher savings rate eating into consumer spending (=70% of GDP) and government stimulus waning a double-dip recession is all but guaranteed. Looking at how far yields have dropped over the last 3 months the stock market is at least 20% overvalued:

We remain long gold (PHYS, GDX) and short the US stock market (SH, SPY bear call spreads). Gold might suffer together with stocks, but a weak stock market will force the Fed into printing even more money – leading to a potential run on gold.

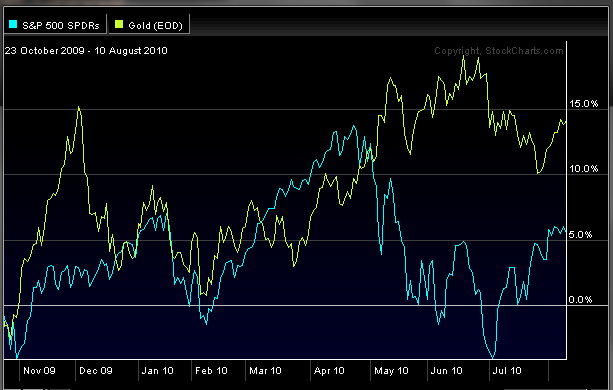

Sometimes gold and stocks move parallel to each other, sometimes inverse, and sometimes independently.

Even the – normally – inverse relationship between the gold price and the USD has been turned on its head (except for past few weeks).