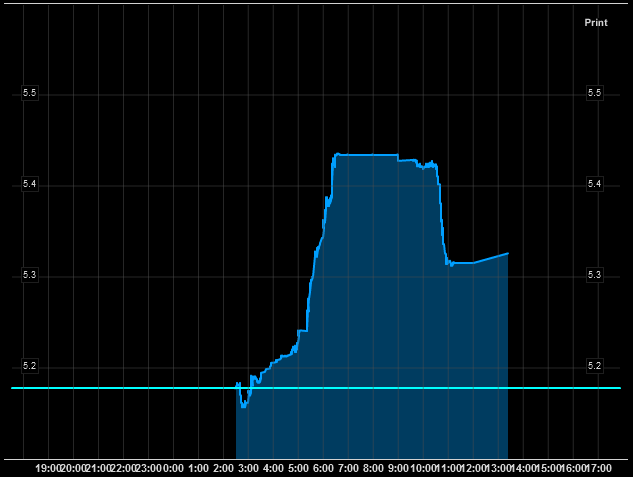

Stock markets falling word-wide, bond markets surging (prices up, yields down) – except a few outliers, like Ireland. Take a look at the intra-day yield of 10 year Irish government bonds; big rise, then sudden stop. Rumors of ECB having stepped in and buying Irish government bonds. To me, the chart looks like those rumors are true. Ergo: Central Banks around the world will be forced to buy more government bonds (which is equal to printing money). The debasing of our currencies has begun.

Source: Bloomberg

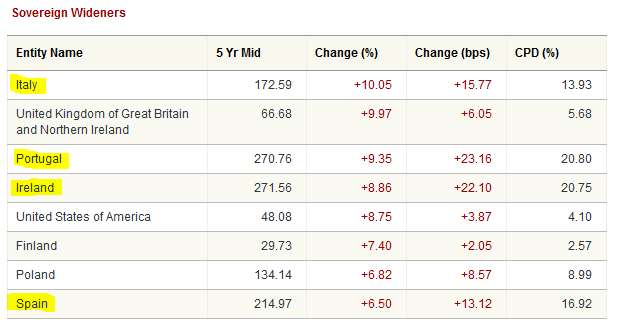

Meanwhile, the German 10yr government bond yield sank to 2.43% (-0.11), and the Swiss to 1.24% (-0.09). Portugal, Greece and Ireland were some of the few wideners.

Looking at the worst sovereign credits today we duly see 4 of our 5 PIIGS among the list, courtesy of CMA.