The European periphery is on fire. While German 10yr government bond yields declined to 2.33% (-0.06), Irish were unchanged at 5.31% and Greece widened to 10.67% (+0.19).

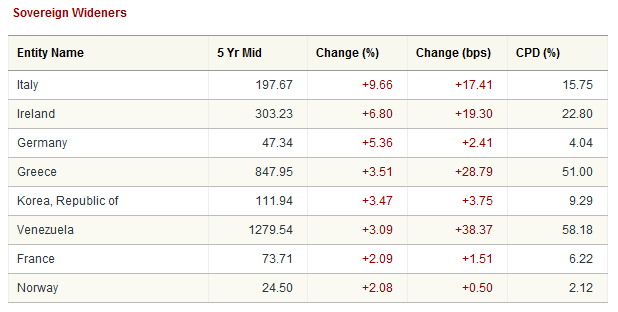

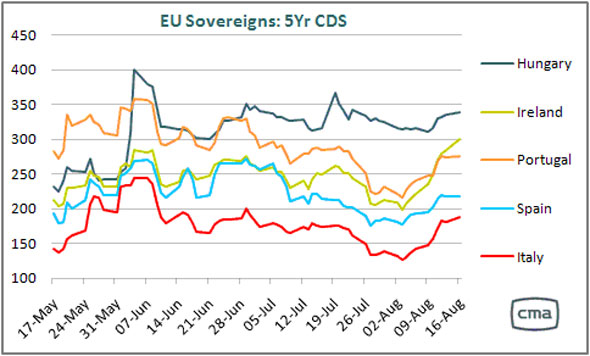

Credit Default Swaps widened on Italy (from 130 to 200 within 2 weeks), Ireland (from 200 to 300) and of course basket-case Greece. Ireland will try to sell some more government bonds this week.

Even Germany (+5%) is not immune from doubts over its debt (after Die Zeit reported that debt-to-GDP ratio for Germany would increase to 90% if the government would assume debt from “bad banks” of WestLB and HypoRealEstate.

10yr yields on Japanese government bonds are now firmly entrenched below 1% (0.95%, -0.04) while Switzerland is on the way to achieve same fame (1.15%, -0.07).

While bond markets are screaming “double-dip recession”, stock markets still don’t seem to get it. This might cascade into a crash once economic data confirms the looming slow-down.

Source: CMA

Source: CMA