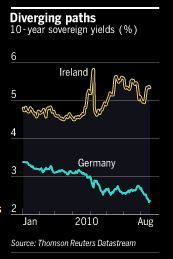

Huge sigh of relief after Ireland managed to sell EUR 1.5bn fresh debt today (how much of that was bought by the ECB?). Irish CDS tightened 28bps to 275. Still, spreads are elevated, and it would be ludicrous to assume that more debt could cure an indebted nation. The European periphery had generally lower bond yields – except for Greece (10.69, +0.02). Stock markets rallied on take-over speculation (BHP/POT), but that might be short-lived.

Source: FT