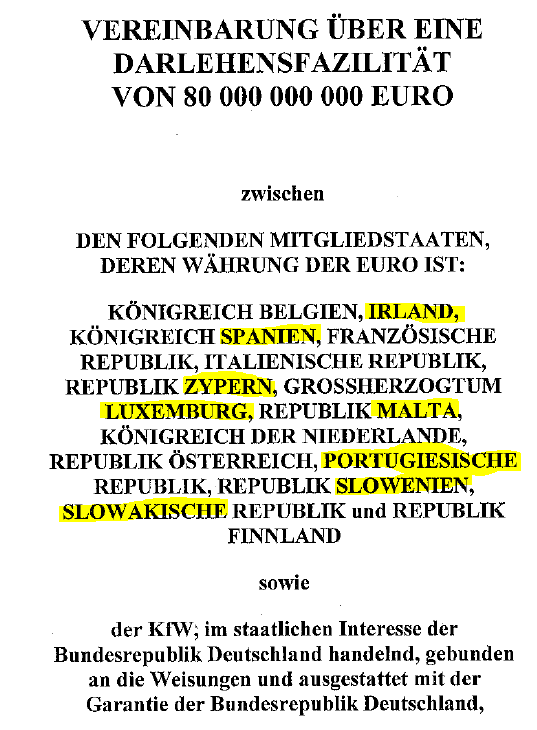

The EUR 80bn bail-out treaty from Greece (42 pages) is an interesting read. Among the countries providing credit are such pillars of wealth and stability like Ireland, Spain, Cyprus, Luxembourg, Malta, Portugal, Slovenia and Slovakia. The Slovak parliament in August voted not to participate.

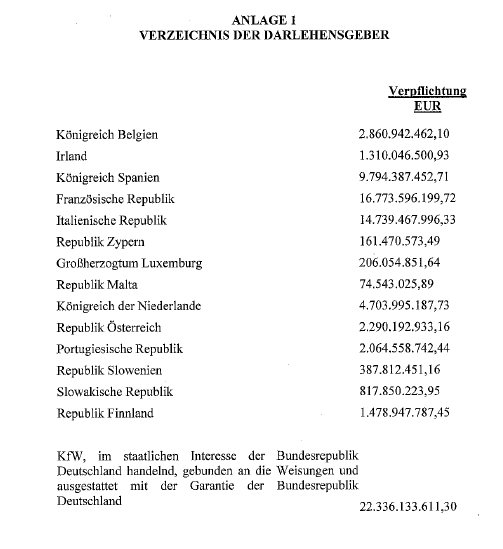

Not to be disrespectful of small countries, but Cyprus and Malta will not be able to make a dent in the Greek debt problem. Thankfully the treaty breaks each country’s commitment down to the cent:

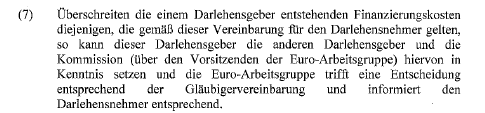

And then there is a clause on page 15: “Should the cost of financing for any country exceed the cost of the interest paid by Greece the EU working group will take a decision”. In plain English: no country can be forced to participate if its own financing costs exceed the interest rate it would receive on its loan to Greece (3-months Euribor +300bps, currently = 3.88%). With Ireland paying 6% for 10yr bonds (and Portugal not far behind at 5.8%) who will be left holding the bag? Germany and France?

To add insult to injury, German banks seem to have voluntarily agreed not to sell any Greek debt they might hold on their balance sheets. This is only topped by the stupidity of an ad campaign in the Handelsblatt of May 3rd, 2010:

Former German Finance Minister Eichel: “For the first time in my life I am buying government bonds [??] – actually Greek government bonds. Because the Euro zone has to be kept together. The Greek have to make a lot of sacrifices – there is no way around that. We should show our solidarity.”

Wolfgang Kirsch, CEO DZ Bank: “I own Greek government bonds because I believe in the idea of European unity.”

Gustav Horn (Director IMK – Institute for Macro-economy and economic research): “I have bought Greek bonds because, as a European citizen, I can not want to leave the Euro’s fate in the hands of speculators.”

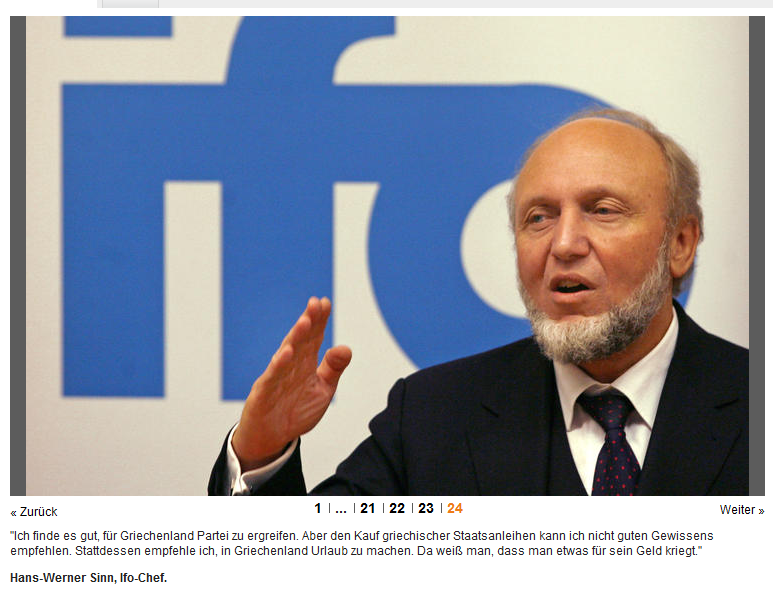

The only one who had the guts to deviate – Hans-Werner Sinn, President IFO Institute for Economic Research: “It’s okay to be partial for Greece. But I cannot recommend buying Greek government bonds with a clear conscience. I would rather go to Greece for vacation. At least then you know what you get for your money.”

The only one who had the guts to deviate – Hans-Werner Sinn, President IFO Institute for Economic Research: “It’s okay to be partial for Greece. But I cannot recommend buying Greek government bonds with a clear conscience. I would rather go to Greece for vacation. At least then you know what you get for your money.”

On May 3rd, 10yr Greek government bond yields were 5.4-5.8% above German yields. Today, the spread widened to 9.45%:

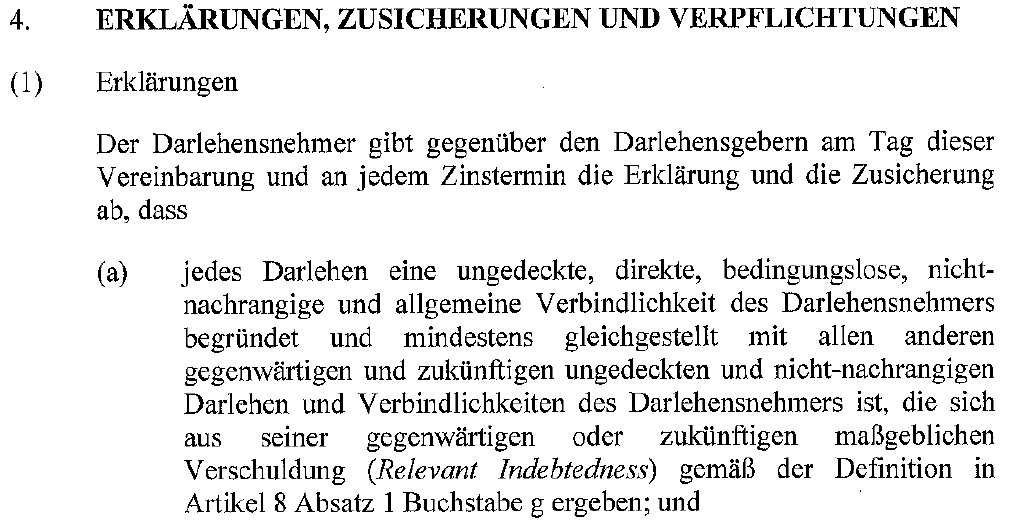

The treaty (page 10) further states the 80bn loan will be senior debt (as opposed to junior, or subordinated), and at least equally senior as all other previous and future claims:

Senior debt gets paid first in case of a default (if something to pay is left at all). So if you owned Greek government bonds before the bail-out your “senior” claim has been “diluted” by another 80bn. Due to the short duration (3 to maximum 5 years) you could say the EU loans actually put longer dated debt in a junior position. This increased risk has been correctly priced into Greek government bonds; prices declined and yields increased. Wasn’t the package meant to end speculators vicious manipulation of Greek yields?