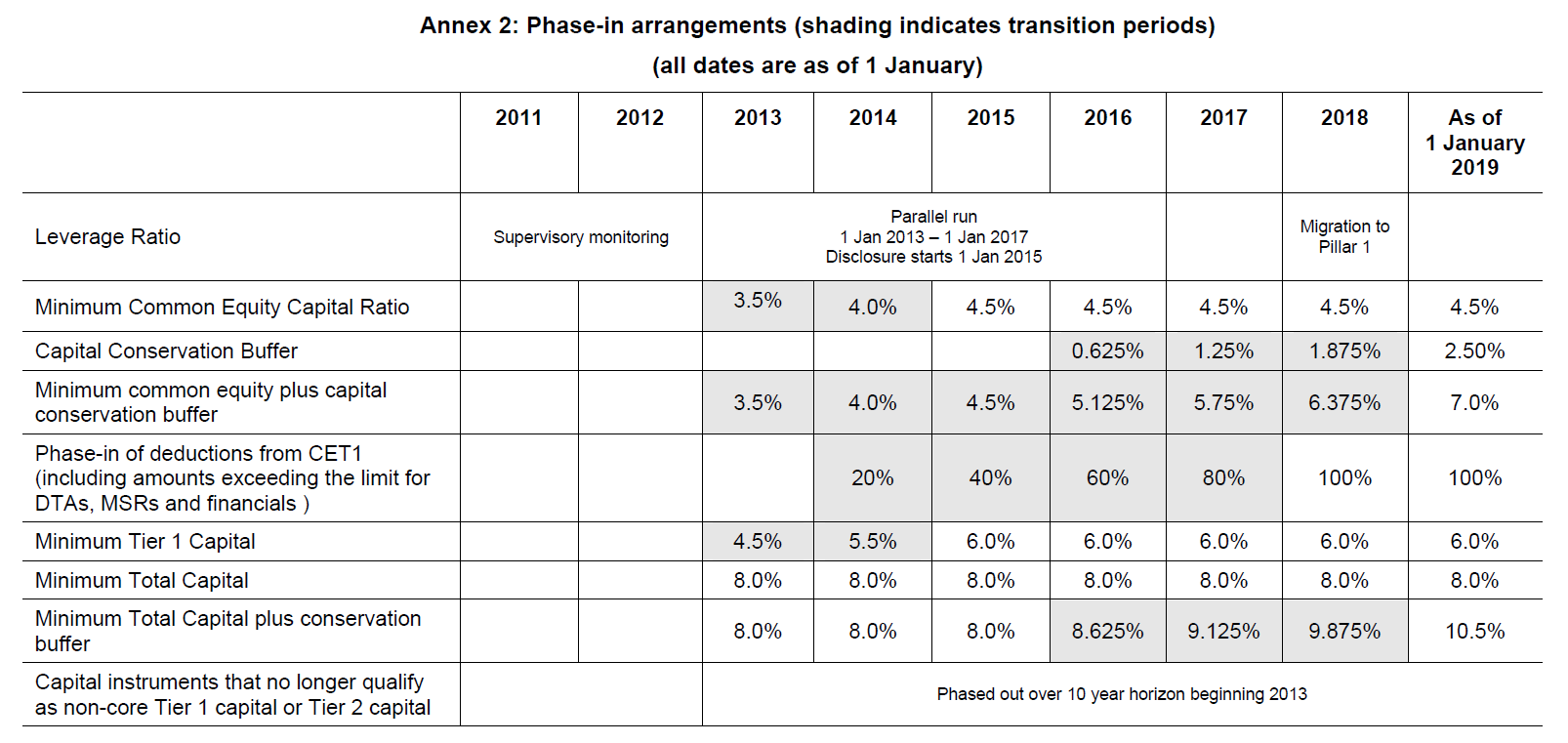

On Sunday, G-10 Governors and Heads of Supervision (GHOS) reached an agreement on new guidelines for banks, issued by the “Basel Committee on Banking Supervision”, also known as “Basel III”.:

Took them 2 years after Lehman to realize the refined rules of “Basel II” were a joke (and almost led to a melt-down of the global banking system as a core-Tier 1 equity ratio of 2%, allowing 50x leverage, was deemed sufficient).

Despite full implementation only by 2023 (!) Deutsche Bank prefers to front-run everybody else and will ask shareholders to increase its capital by 50% (1-for-2). Unfortunately, most of the ca EUR 10bn raised will disappear in partially-owned Postbank (2.4bn write-down, increased capital requirements).