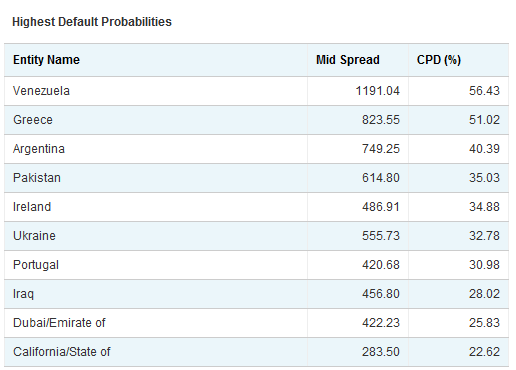

Ireland is now right between Ukraine and Pakistan when it comes to likelihood of default (which, over the next 5 years, is at 35%). This after Irish GDP fell 1.2% in Q2 (vs +0.5% expected) and Q1 growth rate was revised down to 2.2% (from 2.7%). GNP (gross national product) fell 4.1% (-2.7% expected).

Irish tax revenues are now down to EUR 31bn compared to 47bn in 2007. Compare that to the cost of re-capitalizing Anglo Irish Bank alone of EUR 25bn (a figure mentioned by the government – hence likely to be too low).

Meanwhile rumors that Greece asked Germany to agree to an extension of the bail-out package (planned to expire after 3 years). Greece also considering coming back to the capital market with longer dated bonds next year (plain English: we can’t sell any longer-dated bonds right now).

Top 10 sovereign entities most likely to default. Source: CMA