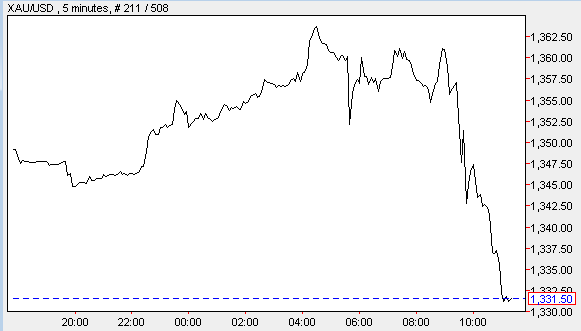

First serious setback in the gold price since quite some time (from a record-high $1,363 per ounce to $1,333 within a few hours):

Gold price ($/oz) intraday 2010-10-07. Souce: DailyFX.com

Coincidently, AngloGold Ashanti announced it has completed the unwinding of its hedge book (gold mining companies used to sell gold forward at fixed prices to make earnings predictable, but this has looked them in to sell gold at prices much lower than the current market price). The average buy-back price has been $1,300 per ounce. As speculated before, the recent acceleration in the rise of gold (measured in USD) started with AngloGold’s announcement. May be now, with the repurchase of gold contracts terminated, the market is due for a correction.

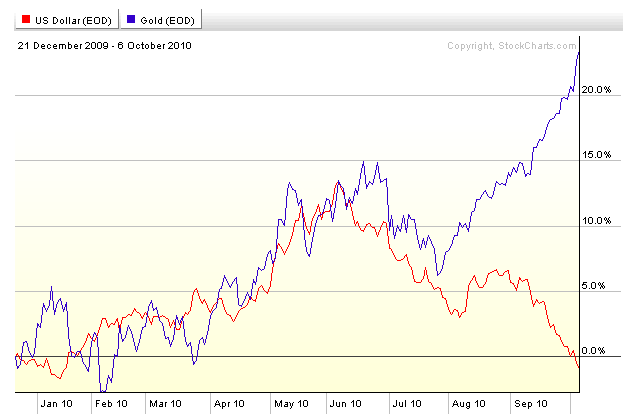

But lets not forget that the strength in gold was also triggered by constant mumbling from the Fed about the possibility of further “quantitative easing” (= printing money). This has really weakened the USD (from 1.19 to 1.40 versus the Euro). The gold price in USD has been moving inverse to the USD recently:

Gold price ($/oz) and US-dollar index, rebased. Source: StockCharts.com

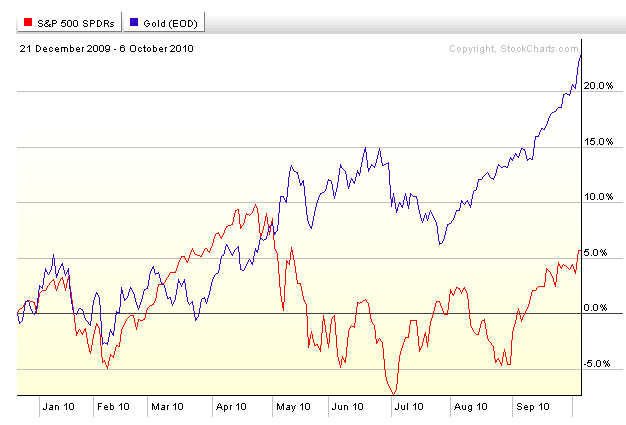

Compared to the S&P 500 index, gold moved in tandem. This can be explained by the old farmers’ rule that “weak currency = strong stock market” as exporters enjoy better earnings (either sell more products abroad as they can slash prices or have higher revenues and earnings once foreign sales are translated back into local currency):

Gold ($/oz) and S&P 500 Index (rebased). Source: StockCharts.com

Gold ($/oz) and S&P 500 Index (rebased). Source: StockCharts.com

However, if we look at gold in a “hard” currency (like the Swiss Franc) there has been barely much action lately (see chart below):

Gold price in CHF per kg. Source: Swissquote.ch

Finally, the US Mint today at noon will begin selling new American Eagle gold coins (25,000 one ounce pieces and smaller denominations) after a long hiatus (claiming to have run out of high-quality gold). We will be interested to see how long supply lasts.