Will Bank of America (BAC) get into difficulties because of a) legal problems to foreclose on delinquent homeowners and b) being forced to repurchase soured mortgage-backed securities?

A mortgage is a publicly registered lien on the house. The attached mortgage note is a debt instrument that can be, like a check, endorsed to others. This is what happened in the mortgage securitization business: mortgage notes got packaged and sold on to others (investment banks, hedge funds) and finally ended up in a trust. In the excitement of the heydays of sub-prime, paper work was shoddy. Now almost all major banks (who control 70% of the mortgage servicing business) had to halt foreclosures because of this (often “healed” by forged documents).

In the State of New York it currently takes an average of 782 days to evict someone from his home after the person stopped paying his mortgage. That means people who stopped paying when Lehman went under are still living in their houses for “free”. So this will make it even more difficult to get rid of the problem. Banks are not good at handling real assets (like houses). Some claim they on average try to contact the homeowner 75 times by phone and send 50 letters before they foreclose. You have to hire a whole army to handle the massive amounts of foreclosures.

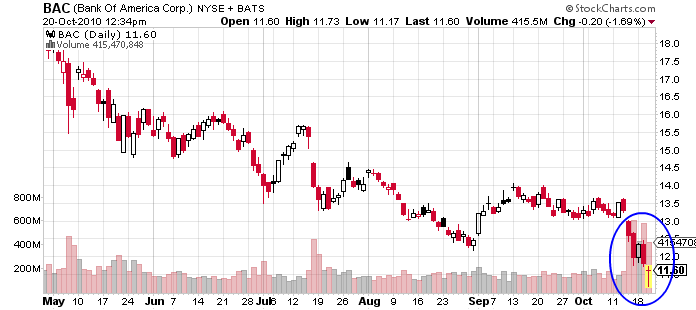

Bank of America got itself into trouble by taking over Countrywide, one of the worst sub-prime mortgage shops around. The stock within days lost 15% with very high volume. Still above the lows around $3 in March 2009. But there are some prominent voices (Chris Whalen, Institutional Risk Analytics) seeing a necessary rescue for the bank coming next year.