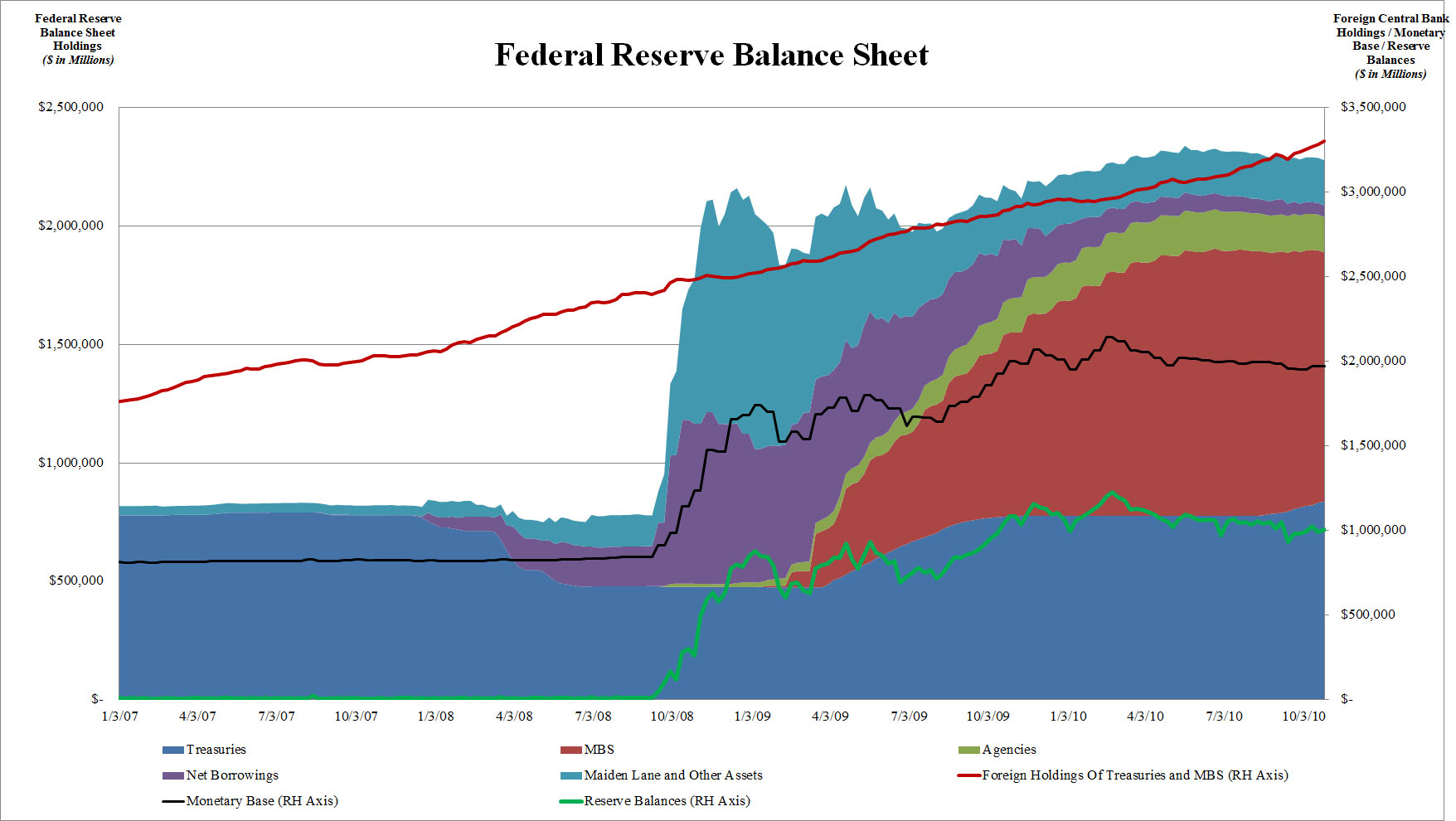

Tuesday we have US mid-term elections, and Tuesday-Wednesday the FOMC (Federal Open Market Committee) meeting. Policy announcement on Wednesday 2:15 EST. So far, the Fed has increased its balance sheet by $1,500bn (from $750bn to $2,300bn) by purchasing various assets (MBS – mortgage backed securities, GSE debt – government sponsored entities and treasury debt).

Federal Reserve Bank Balance Sheet as of October 27, 2010. Source: zerohedge.com

If the Fed buys assets, it creates money (aka “printing” money). The thinking behind those purchases was that it would enable the banks to increase lending to their customers. What did the banks do? Send $1,000bn right back to the Fed as excess reserves. To be fair, many customers do not want or cannot increase debt.

For Wednesday, the market widely expects the Fed to announce a new program to purchase treasuries in the order of $500bn-1,000bn. But, if “QE 1” (quantitative easing no 1 ) did not work – why would doing more of the same work?

We know the Fed is obsessed about avoiding deflation – for good reasons – but it is not clear how creating a bubble in financial assets (bonds, stocks, commodities) would prevent deflation as measured by the consumer price index (CPI). What is the biggest component of CPI? Housing (41%), followed by Food & Beverage (17%) and Transportation (17%). That’s 75%. Is the Fed going to buy houses? Eggs? Make transportation more expensive by devaluing the US dollar, so gasoline prices go up (via increasing oil price)? At least buying houses of delinquent home owners would benefit people who need help. However, I doubt that creating financial asset bubbles is helping those most in need.

Since Chairman Bernanke’s turn-around speech at Jackson Hole (August 27) the Fed has signaled its next move over and over again. Bond yields and the US dollar fell, stocks rose and precious metals went ballistic. Most of the beneficial effects should be priced in by now.

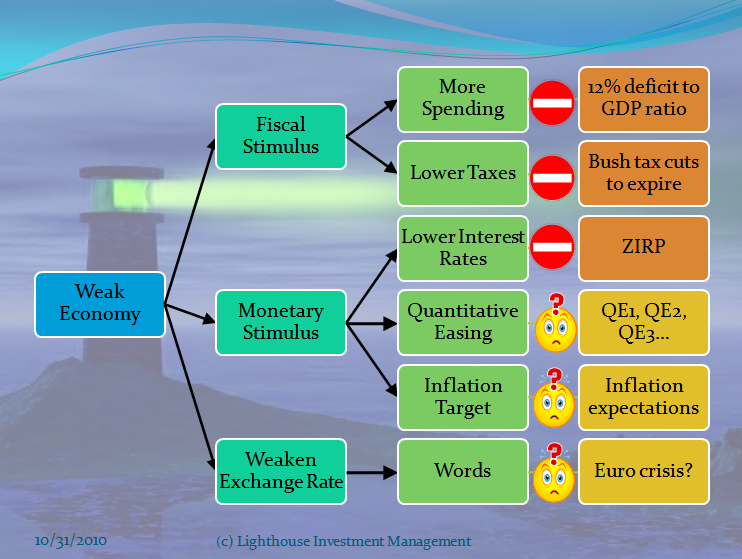

Most options to stimulate an ailing economy have been exhausted: fiscal stimulus (more deficit spending would jeopardize the AAA rating), lower taxes (might even go up if Bush tax cuts are allowed to expire), lower interest rates (nominal rates cannot go below 0%), quantitative easing (tried and failed), inflation target (difficult to implement) and a devaluation of the currency. The last option is dependent on other countries having a strong currency (i.e. Japan, emerging markets). As those countries are actively fighting against currency appreciation, and with another Euro crisis looming, the Fed has run out of options. Should the economy continue to weaken, more asset purchases won’t help. Once the stock market realizes this, it will crash.

Has the Fed run out of options? Source: Lighthouse Investment Management

This might also be a rude awakening for precious metals, as many expect a continuation of a weak dollar (via continued “printing” of dollars). But any global crisis will lead (again) to a flight into the dollar. The recent dollar weakness would be reversed, and precious metals suffer.

One response to “The Fed has run out of options – is it bluffing?”

[…] Performance and Asset Allocation […]