In 2006 and 2007, more than 90% of new Hungarian mortgages were denominated in foreign currencies. Many foreign banks (KBC, Bayerische Landesbank, Erste Bank, Intesa Sanpaolo, Raiffeisen, Unicredit) were luring Hungarians with low interest rates. At the time, Hungarian mortgage rates were around 9%, while Euro-mortgages cost around 4.5%. But those cheapo Swissies were to be had at 3%.

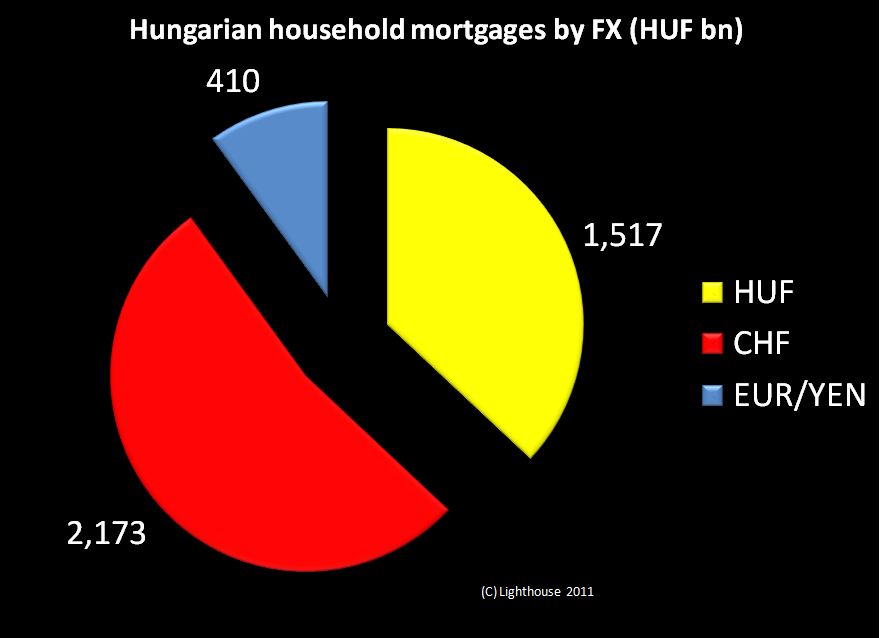

According to a Bloomberg article more than half of all outstanding mortgage debt by Hungarian households is denominated in Swiss Francs:

Hungarian household mortgage debt outstanding, by currency. Source: Bloomberg.com, own calculations

What happened then is history – the Swiss Franc rose to 220 from levels around 150-175 (see chart), and mortgage debtors saw their debt increase by 25-50%.

Chart: HUF per CHF currency. Source: Bloomberg.com

Chart: HUF per CHF currency. Source: Bloomberg.com

To appease voters, the Hungarian government forced banks to offer a price cap for foreign currency mortgages of 180 Forint per Swiss Franc. But if I read the statement correctly, this comes as a Trojan Horse:

“The difference between the fixed-rate payments and the actual exchange rate will be booked in a separate forint account where the debt will accumulate or disappear if better exchange rates emerge. Debtors will have to start repaying the difference as of January 2015 at a set interest rate.”

Banks are laughing all the way to the, well, bank, since those “capped” loans will be guaranteed by the government. As icing on the cake, the government will lift a moratorium on evictions after July 1.

However, it was not only “average Laszlo” drinking CHF-laced Kool Aid. From the latest Report on Financial (In-)Stability (April 2011, page 23) by Magyar Nemzeti Bank (Hungarian Central Bank):

“In the local government system a substantial un-hedged CHF position had built up: at the end of 2010 60 per cent of municipalities’ indebtedness vis-à-vis the banking sector (loans and bonds) was denominated in foreign currency. As a result of the strengthening of the Alpine currency, the total indebtedness of the sector had increased by over HUF 100 billion since the beginning of 2009.”

Hungarians, which had reached home ownership nirvana (92% home ownership ratio, one of the highest in the world) may find their CHF-financed homes to be mere castles in the Sky.

Alexander Gloy is founder and CIO of Lighthouse Investment Management