Much of the following next is an excerpt from the May 2011 “Letter to investors”. This is supposed to be”big-picture thinking” and will only be updated if warranted.

1. As the economy is artificially inflated so are company profits and stocks. The party might continue – until someone like Paul Volker gets installed at the Fed. It is currently politically impossible for the Fed to launch QE3 (“Quantitative Easing no. 3”). Hence the end of QE2 by end of June. The economy slows down. Then the Fed can say “See what happens when we stop printing money” and every politician will applaud the launch of QE3, 4, 5…

2. As politicians lack any interest in reducing deficits the US will move towards unsustainable debt levels in relation to GDP. The only way to “cure” this is inflation, hence negative for bonds. An economic slow-down or a crisis might temporarily be positive for bonds.

3. Real estate: partial inflation-hedge (but not desirable in my opinion as the bubble has only partially deflated and low-quality job creation does not allow for household formation). The absorption of excess inventory in the US might take 10, or even 20 years.

4. Currencies: All major currencies are trending towards their intrinsic value (which is the cost of putting ink on a mix of cotton and pulp). Apart from the Swiss Franc, which, I assume, will soon be subject to capital controls, I cannot identify any other currency worth looking at.

5. Precious metals: Seems like the only asset class promising positive returns. But it is also the most difficult to value. How do you value something that doesn’t pay interest or a dividend and has no earnings? How exactly do you invest? The best known vehicles are ETFs (such as GLD, SLV). But what do you have in hand when the counterparty of the ETF fails (and therefore the derivative claim to gold)? Or trading is impossible for an extended period of time due to turmoil?

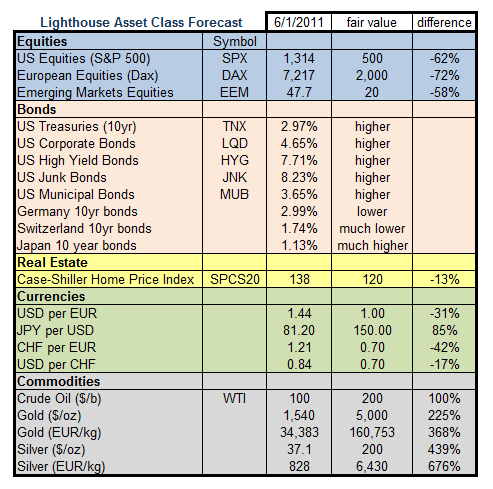

Probably the safest way is to own gold in a fire-proof safe under the house. Second best: gold at a Swiss bank. Third best: gold and silver mining stocks as well as shares in gold and silver trusts holding physical metal outside the US (PHYS, PSLV). Forth best: ETF’s on gold and silver mining stocks. Risks: a crash in the stock market would probably also impact precious metal prices. Solution: hedge that risk by going short stock market via inverse ETF’s (like SH). This leads to the following table:

No, there are no typos in the table. I believe stock markets can decline 60-75% without much “effort”. In a very “light” recession (not even two consecutive quarters of negative GDP growth) the S&P 500 index declined from 1,527 (March 2000) to 776 (October 2002) or 49%. The German Dax Index lost 72% – from 8,065 to 2,202 (March 2003). And there wasn’t event talk of entire countries going bankrupt.