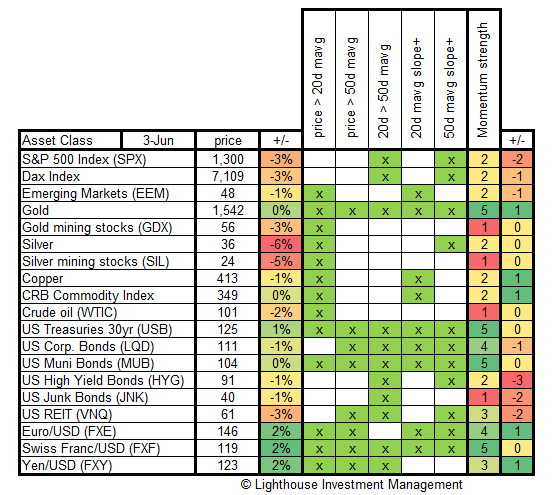

Each week we test major asset classes for the strength of their momentum. We check:

- is current price above 20-day moving average?

- is current price above 50-day moving average?

- is 20-day moving average above the 50-day moving average?

- does the 20-day moving average have a positive slope (i.e. is it rising)?

- does the 50-day moving average have a positive slope (i.e. is it rising)?

If the answer is yes, we give one point. If all conditions are fulfilled then the asset class has five points. This is considered a very strong momentum. Investors believing in strong trends would invest in assets showing a strong (positive) momentum.

We also track weekly price change (%) and the change in points.

Here is the latest table:

Comments:

- Silver and silver mining stocks were the biggest losers in percent. Momentum remains low.

- Equity-related assets (SPX, DAX, EEM) clearly lost momentum.

- Low-risk fixed-income remains on strong momentum (although LQD gave up one point).

- High-risk fixed-income (HYG, JNK) clearly lost momentum.

- Interestingly, gold did not suffer at all from the “risk-off” theme (flat on the week) and even increased its momentum to the maximum of 5 points.

- All major currencies advanced versus the US Dollar; Euro and Yen improved their momentum while the Swiss Franc has reached maximum momentum.

- Copper and the CRB commodity index improved their momentum by +1 each, albeit from a low level.

Conclusion: based on these proprietary momentum indices investors should do well in gold, US Treasury bonds and non-USD currencies.