After almost a year of gathering data we are fine-tuning the Lighthouse Investment Management Timing Indicator (LIMTI). We want to overweight constituents delivering good entry and exit signals.

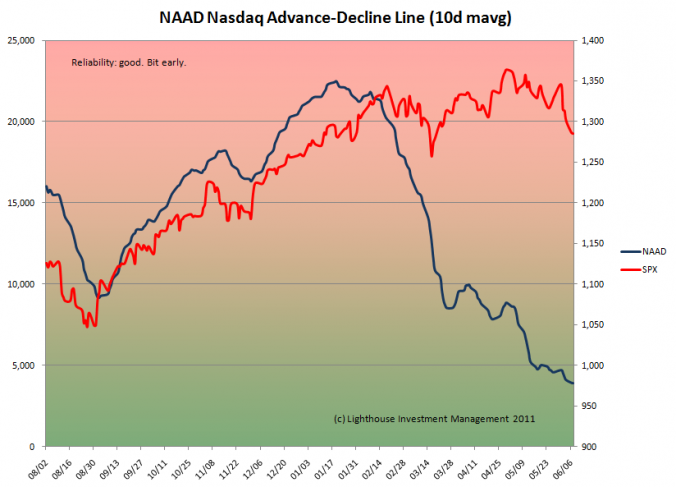

One such indicator is the Advance-Decline-Line (number of rising stocks minus number of falling stocks, cumulative over a time period). We prefer the Nasdaq (as NYSE has too many fixed-income related ETF’s that distort the picture since they might go up as the stock market moves lower).

The NAAD gave a good entry signal in August 2010, but was too early to leave the party in January 2011. It was still a good warning flag as the market was carried higher by less and less stocks (deteriorating breadth).

The NAAD gave a good entry signal in August 2010, but was too early to leave the party in January 2011. It was still a good warning flag as the market was carried higher by less and less stocks (deteriorating breadth).

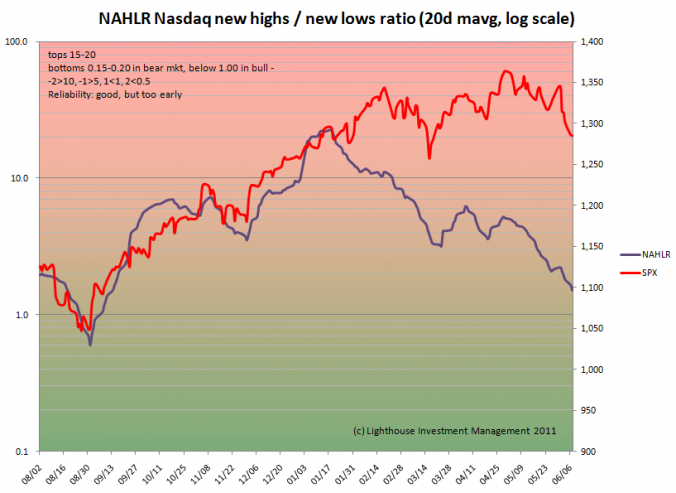

We get a similar picture if we use the ratio (NAHLr) of daily new 52-week highs and new lows. A number above means that there are more stocks trading at a 52-week high than at 52-week low. A rising trend means the momentum is getting stronger:

Again, good entry timing, but too early on the exit.

Again, good entry timing, but too early on the exit.

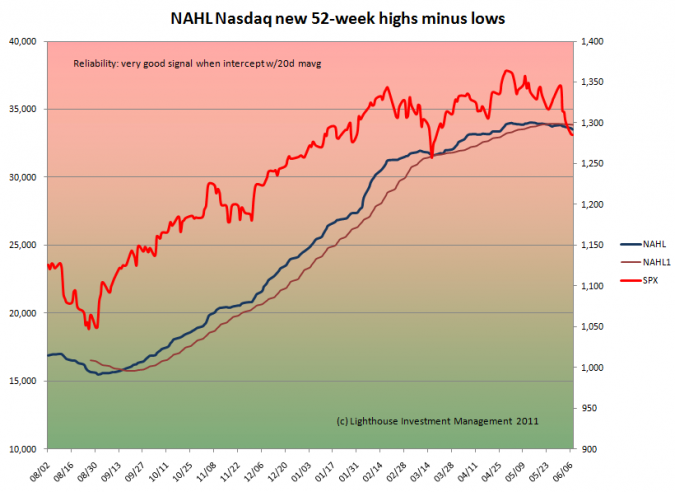

The best result can be achieved by using NAHL (Nasdaq daily 52-week new highs minus lows, cumulative, 20-day moving average) and overlaying a 20-day moving average as a trigger line:

Entry and exit signals were timely. There was a risk of a wrong “sell” signal in March (narrowly averted).

Entry and exit signals were timely. There was a risk of a wrong “sell” signal in March (narrowly averted).

We will overweight the NAHL signal in our overall timing indicator LIMTI. More updates to follow.