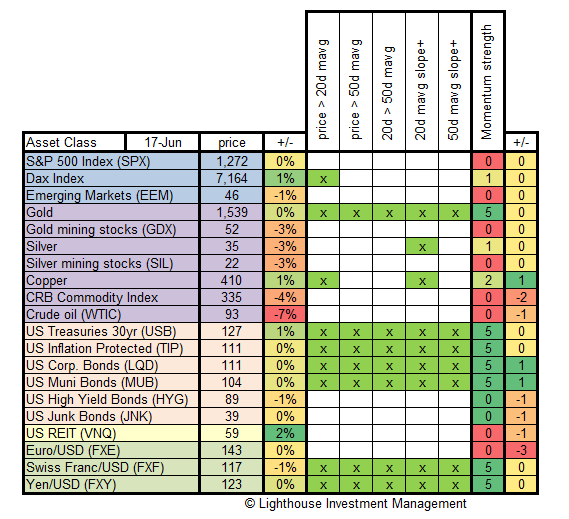

Each week we test major asset classes for the strength of their momentum. We check:

- is current price above 20-day moving average?

- is current price above 50-day moving average?

- is 20-day moving average above the 50-day moving average?

- does the 20-day moving average have a positive slope (i.e. is it rising)?

- does the 50-day moving average have a positive slope (i.e. is it rising)?

If the answer is yes, we give one point. If all conditions are fulfilled then the asset class has five points. This is considered a very strong momentum. Investors believing in strong trends would invest in assets showing a strong (positive) momentum.

We also track weekly price change (%) and the change in points.

Here is the latest table:

Observations:

- S&P 500 ended six weeks of declining prices (albeit barely; up 0.04% for the week). Momentum continues to be very weak (zero points).

- Gold is holding up extremely well, especially considering the stock market believes the Fed being in a “no-action zone”. Momentum very strong with 5 points (unchanged).

- Gold- and silver mining stocks however disappoint (again) with 3% declines (despite stable gold price). Big disconnect. Should not come as a surprise as momentum remains weak. Commodities with industrial use (oil, silver) suffer, while commodities used primarily as a store of value (gold) have so far escaped unscathed. Copper a bit of an outlier.

- Very strong momentum in fixed income (Treasuries, investment-grade, munis) except for non-investment grade (high-yield, junk).

- Further deterioration in momentum for the Euro; Swiss Franc and Yen still very strong.

Conclusion:

- Stay away from stocks, non-gold commodities, non-investment grade fixed income, be long gold, treasury bonds and Swiss Francs.

Charts can be found here: