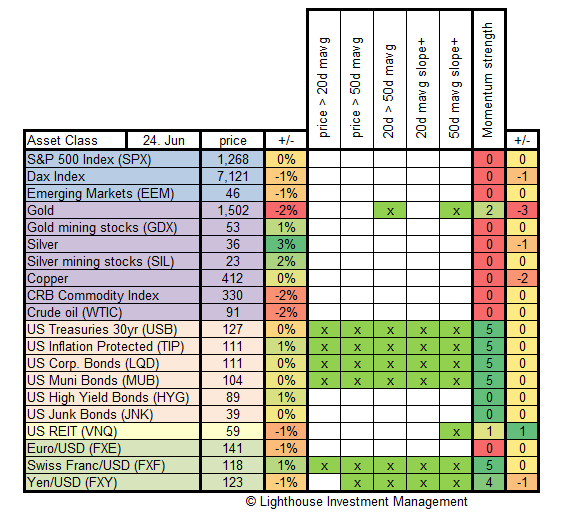

Each week we test major asset classes for the strength of their momentum. We check:

- is current price above 20-day moving average?

- is current price above 50-day moving average?

- is 20-day moving average above the 50-day moving average?

- does the 20-day moving average have a positive slope (i.e. is it rising)?

- does the 50-day moving average have a positive slope (i.e. is it rising)?

If the answer is yes, we give one point. If all conditions are fulfilled then the asset class has five points. This is considered a very strong momentum. Investors believing in strong trends would invest in assets showing a strong (positive) momentum.

We also track weekly price change (%) and the change in points.

Here is the latest table:

Observations:

- Most commodities suffered under the oil price decline (triggered by the release of strategic oil reserves announcement from the International Energy Agency).

- Gold failed to make new all-time-highs and fell below its 20- and 50-day moving average (last week we pointed out how well it was holding up). Gold had the most pronounced decline in momentum of all asset classes (from 5 to 2 points). Gold simply cannot escape its correlation with other inflation-related asset classes (i.e. stocks).

- Gold- and silver mining stocks tried to stage a break-out during the week but failed.

- Treasury bonds performed well. The momentum in risky bonds (high-yield and junk) however is horrible, and one would expect further weakness in that area.

- The Swiss Franc remains one of the strongest currencies in the world. Monentum in the Japanese Yen declined slightly. The Euro is in jeopardy (zero momentum points unchanged).

Conclusions:

- Avoid risky assets such as stocks, commodities and high yield bonds.

- Remain long in Treasury bonds.

- Gold positions should be hedged with short positions in stock markets.

- Remain long Swiss Franc, short Euros.