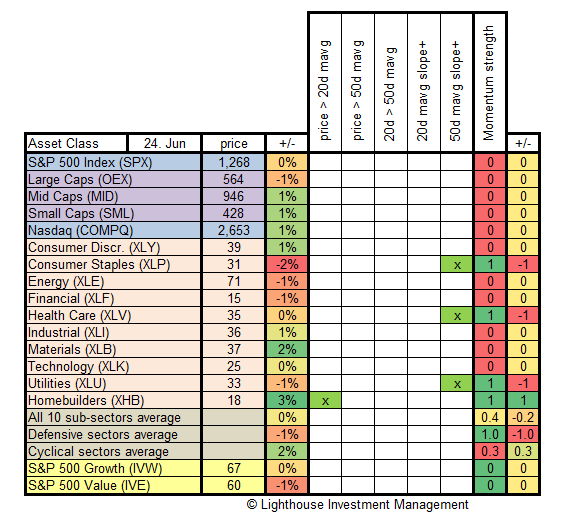

Each week we test major asset classes for the strength of their momentum. We check:

- is current price above 20-day moving average?

- is current price above 50-day moving average?

- is 20-day moving average above the 50-day moving average?

- does the 20-day moving average have a positive slope (i.e. is it rising)?

- does the 50-day moving average have a positive slope (i.e. is it rising)?

If the answer is yes, we give one point. If all conditions are fulfilled then the asset class has five points. This is considered a very strong momentum. Investors believing in strong trends would invest in assets showing a strong (positive) momentum.

We also track weekly price change (%) and the change in points.

Here is the latest table:

- Momentum remains very weak across all sectors

- Defensive sectors such as Consumer Staples, Health Care and Utilities each lost 1 point

- Home Builders gained one point due to strong performance, but this could be short-lived

- Large caps declined while mid- and small-caps slightly advanced

- Cyclical sectors performed better than defensive sectors

- Value slightly underperformed growth

Conclusion:

- Momentum-oriented investors should abstain from going long any sectors of the stock market.