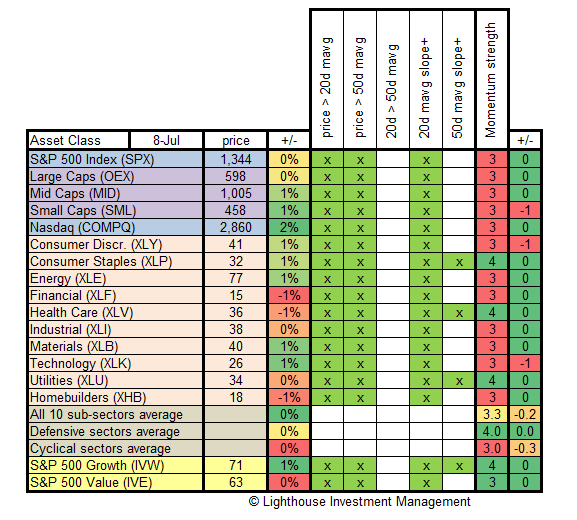

Each week we test major asset classes for the strength of their momentum. We check:

- is current price above 20-day moving average?

- is current price above 50-day moving average?

- is 20-day moving average above the 50-day moving average?

- does the 20-day moving average have a positive slope (i.e. is it rising)?

- does the 50-day moving average have a positive slope (i.e. is it rising)?

If the answer is yes, we give one point. If all conditions are fulfilled then the asset class has five points. This is considered a very strong momentum. Investors believing in strong trends would invest in assets showing a strong (positive) momentum.

We also track weekly price change (%) and the change in points.

Here is the latest table:

- Not much divergence to report other than weak financials and home builders while technology and materials outperformed.

- Small caps outperformed large caps.

- Growth outperformed value.

Conclusion:

- Momentum across all sectors still pretty good. Albeit none shows the 20-day moving average above the 50-day moving average.

- Still unconvinced this low-volume rally can be sustained. Would recommend focusing on defensive sectors (if at all).