In theory, stock prices react positively to inflation. You can explain that with the balance sheet effect: while debt remains same in nominal terms, assets gain in value (with the difference showing up in the equity position via net profit).

Gold should also benefit from inflation as the supply of precious metals is limited – hence they will go up in price if money supply increases.

Taken together we should assume that gold and stocks are positively correlated (if one moves up, the other one does the same).

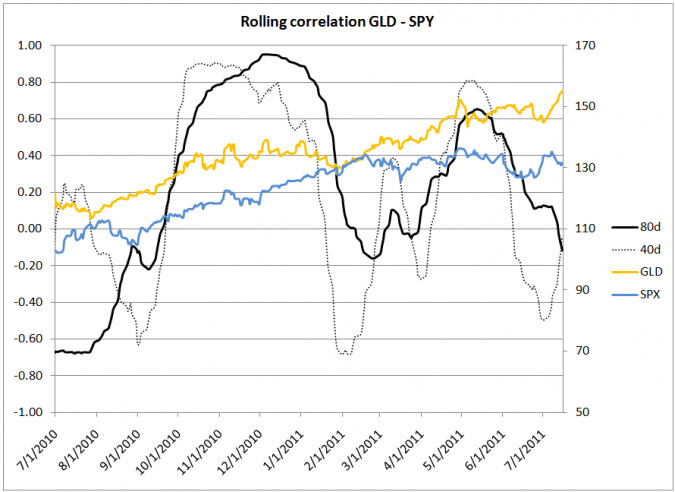

Let’s look at rolling correlations (40 and 80 days) between GLD (gold ETF) and SPY (1/10 S&P 500 Index ETF):

In the above chart you will see that correlation actually varies wildly (between -0.6 and +0.9).

A major change into positive territory ensued after Ben Bernanke announced QE2 (Quantitative Easing round 2) in a speech on August 27, 2010. This was clearly positive for both stocks and gold, since the economy was supposed to be stimulated by printing money.

The subsequent break-down in correlation into February 2011 could be explained by the fact that, despite quantitative easing, inflation remained somewhat contained in the United States.

Recent weakness in marco-economic indicators took a toll on stocks while gold managed to reach new record highs. The reasoning could be that the worse the economy gets, the more likely the Federal Reserve Bank will unleash more quantitative easing.

As long as the stock market does not show signs of serious trouble the Fed seems unlikely to act; the current “decoupling” (negative correlation) is therefore expected to continue for the time being.

One response to “Gold and stocks love inflation, right?”

[…] Gold and stocks love inflation, right? (Lighthouse) […]