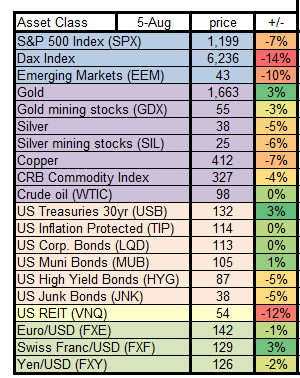

Looking at asset class performance during the week August 1-5, 2011:

Horrible week for the Dax index, US REITs (Real Estate Investment Trusts) and Emerging Markets. I had wondered why the Dax managed to perform so well despite Euro zone troubles. It is a pretty cyclical index, and usually outperforms the US indices – in both directions. Foreign investors make up a larger percentage. Hence in a crisis, when large international investors recoil towards their home markets, the selling hits the Dax more than, for example, the S&P 500.

Horrible week for the Dax index, US REITs (Real Estate Investment Trusts) and Emerging Markets. I had wondered why the Dax managed to perform so well despite Euro zone troubles. It is a pretty cyclical index, and usually outperforms the US indices – in both directions. Foreign investors make up a larger percentage. Hence in a crisis, when large international investors recoil towards their home markets, the selling hits the Dax more than, for example, the S&P 500.

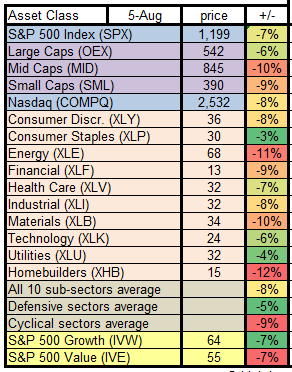

Let’s look at US equity sectors:

As you would expect, cyclical sectors (-9%) underperformed defensive sectors (-5%). Mid caps (-10%) did worse than small caps (-9%) and large caps (-6%). Somehow surprising is the fact that value stocks (-7%) did not do better than growth stocks (-7%). This is an effect often observed in a crash: investors anticipating a slow down in the economy shifted into defensive sectors, making them more expensive relative to its own history and the market average. In a global sell-off, they feel the same brunt.

As you would expect, cyclical sectors (-9%) underperformed defensive sectors (-5%). Mid caps (-10%) did worse than small caps (-9%) and large caps (-6%). Somehow surprising is the fact that value stocks (-7%) did not do better than growth stocks (-7%). This is an effect often observed in a crash: investors anticipating a slow down in the economy shifted into defensive sectors, making them more expensive relative to its own history and the market average. In a global sell-off, they feel the same brunt.