An article by Bloomberg “Gold Traders Most Bullish After Bear Market Averted” grabbed my attention; not because of the headline, but what was buried in the text:

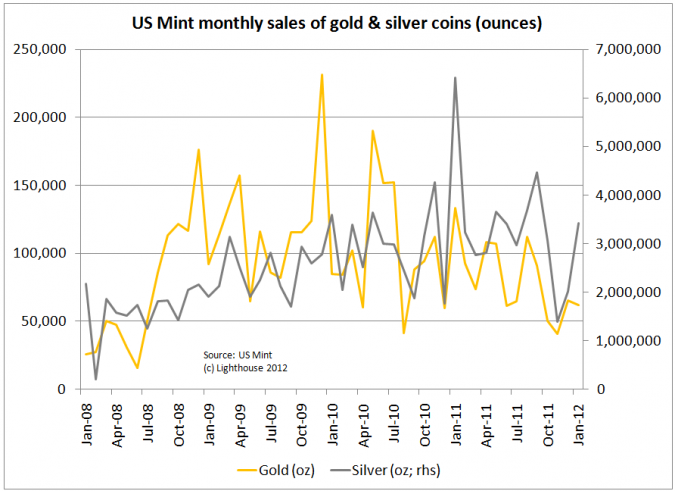

“The US Mint sold 45,500 ounces of American Eagle gold coins this month, compared with 65,500 ounces in the whole of December and 41,000 in November, its website showed.”

And I thought to myself “wait-a-minute, we only had 3 business days in January, and the US Mint sold more gold ounces than in the entire November?

So I check the data, and by today (January 6), the total amount of ounces of Gold Eagle coins is up to 62,000. That’s a run rate of 15,000 per business day. At this pace we could end up with 300,000 ounces for January, handily beating the old record (231,500 from December 2009).

(Source: US Mint)

Same for silver; 3,422,000 ounces sold so far in January, compared to 2,009,000 for the entire December (which probably got a boost from purchases as holiday gifts). The old record for silver Eagles is 6.4m ounces from January 2011.

This is not a battle cry to pile into gold. The precious metal is often positively correlated to stock markets, and negatively correlated to the US Dollar. Euro crisis means strong dollar means weak gold.

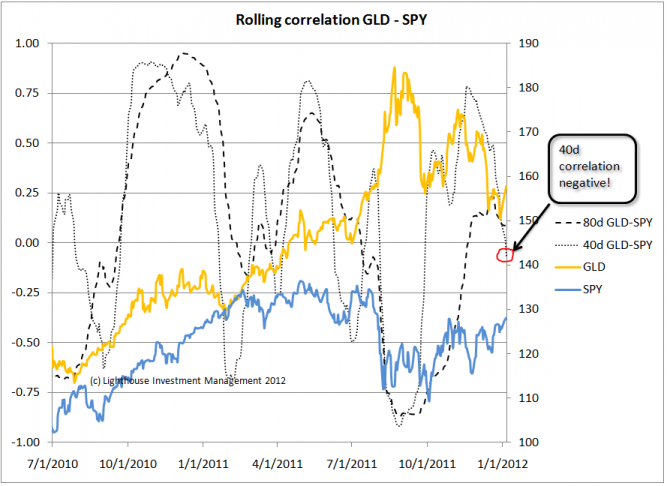

To make things more complicated, the correlation between gold and the US stock market swings wildly between positive and negative:

The 40-day correlation between the GLD gold ETF and the SPY has dipped into negative territory for the last 2 days. If this trend continues, there are two possibilities: either stocks go up and gold goes down, or vice-versa.

The timing will be impossible to get right. One way to reduce the risk of “bad timing” is to stretch gold purchases over many months in order to smooth out the wobbles.

Investors need to carefully think about “paper” gold ETF’s. When the going gets rough, those claims might be worthless.

If you are reading this article on a third party blog, and the charts are not loading, please refer to my blog at lighthouseinvestmentmanagement dot com.