Our investment thesis can be summarized as follows:

- Equities are worthless when associated debt becomes encumbered (risk capital takes the first loss). Equity is not an asset; it is merely the remainder that is left over once debt is subtracted from assets.

- Recent GDP growth was possible only thanks to massive deficit spending and monetary easing; however, the marginal utility of additional debt and additional monetary easing is trending towards zero. Global debt has risen much faster than global GDP. The world has reached the Keynesian endpoint (where the economy cannot be stimulated anymore due to the weight of heavy debt burden). Increase in debt is inflationary, but high and stable debt as well as de-leveraging is deflationary.

- The 2008/9 financial crisis was contained thanks to governments (read: taxpayers) absorbing bank debt. Any progress households made on de-leveraging has been added back onto them via bailouts. Meanwhile, the escape hatch of government bail-outs is closed as many governments face insolvency. Capital markets deny refinancing their considerable mountains of debt.

- The US has the advantage of producing the world’s reserve currency, guaranteeing access to most commodities. This will hold true even in case the dollar is being further devalued, as long as key commodities are priced in dollars. Trillions of US dollars have found their way into the balance sheets of foreign central banks; the burden of devaluation is hence shared with millions of unsuspecting Chinese, Japanese, Russians and others.

- Europe, however, is unable to solve its crisis due to insurmountable differences in fiscal policies, trade balances and scarred memories of hyperinflation in the past century.

There are only two solutions to the Euro-zone crisis:

- Jokes aside, the Euro-crisis will only be solved once the causes (trade imbalances, high deficits) are removed.

- Trade imbalances can only be healed by relative improvement in unit labor costs between the North and the South

- This can only be achieved through

(1) severe deflation for the PIIGS- leading to social unrest – or

(2) devaluation by the PIIGS – meaning Euro exit or

(3) substantial inflation in Germany (unlikely to happen). - Fiscal deficits can only be reduced by austerity (higher taxes, lower spending, or both). Stalling economic growth will lead to higher unemployment and possibly social unrest.

- Another alternative is to default on debt (which, coincidentally, would also be the consequence of a Euro-exit).

- In the end, all roads lead to a break-up of the Euro and multiple sovereign defaults.

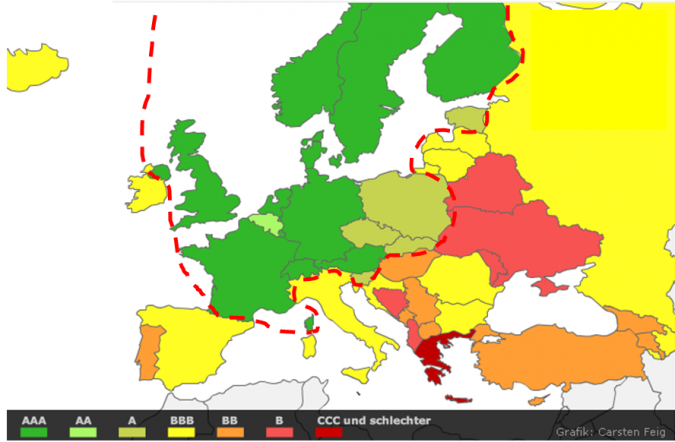

In the above map you will notice the red “demarcation” line between A- and non-A-rated countries. It is the divide between the fiscally responsible North and the profligate South & East.

Germany and France are number 1 and 2 EU members by GDP, and together account for 36% of the EU’s economic power (29% of population). But France is culturally closer to Italy and Spain; it historically had a weak currency, and frequently suffered devaluations in the European Exchange Rate Mechanism (the managed floating rate mechanism before the introduction of the Euro). It is clear that as the Franco-German axis breaks, the European project is dead.

CONCLUSION: Sooner or later, something has got to give. There are no good outcomes. Deleveraging of excessive debt levels hurts, especially if the country seen as imposing those conditions is doing relatively fine. A Euro-exit by Germany, possibly together with the Netherlands, would be the least catastrophic “solution”, allowing the rest of Europe to regain competitiveness by weakening their Euro. However, such an outcome is unlikely, as Germany would be seen as the one ending European integration (and, in addition, losing all control over the fiscal policies of its neighbors).