US Bond market:

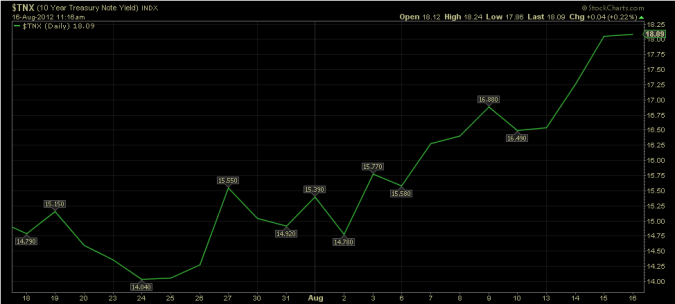

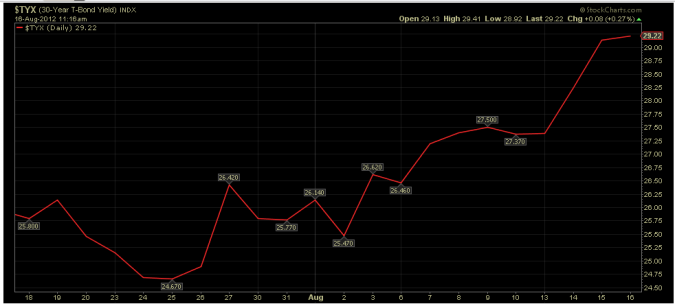

- Over the last three weeks, 10-year US government bond yields increased from 1.4% to 1.81% (green line below) while 30-year went up from 2.46% to 2.93% (red line in second chart):

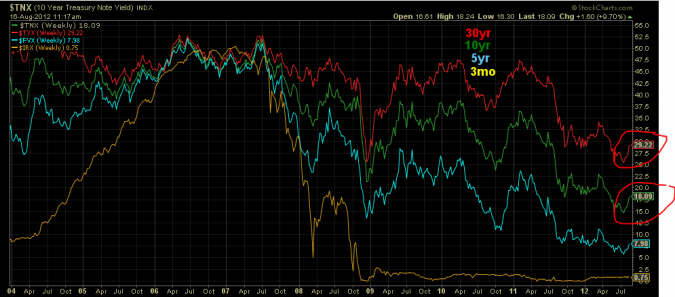

- To put things into perspective: Here are those movements on a longer time scale (together with 5-year yields, blue, and the 3-months yield, yellow):

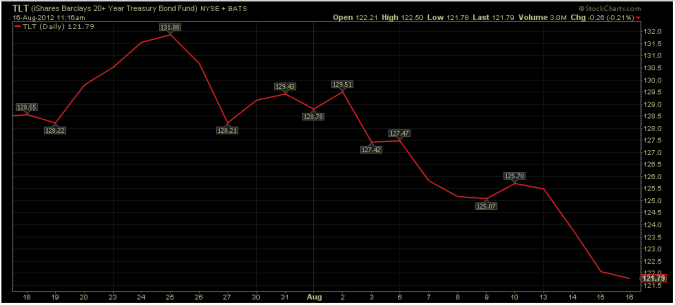

- And this is what this “minor” increase in yields does to long-term bonds:

- The 20+ year Treasury bond ETF (TLT) declined 7.7% from the top. That’s more than three years worth of interest, gone in just three weeks.

- Yes, there is a flip side to central bankers artificially depressing bond yields. And you thought you were smart, not falling for Bernanke’s siren songs to push you into “risky” investments.