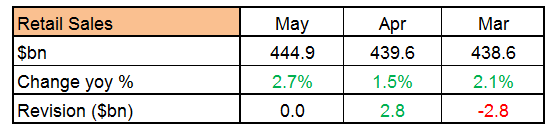

May US retail sales came in a bit better than expected (core +1.0% versus +0.7% expected).

That is a change from a series of earlier disappointments. Furthermore, April numbers were revised upwards:

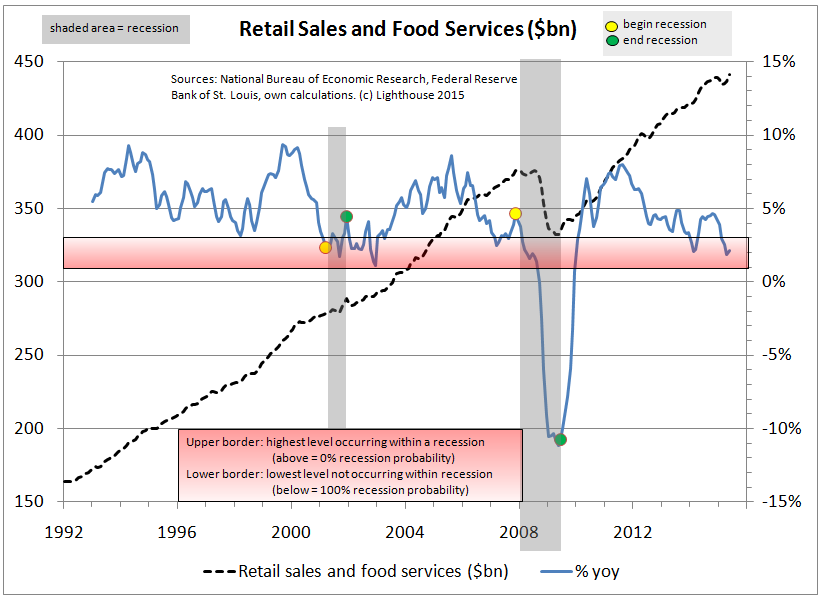

However, growth remains low. Since retail sales are a nominal value, low inflation (as currently) is holding back growth.

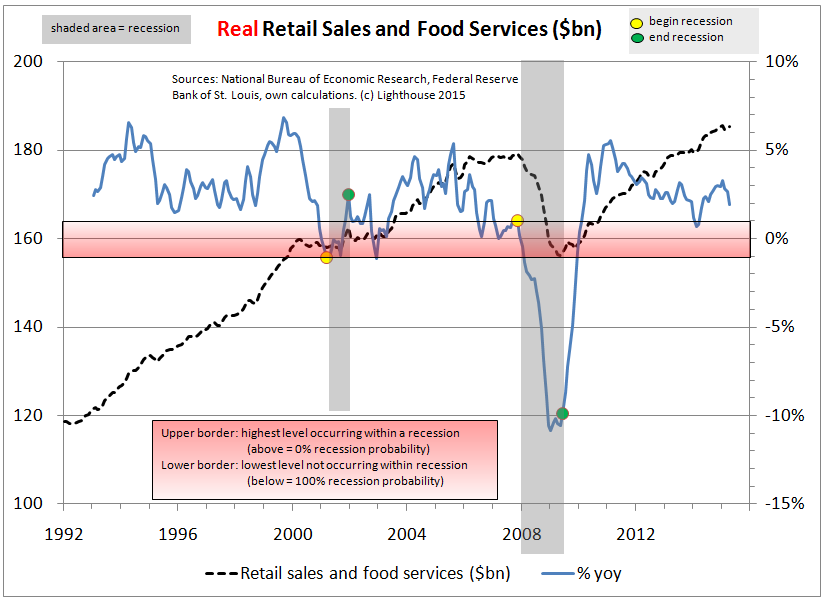

Real retail sales growth therefore looks a bit better in historic comparison (May data not yet available):

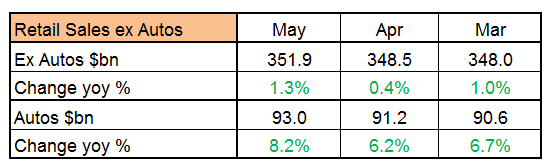

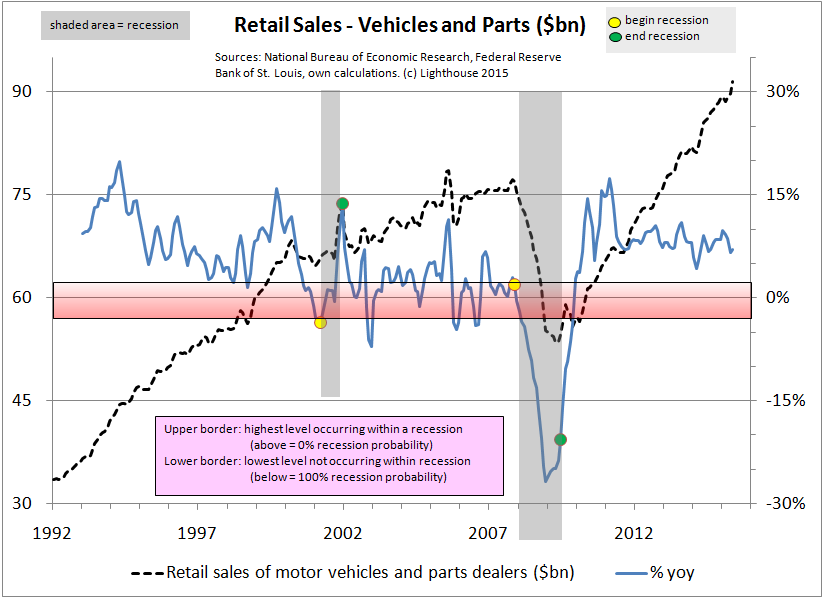

Auto sales reached a record level; 3-months annualized growth soared to 13% (from 2% in April).

Auto sales are boosted by 0% financing and abundant availability of used car loans for subprime borrowers.

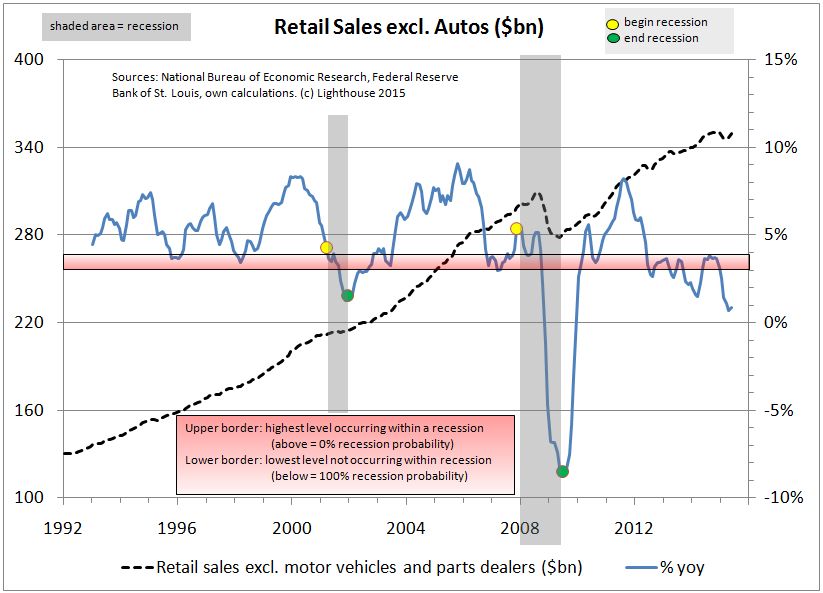

Excluding autos, retail sales still look horrible:

The May numbers look conspicuously strong, and I wouldn’t be surprised about a downward revision in June.

CONCLUSION: Limited real wage growth and lack of full-time jobs with health benefits do not bode well for consumption. Once the boom in automotive sales stutters, US retail sales will look dismal.