- After the IMF left negotiations with Greece, the EU also declared Sunday’s talks to have failed after a brief 45-minute meeting

- According to the EU Commission, a gap on fiscal measures was around EUR 2bn (1.1% of GDP) annually remains. That’s not huge, and probably not worth leaving the Euro-zone for, but who knows if that is the full story

- “Further Greece discussion will now move to EuroGroup” (next meeting of finance ministers from the Euro-zone is on Thursday, June 18)

- Greek side claims it was Juncker who walked out after saying he didn’t have authority to make any concessions regarding fiscal gap

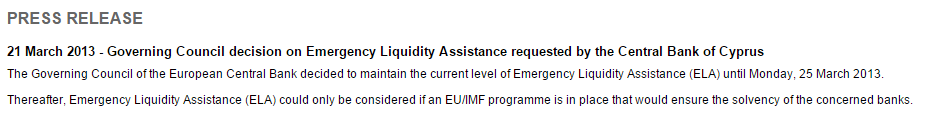

- With IMF and EU/EuroGroup potentially at the end of their patience, the only thing keeping Greece afloat is the ECB. When the ECB loses patience it will look like this (Cyprus):

- ECB could easily put an end to the drama by issuing a similar deadline. As long as it doesn’t, there is still hope.

- On Wednesday (June 17) the ECB will decide on ELA (emergency liquidity assistance) and haircuts for sovereign bonds

- Peter Spiegel (FT) was able to get the following classy comment:

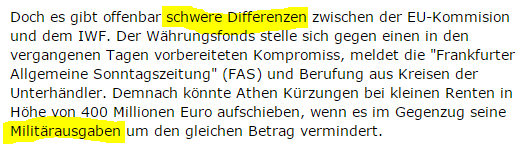

- According to Der Spiegel, quoting FAS, Greece proposed cutting 2% of GDP in military spending (instead of cutting same amount from pension payments). Apparently, this caused “grave differences” between the IMF and the EU Commission.

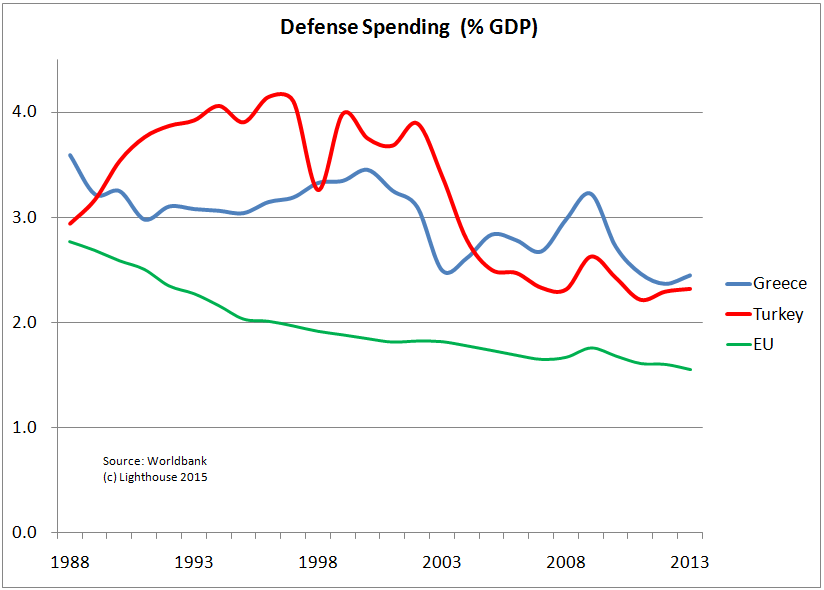

- Germany benefits most from Greek military orders; it is not clear to me why the IMF would oppose such proposals. Greece has always been spending a lot of money on defense (in relation to GDP). This can be explained by the need to be able to defend more than 6,000 islands, many of which are located directly in front of its main adversary, Turkey.

- Greece could, theoretically, block all maritime traffic through the Bosphorus.

- Look at the Greek island of Kastellorizo (Meis), 2 km away from Turkey mainland, but 570 km away from Athens:

- The Turkish invasion of Cyprus (1974) after a Greek military coup didn’t help either.

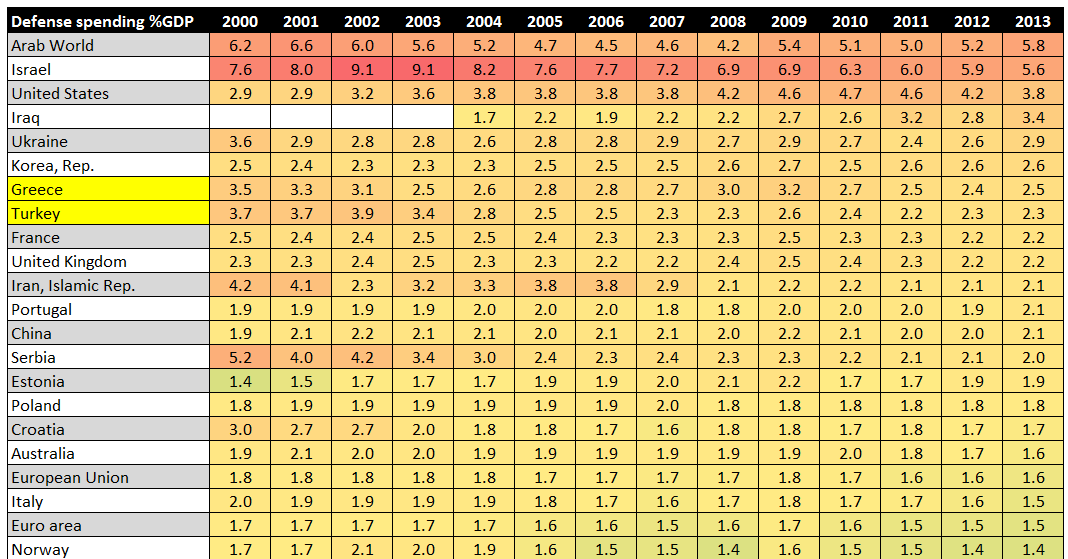

- Defense spending in both countries is about twice the level in the EU and seems to be correlated:

- The US has openly asked European members of NATO to increase military spending to 2% of GDP as a “response to Russian aggression in Eastern Europe”. The IMF, as a US-influenced organization, might have orders not to touch military spending. Being forced to cut pensions in order to be able to continue weapons purchases might be the straw that breaks the camel’s back.

CONCLUSION: In the end, the ECB decides over life and death of the Greek banking system. Wednesday’s ELA decision, together with FOMC meeting, might make for a volatile week in financial markets.