After the close of European equity markets the Sueddeutsche Zeitung ran the following story:

Without naming sources, the newspaper claims Euro-Group had decided on an emergency plan for Greece, which would include capital controls.

Which is nonsense, since only Greece can decide on capital controls. Greece, of course, denied having such plans:

By refusing to deny the report, the German government actively encouraged speculation.

Such reports, placed in the media by Euro-Group people without doubt, serve only one aim: incite capital flight from Greece, and thereby increasing the pressure on the current Greek government to agree to more austerity measures.

Any Greek saver still leaving his money in the Greek banking system after these reports must be asleep.

The ECB will have to further increase ELA (emergency liquidity assistance) on Wednesday unless it wants to see the collapse of the Greek banking system. Since EuroGroup only meets on Thursday, this seems unlikely. However, ECB has always said that ELA is conditional on Greek banks remaining solvent, and further financial aid flowing to Greece. Should EuroGroup decide on Friday that Greece does not offer enough reforms in order for further financial help, the ECB should, consequently, declare an end to ELA. This would lead to a complete collapse of the Greek banking system, with the remaining savers losing most of their deposits as they are being bailed-in (as seen in Cyprus). This would be quite unpopular and come to haunt the current government.

ECB and EuroGroup seem to bet on the idea that the Greek government would not opt for political suicide; however, agreeing to more austerity measures might also make it impossible for Syriza to survive politically.

It seems we have reached the end of the road, and the can cannot be kicked down the road any further. There is a non-trivial chance Greece will not budge, and the ECB will pull the plug. In order to avoid a collapse of the banking system, Greece would need to switch to a new currency immediately.

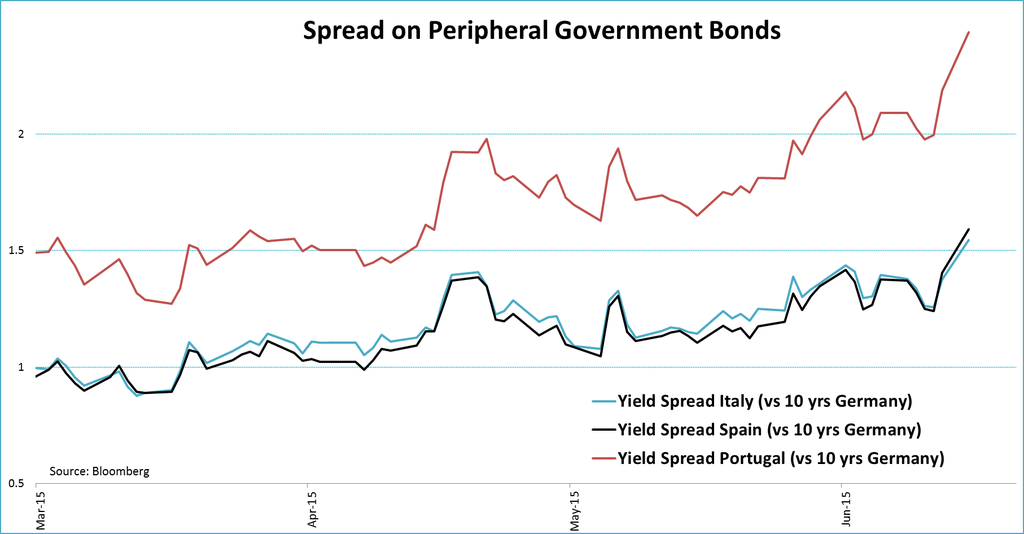

Contagion is already visible in government bond spreads of Portugal, Italy and Spain:

It is dangerous to assume a “Grexit” is priced-in and would not lead to serious repercussions in financial markets.