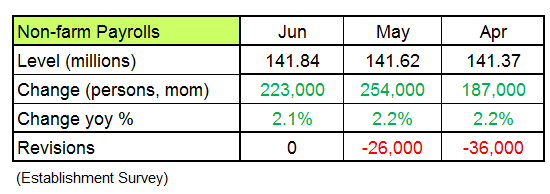

US June non-farm payrolls (+223,000) came in roughly in line with expectations (+230,000). However, revisions over the past five months add up to -154,000. Each of the past five months has been revised downwards (something last seen during the 2008/09 financial crisis).

No reason to sound the alarm, but definitely worth watching. Year-over-year, employment growth is still healthy at 2.1%.

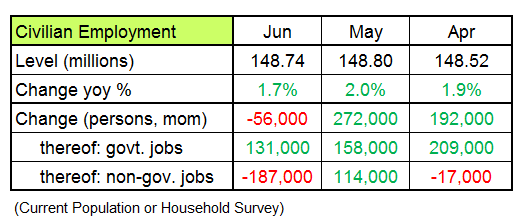

The (more volatile) household survey even registered a decline in employment, especially in the private sector:

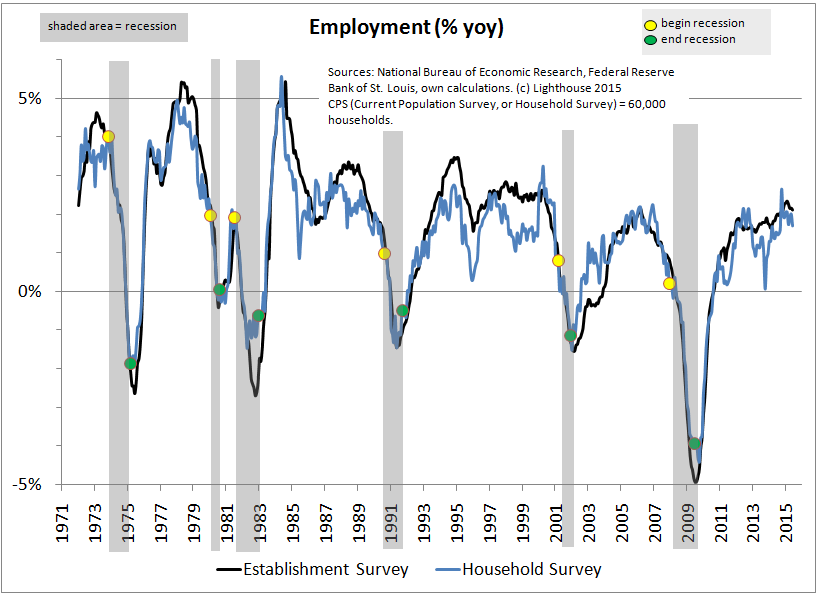

Visual inspection in historic contest does not (yet) reveal a change in trend:

However, revisions can be up to 300,000, so it is theoretically possible (though unlikely) the workforce shrunk in June.

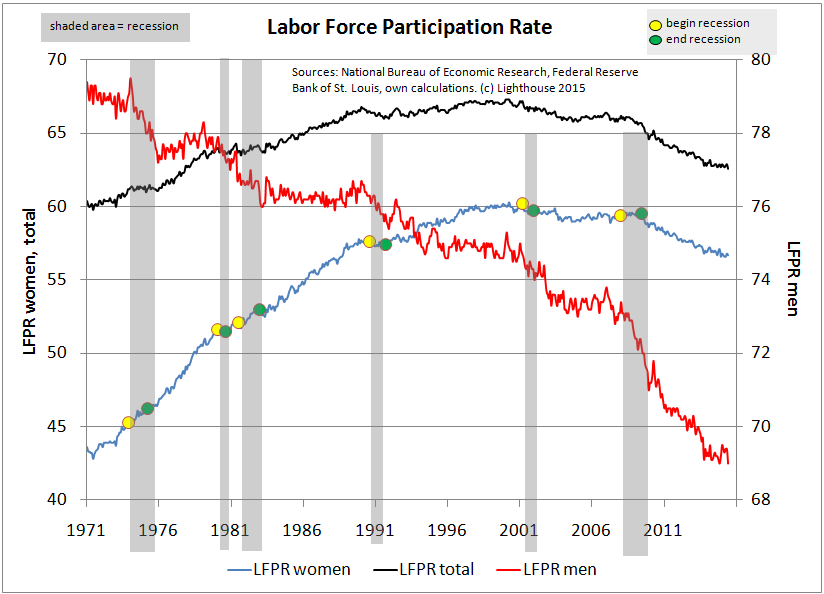

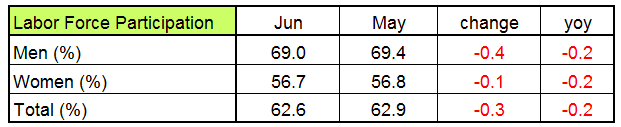

The labor-force-participation-rate (employed population relative to working-age population) declined to the lowest level since 1977:

The downtrend in LFPR seems to have resumed, which is obviously negative for overall income, consumption and therefore GDP:

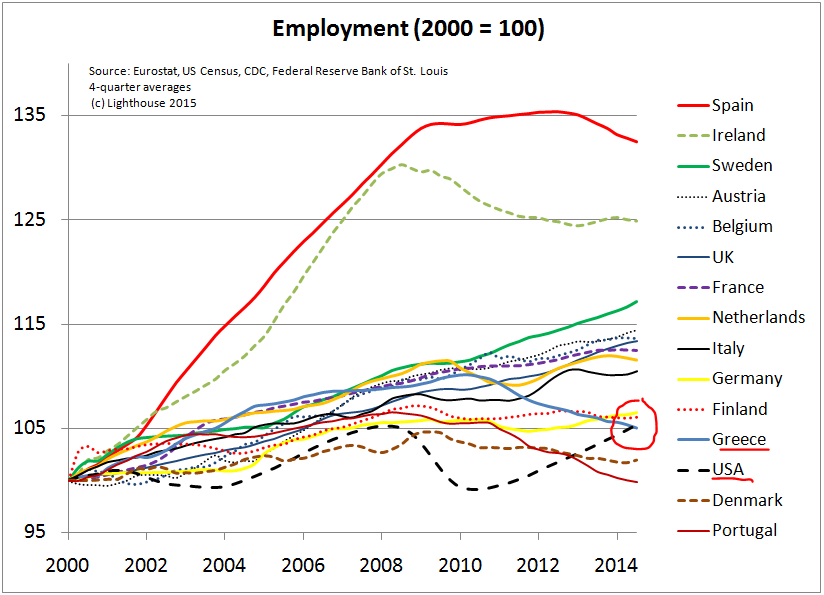

Hard to believe, but the US and Greece had the same change in employment since the year 2000:

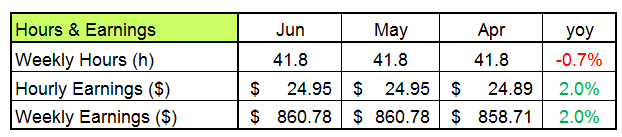

Hourly earnings and hours worked were flat in June (see below). It has happened before during the current expansion. However, with a decline of 0.8% from its previous peak the “weekly hours” indicator is already half-way towards triggering a recession warning (from -1.5% on). So this, too, needs to be watched:

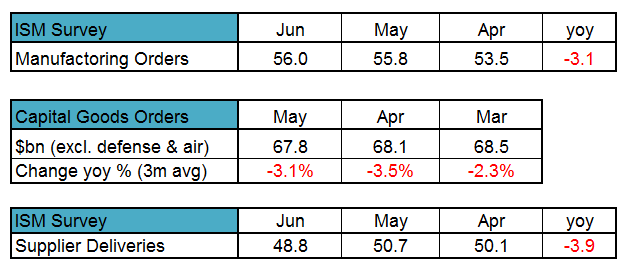

Finally, ISM and capital goods orders were quite soft:

CONCLUSION: The Fed won’t be able to raise rates in this environment. This could weaken the US Dollar and strengthen the Euro (together with gold).