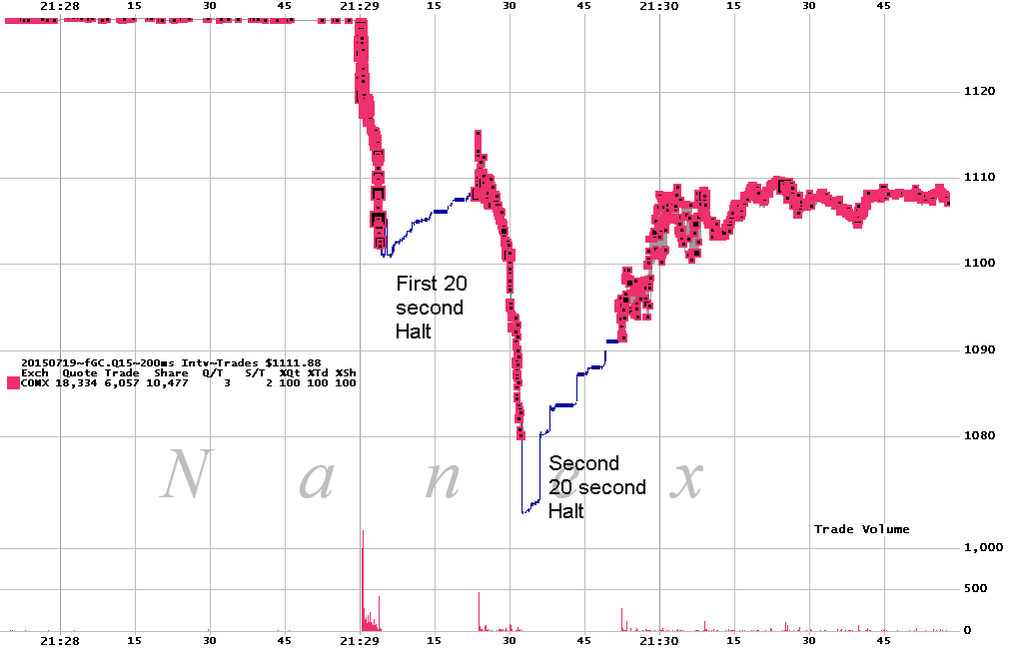

In early Asian trade (9:29am Australian time) Gold futures suddenly tanked 5% within seconds. There was no news, no movement in the EUR/USD or other currency pairs. Silver followed, as usual:

The selling was so sudden and so violent trading was halted twice (see above).

Who would sell thousands of gold futures at once into a quiet (and not very liquid) market? It looks as if triggering trading halts was intended.

If you sell futures in this way, you are all but guaranteed to make losses. You are not price-sensitive. Which market participants are not price sensitive? I only know one group: central banks (they intervene based on policy objectives – never on rational thought).

True, gold had just breached previous lows (November 2014, March 2015). This might have triggered some stop-loss orders.

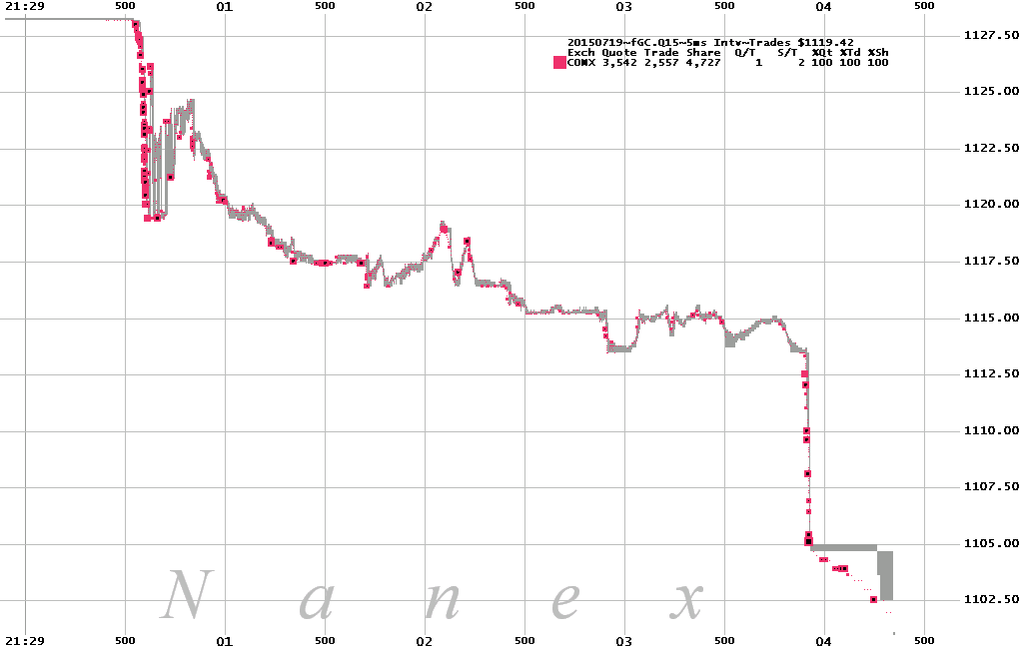

Here are the last 4 seconds of trading before the first trading halt (courtesy of Nanex LLC):

The hit came in the minute before the Australian open (21:30 Central Time). What a coincidence.

It was not a single move down. You see little upward bumps. That means it was not a “fat finger” (false order entry). To me this looks like an algorithm programmed to drown all buy orders.

If you were gutsy enough to buy some gold futures after the first drop you immediately regretted your decision by the time you were liquidated in the second drop (futures traders use leverage, and hence need to use tight stop loss orders to avoid getting wiped out).

If this happened to you a few times, you will refrain from trying to “buy the dip” next time. The seller seems to have unlimited resources and is not acting rationally. As fewer traders dare to stand up to the seller, the latter has an easy game, as potential buyers are running away scared.

The culprit is obvious. The question is “why”? Central banks are the largest holders of investable physical gold. Why would they depress the price of a good they own?

On Friday afternoon, the People’s Bank of China (PBoC) revealed it had increased its gold holdings from 1,054 to 1,658 tonnes. This was the first update since 2009 (!). Jim Rickards (author of Currency Wars) expected the update to happen in 2015, so it was no surprise.

What might have been a surprise (to some) was the increase of 600 tonnes. While a lot, it was less than many market participants expected. According to Rickards, China would need at least 4,500 tonnes to be at par with the United States (gold in relation to GDP). In a recent interview (with Koos Jansen) he stated:

“I know for a fact that SAFE, which is a Sovereign Wealth Fund that manages the foreign exchanges reserves of the People’s Bank Of China, bought 600 tons of physical gold through June and July 2013. I know this from the Perth Mint and Chinese dealers. At this moment the gold is on the balance sheet of SAFE but this can be flipped to the PBOC’s sheet like it happened in 2009.”

So we should not take the PBoC number for granted. It is a highly political number. The Chinese have much more gold than they admit. But it would be unwise for them to reveal all their cards at this time. The Chinese do not want to upset the dollar standard; they simply want to secure a spot at the table for the moment when a new currency system needs to be discussed.

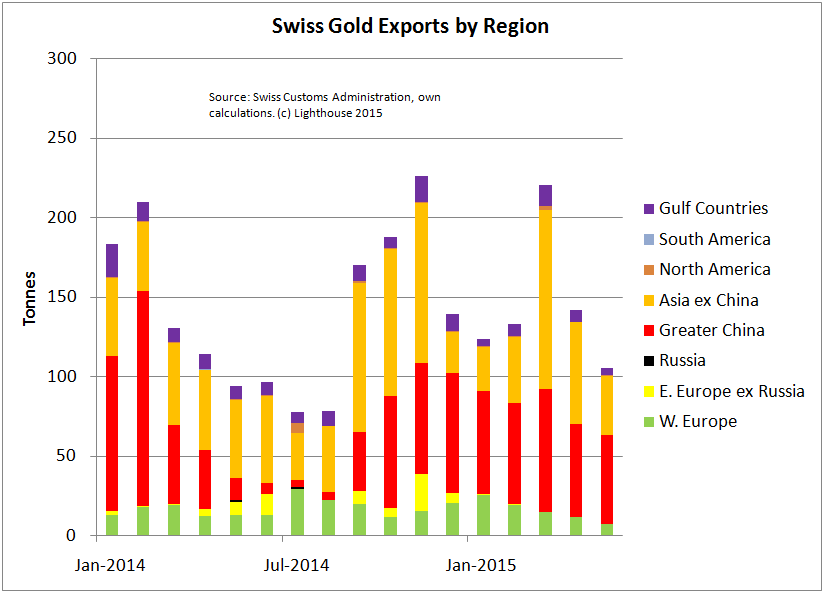

According to Swiss Customs Administration we know China has imported no less than 342 tonnes of gold from Switzerland over the last 17 months (January 2014 – May 2015):

You can probably add Hong Kong (571 tonnes) and Singapore (193 tonnes) to that number. That would make a total of 1,107 tonnes just from Switzerland, just over the past 1 1/2 years.

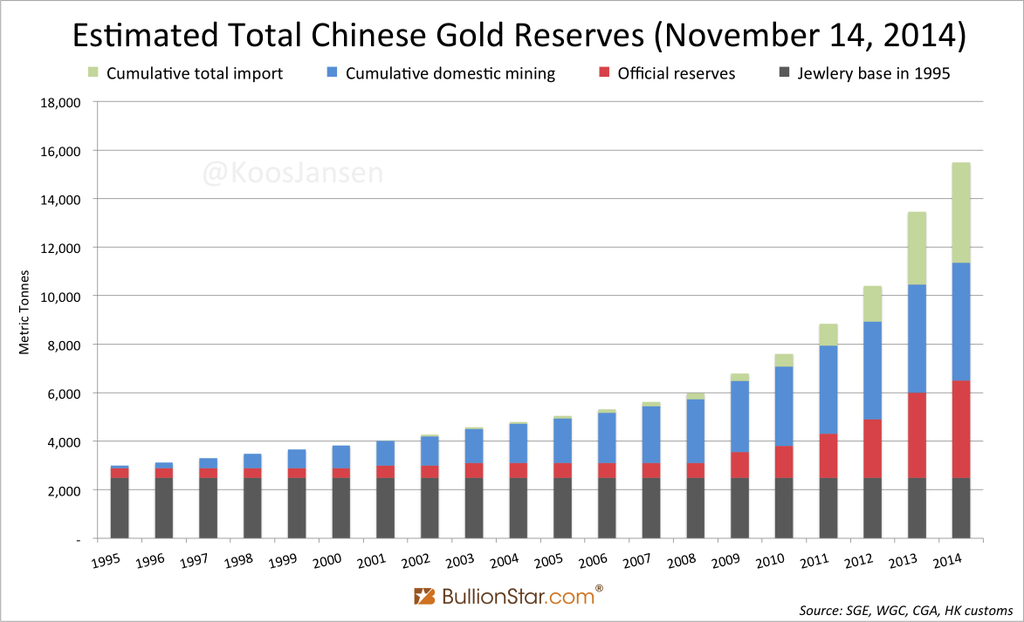

Koos Jansen believes that based on his calculations total Chinese gold reserves amount to around 15,000 tonnes:

So is the gold price crash and the Chinese revelation of increased reserves a coincidence?

China is under immense pressure after its stock market almost had to close down due to selling pressure:

Revealing an increased amount of gold was probably intended to bolster confidence in the Chinese currency and, possibly, convey a message of solvency.

China wants the Yuan to join the IMF’s Special Drawing Rights (SDR), possibly before the end of the year. The last thing they could use is economic turmoil caused by a stock market crash. The IMF would only consider including the Yuan if it can be traded freely (free from central bank intervention, as was necessary over many years to keep it from strengthening towards the US dollar due to large current account surpluses).

The US would most likely lose its veto power in the IMF (15% of votes) if China was included. The US might hence work behind the scenes to avoid such a scenario. The least one could do to embarrass China was to make the PBoC look bad by making the gold price crash just after the PBoC announced a large increase in holdings. Yes, that is childish, but that’s how politics work.

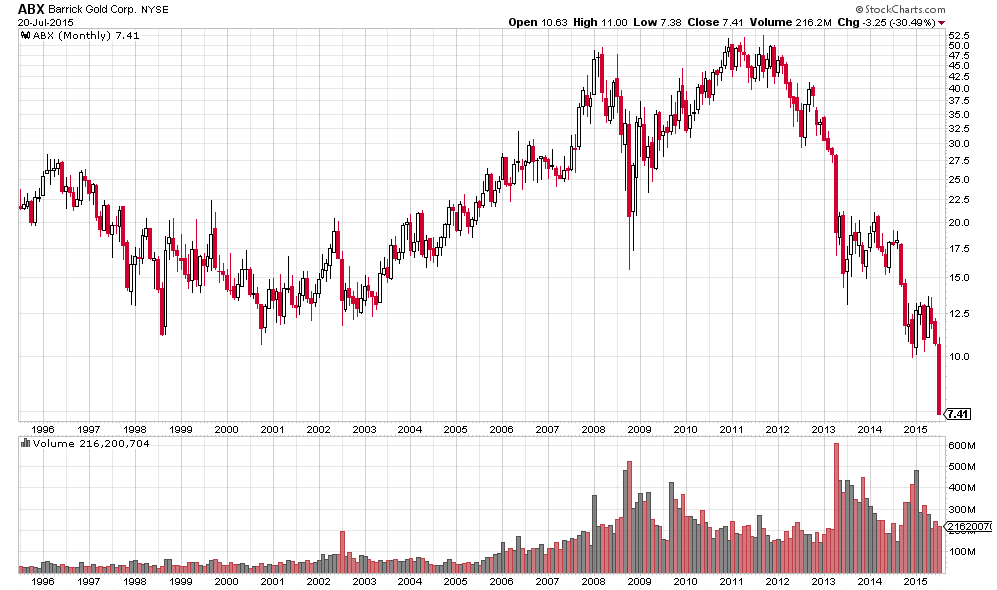

But there is collateral damage: Gold mining stocks. Take American Barrick, for example. It fell no less than 25% within a week, hitting a 25-year low (my chart provider goes back for 20 years only):

The ECB might also have a hand in this. I assume more than a few Greek investors have bought physical gold in the past weeks and months (in order to protect wealth in case of an exit from the Euro). A sharp price drop would make them regret their decision and deter others from doing so in similar situations.

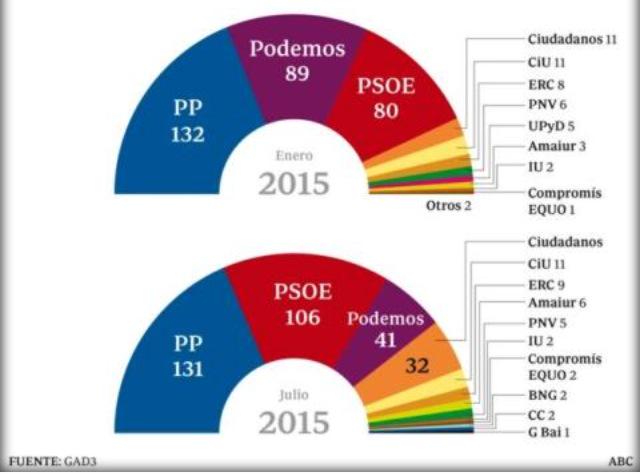

Finally another observation on Greece. Syriza’s failure to obtain any concessions, even after winning a popular referendum, had a terrible effect on the newly formed far-left party Podemos in Spain:

The predicted number of seats in Spain’s upcoming national elections more than halved compared to the beginning of the year. Maybe Greece was simply a sacrifice in order to keep Podemos from becoming the strongest party in Spain. Spain’s debt (EUR 1trn, 98% debt-to-GDP) is probably too large to be bailed out by the Euro-zone’s various rescue mechanisms.