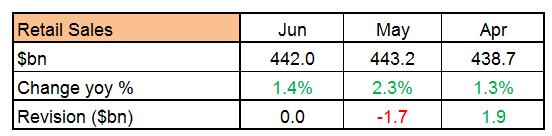

US June retail sales (-0.3% m/m) came in below expectations (+0.3%). Excluding car and gasoline sales, sales declined 0.2% (consensus +0.6%). On top of that, May sales were revised downwards by $1.7bn:

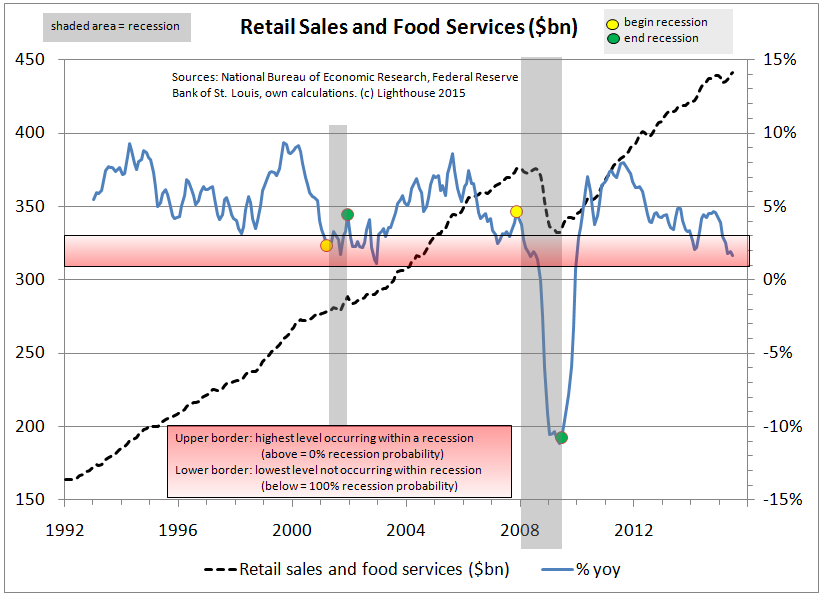

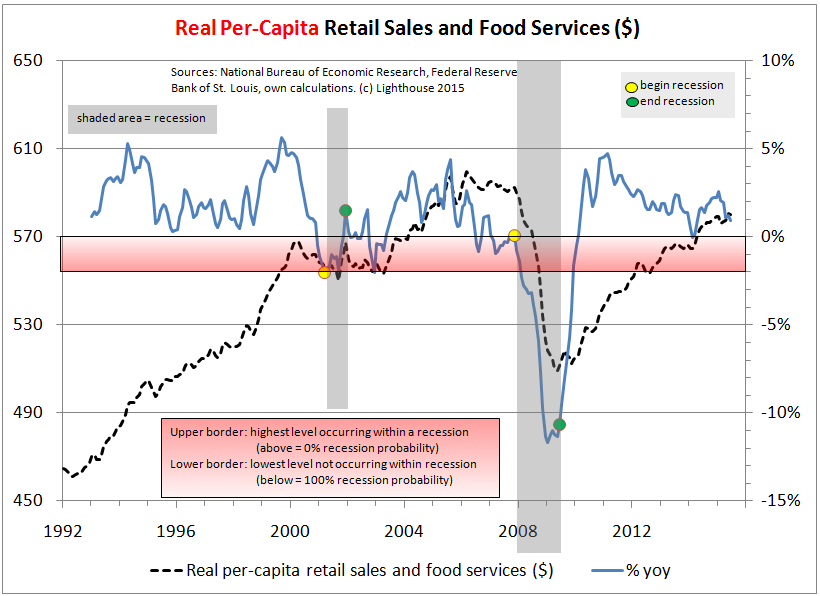

Retail sales growth has slowed down into a range normally associated with recessions (see chart below). However, low inflation is partially to blame for this development (sales = price x volume):

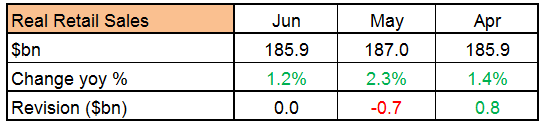

Real retail sales therefore do not look as bad:

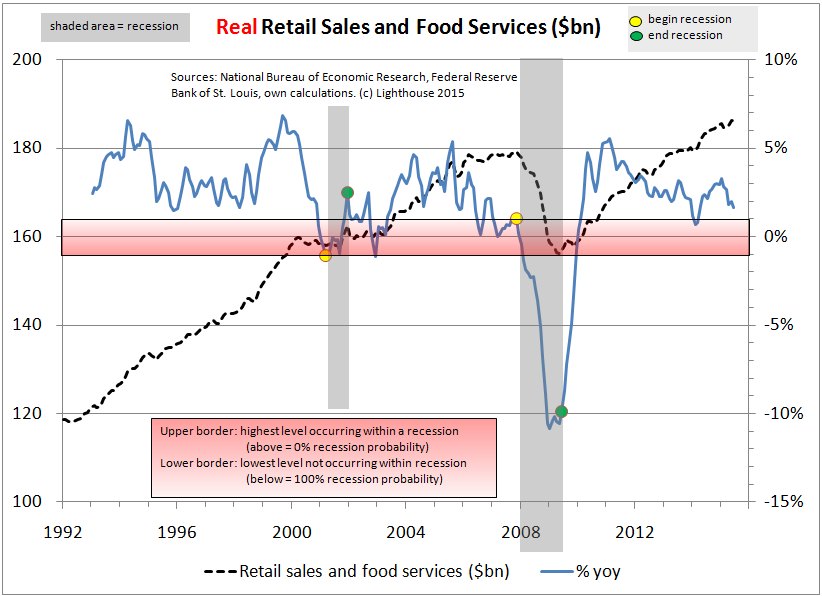

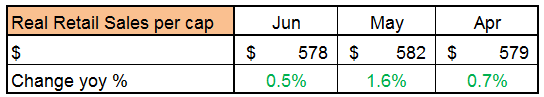

Retail sales are boosted by population growth. In order to normalize, we have to look at per-capita real retail sales:

Real per-capita retail sales are below a level seen in October 2004 (!):

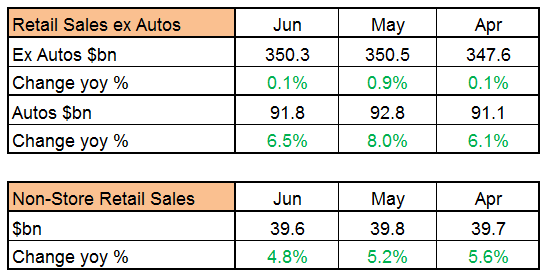

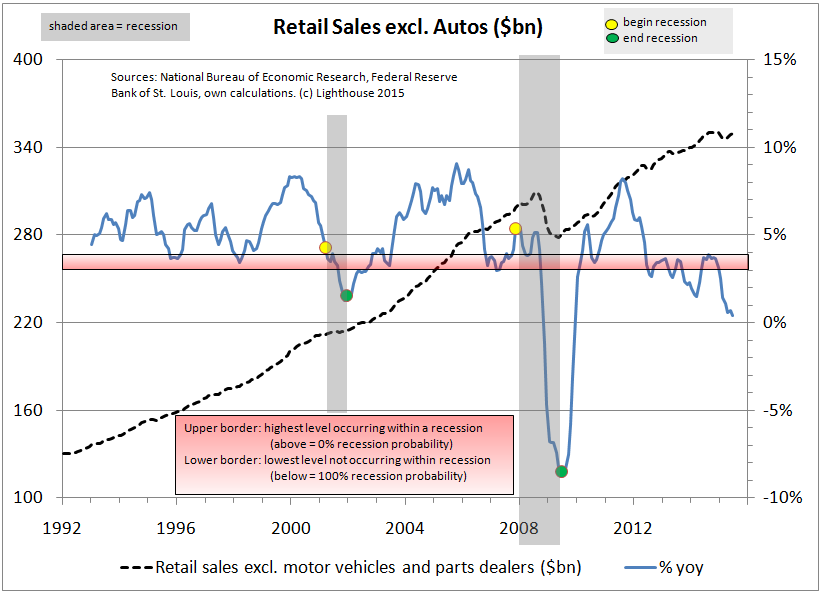

Auto sales, driven by low-interest and subprime loans, are a significant part of retail sales. Without them, retail sales are stagnating:

Retail sales growth excluding autos has dipped deep into recessionary territory:

CONCLUSION:

Retail sales growth is being held back by lack of real income growth. Luckily for consumers, inflation is low. Durable consumer goods are benefitting from cheap and easily available financing. Should those benign conditions change, the consumer will have to cut back on spending. It is hard to see the Fed increasing interest rates under these circumstances. If it did raise rates nevertheless (as it is trying to telegraph to markets), it would be seen as a policy mistake. Therefore, the dollar might not strengthen, but weaken (counter-intuitively), as market participants would assume a swift reversal of any rate hikes. The US economy might even be pushed into another recession.