What can you do if your investment thesis is not working? Look at the arguments of the opposing camp, see if they are convincing or if your train of thought is holding up.

Whom should we hear for the case against gold? You can’t take so-called “research” from investment banks. They are (best case) clueless, as their only objective is to generate client activity (trust me, I worked in this business for 14 years). Given the recent crash in gold prices, what do you think is more likely to propel an investor into action – a call to “catch a falling knife” (“Buy gold now”) or a call to “cut your losses and get rid of that nasty investment”? Fear of losses is greater than fear of missed opportunities.

Let’s take Jason Zweig’s recent Wall Street Journal article “Let’s Be Honest About Gold – It’s a Pet Rock”.

He opens with a valid question:

“Gold is supposed to be a haven amid hard times and soft money. So why, even as Greece has defaulted, the euro has sunk against the dollar, and the Chinese stock market has stumbled, has gold been sitting there like a pet rock?”

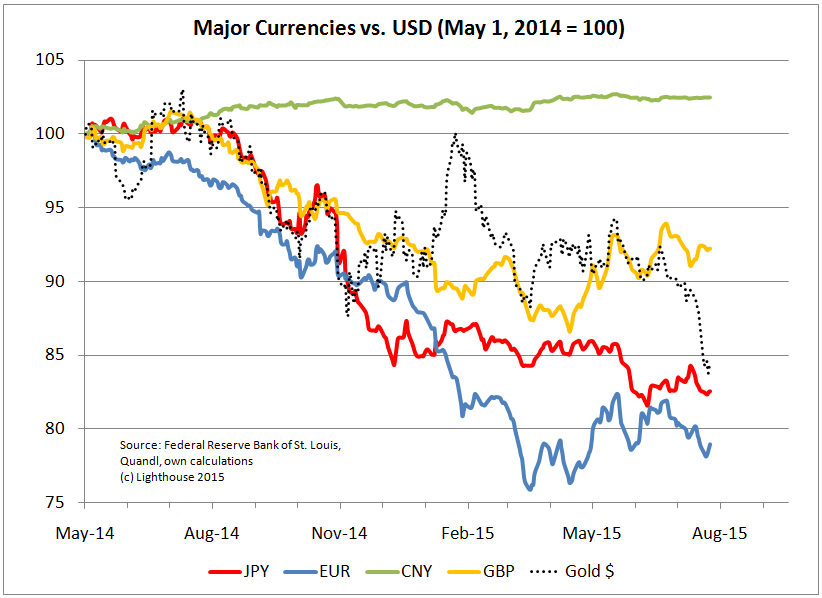

Yes, Greece recently defaulted on a (relatively small) payment to the IMF. Yes, the Euro has declined against the Dollar. But that is also a function of a strong Dollar. Strong Dollar usually means weak gold. If all major currencies (except the pegged Yuan) fall against the Dollar, would you rather say all three are weak or the Dollar is strong?

Gold, despite its recent crash, has beaten the Euro and the Yen since May 2014.

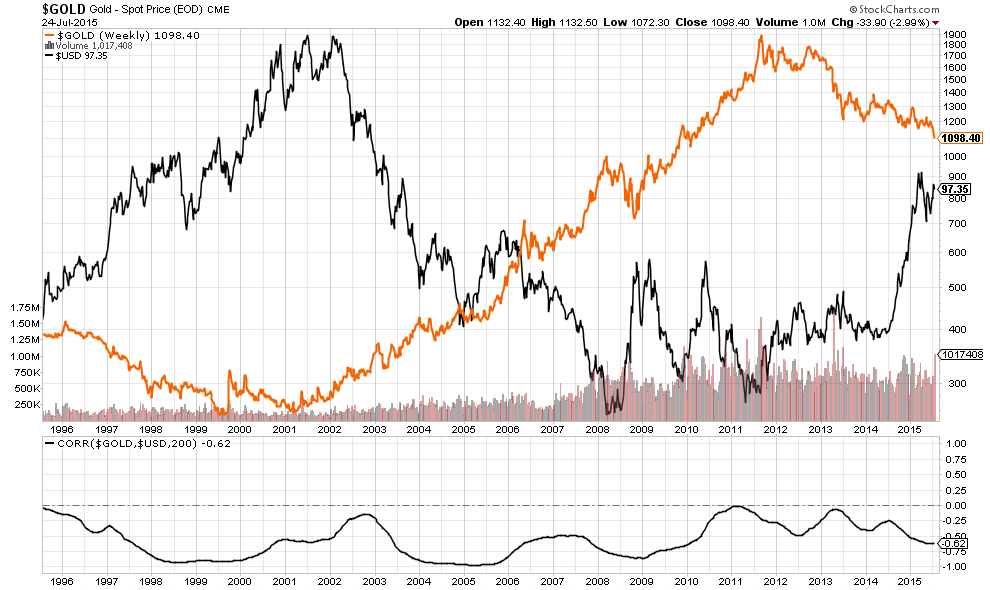

Over the past 20 years, the correlation between gold and the US Dollar has always been negative:

I don’t see why a falling Euro should have boosted the gold price.

Zweig continues:

“Many people may have bought gold for the wrong reasons: because of its glittering 18.7% average annual return between 2002 and 2011, because of its purportedly magical inflation-fighting properties, because it is supposed to shine in the darkest of days. But gold’s long-term returns are muted, it isn’t a panacea for inflation, and it does well in response to unexpected crises—but not long-simmering troubles like the Greek situation.”

It’s probably fair to say many investors were attracted to gold by its stellar performance. But doesn’t that apply to most investments? And if past positive performance is not a good indicator for future performance, wouldn’t the same apply to recent negative performance?

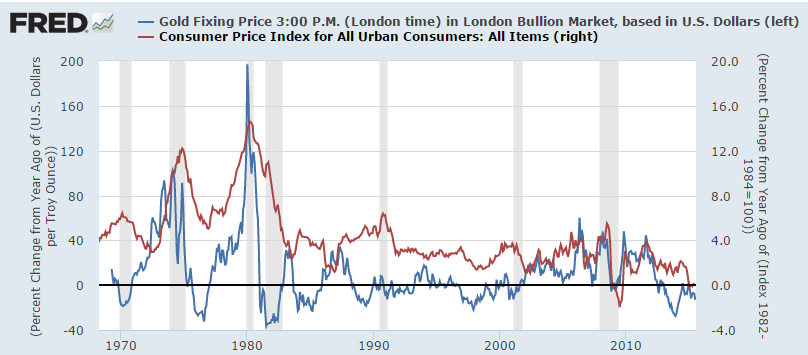

“Purportedly magical inflation-fighting properties”: That statement implies gold was not offering protection from inflation. Let’s look at the facts:

During the one period of elevated inflation (1974, 1980), gold offered perfect protection. Even smaller spikes of inflation (2005, 2008, 2011) seem to reflect on the gold price.

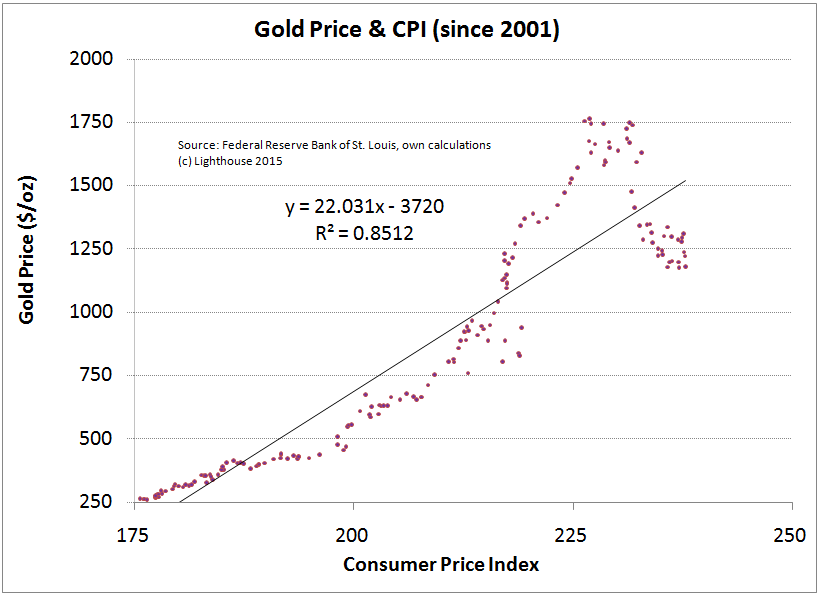

The correlation coefficient (r-squared) between gold price and US consumer price index since 2001 is remarkably high (0.85):

More from Zweig:

“It is time to call owning gold what it is: an act of faith.”

That is a pretty bold statement considering our current (fiat) monetary system is less than 50 years old, following 5,000 years of gold- and silver-based systems.

From Wikipedia:

Fiat money is currency which derives its value from government regulation or law. The term derives from the Latin fiat (“let it be done”, “it shall be”).

Our current monetary system is backed by – nothing. A dollar note is a non-interest bearing debt without maturity issued by a privately-owned bank (Federal Reserve Bank System levered 70 times (July 2015: $4.5 trillion assets, $64 billion capital). You have no assurance the issuer won’t print a lot more of those notes, thereby devaluing yours.

As soon as you deposit that note in your account at a bank you become a creditor of that bank. Your money may continue to exist as pixels on a screen, or bytes on a hard disk. Your deposits may be “bailed-in”, as depositors in Cyprus had to learn. Or access to your funds may be limited to a few Euros per day, as savers in Greece recently experienced.

How is that not based on faith?

Zweig:

“Own gold if you feel you must, but admit honestly that you are relying on hope and imagination.”

Hmm…

“Recognize, too, that gold bugs—the people who believe in owning the yellow metal no matter what—often resemble the subjects of a laboratory experiment on the psychology of cognitive dissonance.”

Why wouldn’t it be the other way ’round – fiat money believers are the actual lab rats?

“When you are in the grip of cognitive dissonance, anything that could be regarded as evidence that you might be wrong becomes proof that you must be right. If, for instance, massive money-printing by central banks hasn’t ignited apocalyptic inflation, that doesn’t mean it won’t. That means it is more likely than ever to happen—someday.”

What is money? Is the definition limited to cash (notes and coins, $1.3trn)? Would you include short-term ($1.1trn) or long-term deposits ($188bn)? If I can buy a car financed by a car loan, doesn’t that qualify as “money” for the car dealer, too? Does he care if he is paid in cash or credit? So isn’t total money therefore all of the above ($59trn)? Should we include derivatives? Globally?

The Fed’s balance sheet as increased from (roughly) $900bn in 2008 to $4.5trn, or $3.6trn. Excess reserves of US banks went up from practically zero to $2.45trn, meaning that two thirds of the money “printed” by the Fed came right back. Only one third, or $1.15trn, “made it out into the real economy”. Meanwhile, the amount of Commercial Paper outstanding fell from $2.2trn to $1trn. So that’s $1.2trn less in credit (= money) outstanding. Fed’s action neutralized.

Zweig might have countered that the total amount of credit outstanding in the US has, nevertheless, increased by 18% from $50trn to $59trn since 2008. So there is more money around.

The amount of goods and services produced / consumed has also increased, but less. Shouldn’t that lead to inflation?

Not so fast.

M * v = Y * p

Monetary aggregates (M) times velocity of money (v) equals real gross national product (GNP, or Y) times price (p).

You may ramp up M, and still get no inflation if the velocity of money declines. And that’s exactly what is happening. Velocity of money is partially psychological. If I earn $10 and put them in a bank account, those $10 have a velocity of 1. If, however, I feel optimistic about my future income I might not save the money, but hop in a taxi. The taxi driver spends the money at a restaurant. The same $10 now had a velocity of 3.

The problem with money created by central banks (“money printing”) or commercial banks (crediting a customer’s account as he takes a loan) is that this money has to be held by someone at any time. It doesn’t go away (unless central bank reduces liquidity by selling assets or commercial banks shrink their loan book in a credit crunch).

When the Fed launches QE4, the ECB keeps printing money, the BoJ, SNB, BoE, PBoC… in short, all the world’s central banks print money, at what point will you start wondering “wait a minute – this paper money is everywhere”. Stuff has value only if it is rare. Eliminate the rarity value and it becomes worthless. One day, the Federal Reserve and the Treasury might agree to “cancel” trillions of debt under the pretext that it was “simply one arm of the government owing money to another arm”. Or the Fed might be forced to buy Japanese government bonds in order to avoid a default of Japan as its currency collapses and Japanese citizens try to exchange their rapidly devaluing Yen into anything denominated in foreign currencies.

So what could make “v” (velocity) go up and lead to inflation?

- demand-driven (not happening in low-growth economy). Possible if government were to increase demand by substantial deficit spending (e.g. war)

- supply-driven (not enough production capacity; currently unlikely)

- wage-driven (currently unlikely as labor organization is declining, high un- or underemployment)

- tangible asset bubble (housing bubbles in US, UK, Canada, Australia could lead to increased rent)

- financial asset bubble (stocks, bonds, alternative assets. Once bubble bursts, money looking for other places)

- import-driven (currently not the case as dollar is strong)

- commodity-driven (currently not the case as prices of oil, copper etc are falling)

- loss of confidence in fiat currency (possible)

One word on Treasury Securities. There are (roughly) $18 trillion outstanding, of which $12 trillion are “marketable” (the remainder locked-up in intra-government debt). Of those $12 trillion, $2.5 are held by the Fed and $3 trillion by foreign central banks. Hence almost 50% of all marketable Treasury securities are held by central banks (and this doesn’t even include sovereign wealth funds). Central banks are price insensitive. They are political buyers and sellers. How comfortable would you be holding those securities knowing there is a huge, potentially irrational elephant in the same room?

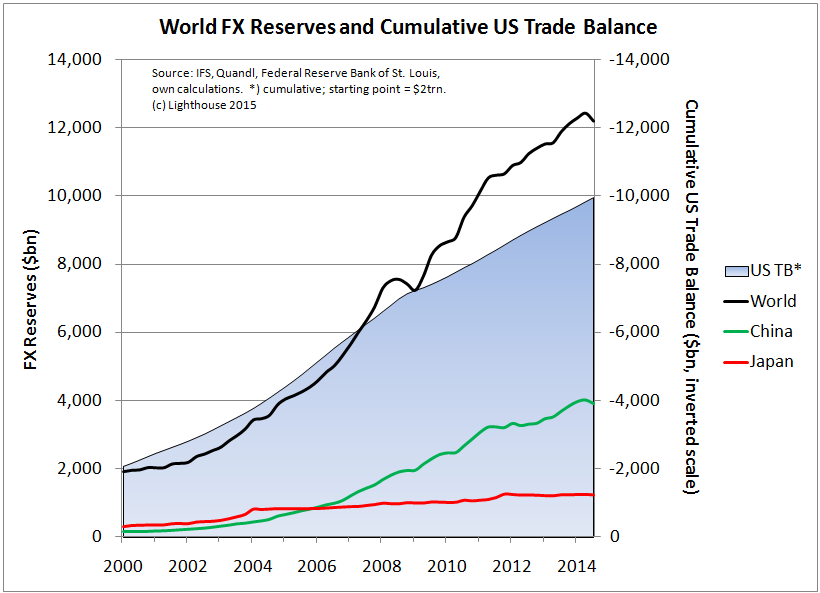

The US has twin deficits (trade and fiscal) that need to be financed. Most of it externally. World currency reserves in US Dollar have increased dramatically in recent years (from $2 to $12 trillion):

China’s appetite for recycling its trade surpluses into Treasury bonds seems to have ended; same for Japan. Those were the two largest foreign buyers.

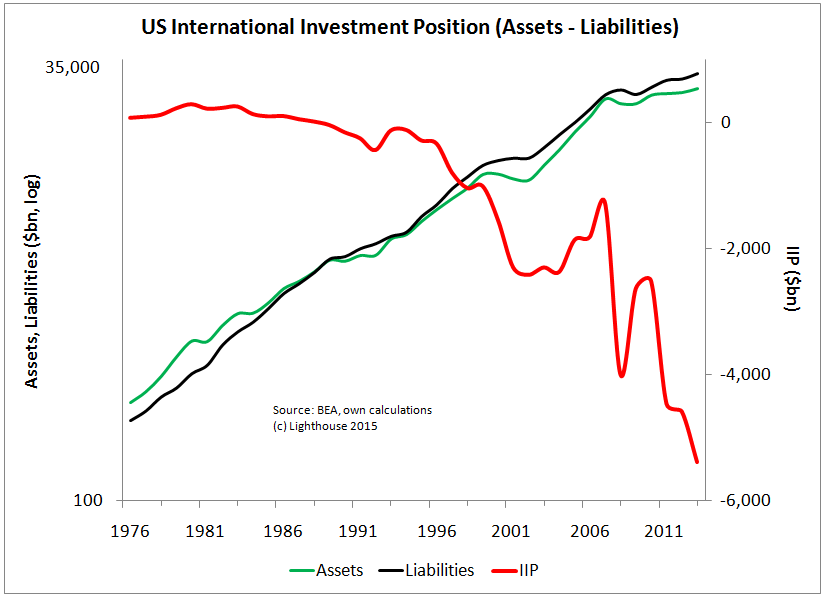

You can let foreigners finance your deficits for a while, but you end up owing more and more debt to foreigners than they owe you. Your “International Investment Position” (IIP) deteriorates. The US used to have a positive IIP until the mid-1980’s. It then reversed and is on an accelerating decline since the financial crisis of 2008:

It will soon reach negative $6 trillion, or 1/3 of GDP. There is a limit up to which foreign creditors (central banks) are willing to continue to finance the US deficits. When that point is reached, a dollar crisis will emerge. The US will have to address its deficits. Imports can be reduced by a recession or dollar cheapening (or both). Both measures hurt the exports of other nations and lead to reduced economic activity.

So my best guess is that inflation will be triggered by a currency crisis.

There is another “excuse” / explanation why recent multi-year money printing has not led to inflation. Increasing debt is inflationary. But a high (and stable) level of debt is, paradoxically, deflationary. Debt needs to be serviced. Only productive assets can produce earnings / cash flow with which to service debt. According to the Bank for International Settlement (BIS), global public and private non-bank debt has reached 260% of GDP. “Persistently low interest rates are a symptom of a debt-fueled growth model”. Or, otherwise said, current levels of debt are extracting so much debt service from productive assets that any interest rate increase would lead to collapse. No wonder the Fed has left interest rates near zero for seven years now.

Back to Zweig:

“There is a case to be made for owning gold, but it speaks in a whisper, not in the shouts of doomsday so customary among gold bugs. Because gold, unlike stocks, bonds, real estate and other financial assets, generates no income, valuing it is all but impossible.”

Why would gold generate income? It’s just a piece of metal. It has no risk of bankruptcy, no counterparty risk, no redemption risk. The only risk I can think of (apart from theft / fire) is that a large meteorite full of gold crashes on earth. Gold is not supposed to generate income. It’s just supposed to exist. Chemical inertia makes it durable for thousands of years. That is all it does.

The Euro-zone (and Switzerland) have played with negative interest rates. If you had a large deposit, the bank would not credit interest, but take something away. Doesn’t that make gold look favorable? Depositors in Cyprus or Greece would probably have been very happy owning some gold instead of having their Euros locked-up or confiscated in their banking systems (without any of their own fault).

I agree on the valuation part. It is not easy. There are some models (based on real interest rates), but I will skip them here.

Back to Zweig:

“Gold is two things, neither of which is easy to price: a commodity and a currency. First, the commodity: At recent prices, mining companies are losing money on more than an eighth of the gold they dig out of the ground, says Ms. Cooper of Barclays. That could lead to a decline in supply. And if demand—even from non-investment buyers like consumers in China or India—rises unexpectedly, there might not be enough gold to go around.”

According to a recent Bloomberg report, leading gold mining companies had the following all-in sustaining costs (AISC) per ounce in Q1 2015: Kinross $957, Barrick $927, Yamana $892, Goldcorp $885 and Newmont $849. Furthermore, gold mining companies sell part of production ahead of time via gold futures. So a depressed spot price takes time to work through their hedges. Anyway – why would an investor in physical gold care about the miners? And why would someone worry about ‘unexpected rise in demand’? The amount of gold ever mined is estimated to be between 160,000 and 185,000 tonnes. That gold still exists (it is never consumed). It is always there as potential supply. We will never run out of gold. It is just a question of price.

For investors in gold mining stocks, however, there is reason for concern. Based on credit default swap rates, the implied probability of default within a year for Barrick Gold is now 71%:

The stock price (in Canadian Dollars, green line above) has declined by 80% since the peak. But the company is still worth US-$ 8.5bn. So before going bankrupt, the company would surely be able to raise money via a rights offering.

If gold remains around current levels, gold miners will have to write down the value of their resources (similar to oil companies) and possibly close some (high cost) mines, but those are mostly non-cash charges. Unless a company is forced to sell some mines or put itself up for sale, its shareholders will benefit once the gold price recovers. Owning a gold-mining ETF makes sure you own those companies able to acquire others on the cheap.

Back to Zweig:

“As a currency, gold has a latent and indeterminate value, Mr. Brodsky says. If the world goes to financial hell in a handbasket, you wouldn’t lug gold ingots to the supermarket so you could stock up on canned goods. But you might pay for those goods with dollars that are again backed with gold, as they were until 1971.”

Now Zweig has me confused. He cites Mr. Brodsky, describing a case where the dollar is again backed by gold. Why would that be the case? Because the current monetary system has collapsed! That is the whole point of gold – it’s the only way to regain the people’s confidence and introduce a new currency.

Zweig’s final paragraph:

“Laurens Swinkels, a senior researcher at Norges Bank Investment Management in Oslo, reckons that the total market value of the world’s financial assets at the end of 2014 was about $102.7 trillion. The World Gold Council estimates that the world’s total quantity of gold held for investment was about $1.4 trillion as of late 2014. So, if you held the same proportion of gold as the world’s investors as a whole, you would allocate 1.3% of your investment portfolio to it. Anything much above that is more than an act of faith; it is a leap in the dark. Not even gold’s glitter can change that.”

I have much more faith in the 1.3% allocated to gold than the 98.7% allocated to paper assets. To me, the current financial system is unsustainable and will probably need a reset within the next few years. Once a crisis hits, markets will move quickly. Possibly too quickly for many to act. As in Greece. One day, you were able to withdraw your entire savings. The next day, it was over.

I am absolutely convinced gold will again play a major role in the future. I know losses in gold- and silver mining companies have been steep, but you will be rewarded nicely for sitting tight. Nobody forces you to sell. Do not realize those losses by selling. On the contrary – I would recommend adding physical precious metals as well as mining companies at current prices.

Back one last time to Zweig. Here he is four years ago, writing on the same subject: