Part 2

(for part 1, please look here)

At the beginning of part 1, I offered three theories to explain what happened on global stocks markets, culminating in the flash crash of August 24, 2015:

- Flash-crash induced by high-frequency traders and panic-covering of short positions in volatility products

- US and China mutually crashing each other’s stock markets in an escalating financial war over AIIB (Asian Infrastructure Investment Bank, a competitor to the IMF) and SDR (Special Drawing Rights, the IMF’s virtual currency)

- The appreciation of the Chinese Yuan versus other Asian currencies hurt Chinese exports and forced the PBoC to devalue the Yuan. This has caused the end of the largest carry-trade in history.

Chinese Stock Market Crash

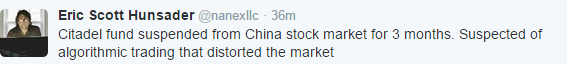

I initially thought I could brush aside theory #2 pretty quickly. But then I read the following:

Citadel, based in Chicago, is one of the largest hedge funds in the world. It masquerades as a market maker, executing 13% of all US stock market and 20% of all US option trading volume. It can safely be called a high-frequency trading firm.

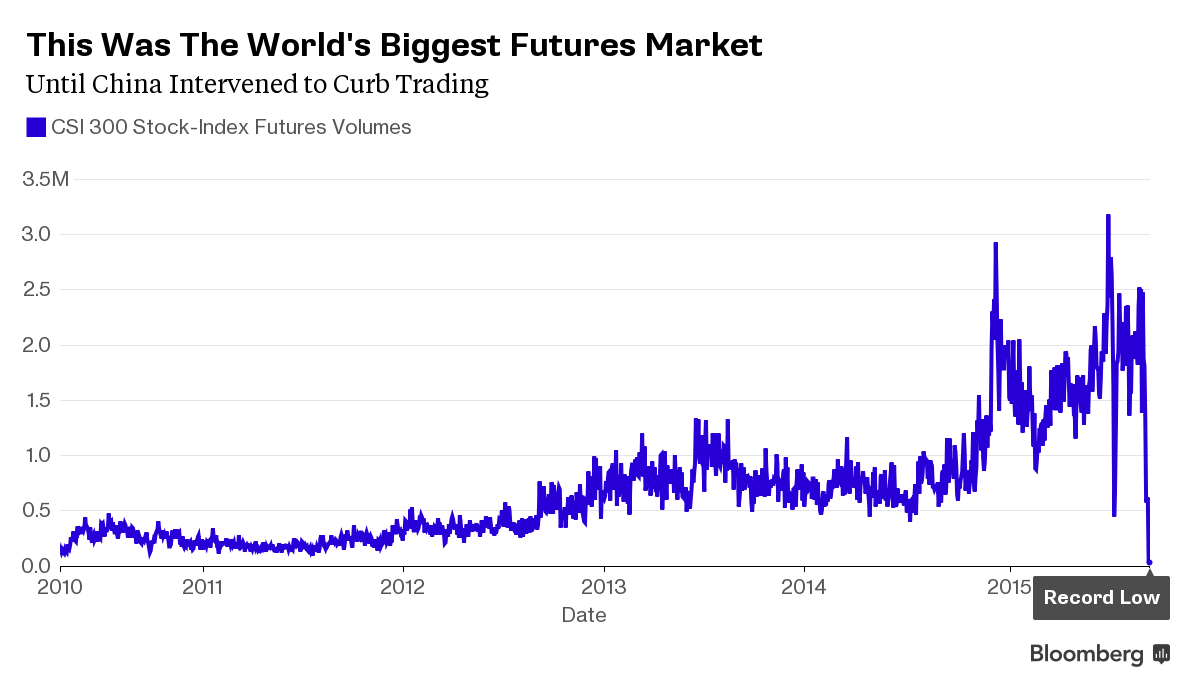

Furthermore, China curbed trading in futures of the country’s prominent market indices, the CSI 300 and CSI 500. Trading volume in CSI 300 futures declined by 99% (!):

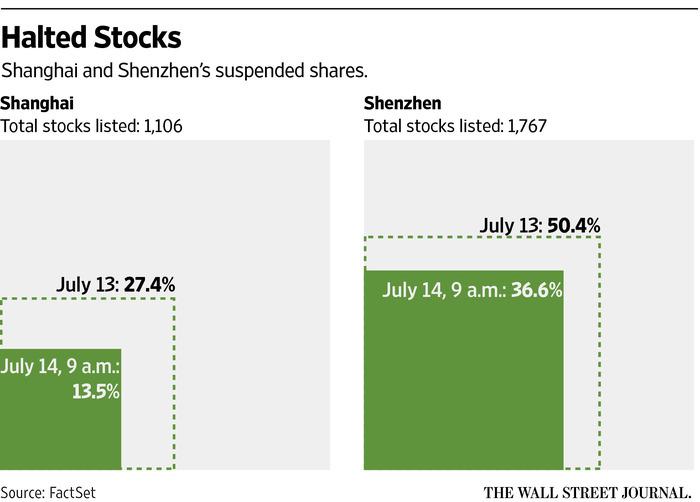

Earlier in July, many stocks listed in China were suspended from trading (peaking at 71% on July 8th):

There were reports of short sellers being imprisoned, portfolio managers being carted away for “re-education” and journalists being forced to apologize for reporting on the Chinese stock market.

Take a look at a 20-year chart of the Shanghai Stock Exchange Composite Index:

Was the Chinese stock market in a bubble? Clearly. Has short-selling and high-frequency trading “helped” making the crash worse? Probably.

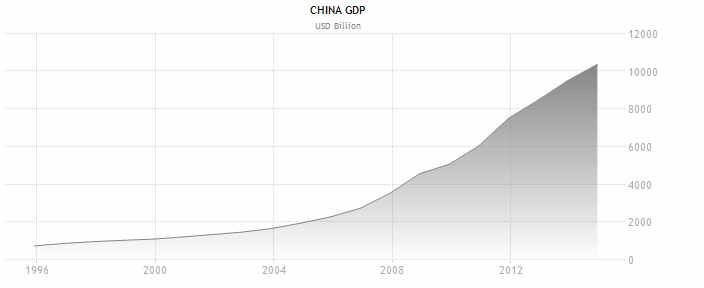

As an aside, consider the growth in Chinese GDP over the same period (in USD):

It went approximately 10-fold. Stocks didn’t do much, except for two bubbles (which quickly deflated). Most investors didn’t make any money in a country with one of the strongest growth rates over the past two decades.

It went approximately 10-fold. Stocks didn’t do much, except for two bubbles (which quickly deflated). Most investors didn’t make any money in a country with one of the strongest growth rates over the past two decades.

Chinese Economy: Serious Slowdown

On August 8, Chinese July export data missed expectations by declining 8.3% (-1% expected). The weakness persisted in August (-5.5%). What happened?

- Chinese wages have risen substantially. Over the past 7 years, monthly minimum wages in Shanghai increased from CNY 690 to 2,020 (+16% per annum). Over the same period, average yearly wages in manufacturing have increased from CNY 15,750 to 51,500 (+22% per annum). Some US companies have moved labor-intensive production back to home (“reshoring”).

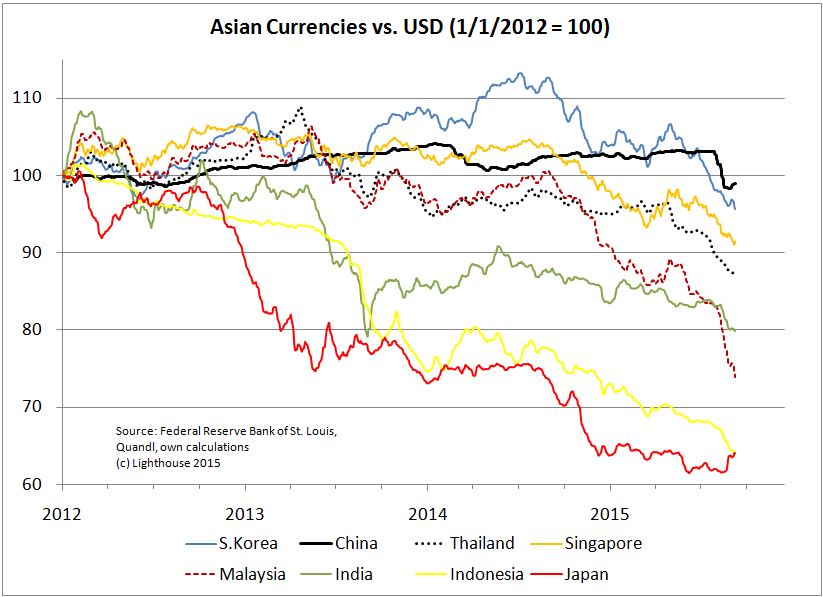

- The Chinese Yuan, due to a soft peg, has not moved much against the US Dollar. However, most other currencies fell against the Dollar. This meant the Yuan appreciated against currencies of competing export countries in Asia (and customer countries in Europe):

- A strong Yuan makes Chinese products less competitive abroad. No wonder exports began to stutter. Additionally, Chinese company margins are getting squeezed from rising labor costs.

- China was coerced into letting its currency appreciate in exchange for its entry into WTO (World Trade Organization):

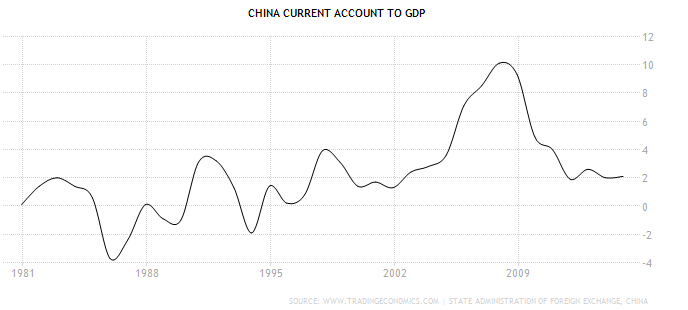

- Foreign Direct Investment (FDI), capital inflows and a large positive trade balance led to a growing positive current account balance:

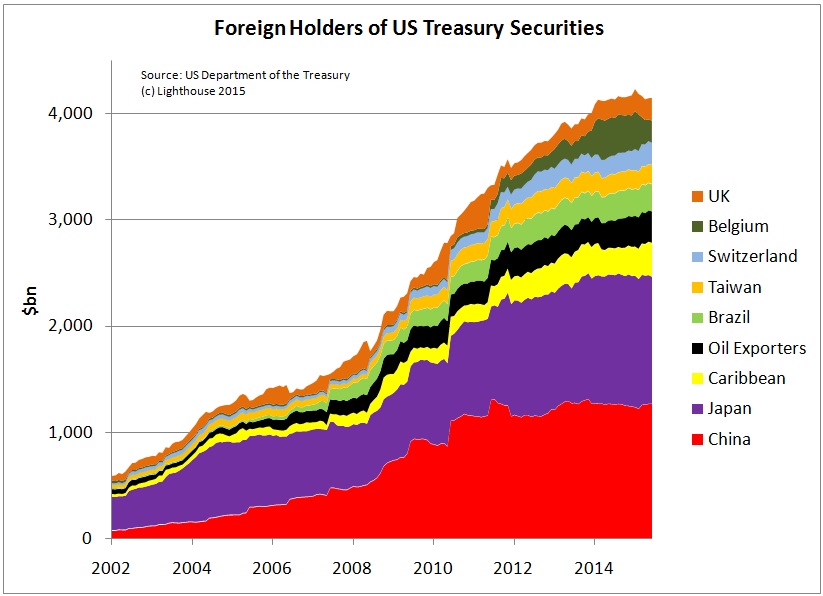

- This enabled China to become the largest foreign holder of US Treasury securities:

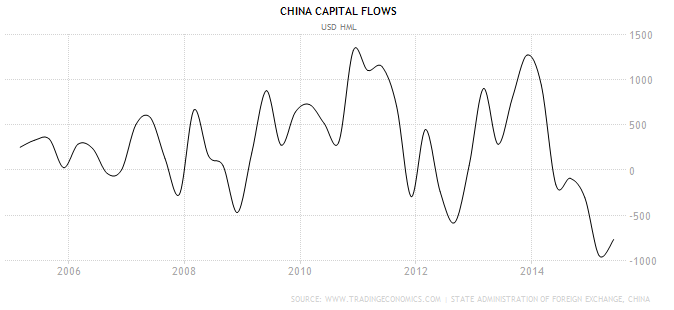

- However, capital flows recently reversed:

Two reasons:

- Wealthy Chinese trying to bring some of their legally or illegally (bribery, crime) acquired wealth abroad. Australian house prices have doubled over the past decade driven by Chinese buying.

- Speculators and hedge funds used to bet on continued appreciation of the Yuan versus the Dollar. It is said to be the largest “carry trade” in history, estimated to have reached up to $3 trillion. In a carry trade, an investor borrows money in a low-yielding currency (USD, Euro or Yen) and investing the proceeds into a higher-yielding one (Yuan, with interest rates between 5.25% and 7.5% over much of the past decade). Usually, interest rate differentials between currencies are being “lost” once you try to lock in your gain by selling forward contracts. However, forward rates in the Chinese Yuan were higher than spot prices as investors expected further appreciation. Carry traders not only benefitted from interest rate differential, but also from currency appreciation on top. You could borrow, for example, Dollars at 1%, buy Yuan, invest at 5%, and get some price appreciation on top. Leveraged a modest 10 times and you could show your investors annual returns of 40-50% without much volatility or draw-down. Every hedge-fund managers’ dream.

All dreams end at some point, and so did this one.

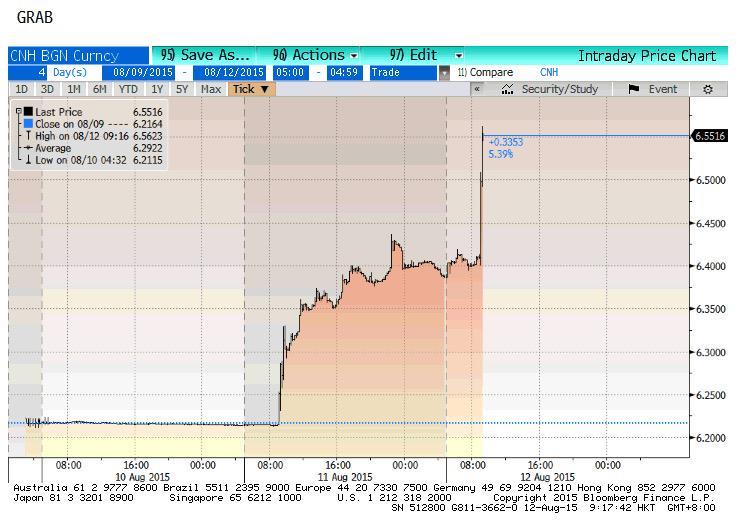

On August 11, the (more freely traded) offshore Yuan began dropping against the USD after the PBoC (People’s Bank of China, China’s central bank) allowed its price to fall (upwards move in chart means weaker Yuan):

- The Yuan devaluation came as a shock to most market participants.

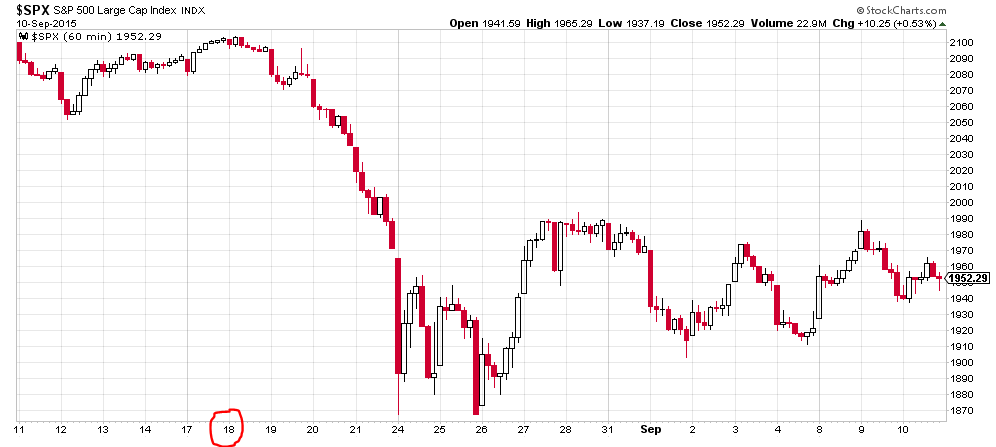

- Equities and currencies began moving, initially contained, then culminating in a waterfall-like movement on Monday, August 24:

- The Shanghai Stock Exchange Composite Index (SSEC) fell 4% on Friday before the flash crash, 8% on Monday and another 8% on Tuesday for a three-day loss of 19%.

- The Japanese Yen strengthened from 124 JPY/USD to 116.

- Remarkably, the Euro also rallied, from 1.10 to 1.17.

- This is an indication of large carry trades being unwound. Yen and Euro had been borrowed (thanks to low interest rates) and sold short. Unwinding those trade meant to buy back Yen and Euros.

Chinese Yuan: Ambushed Ambitions

A five percent devaluation does not seem significant – unless this was just the beginning. Back in 1994, China devalued the Yuan by roughly one third. This put pressure on other Asian currencies, eventually leading to the Asian crisis 1997/98:

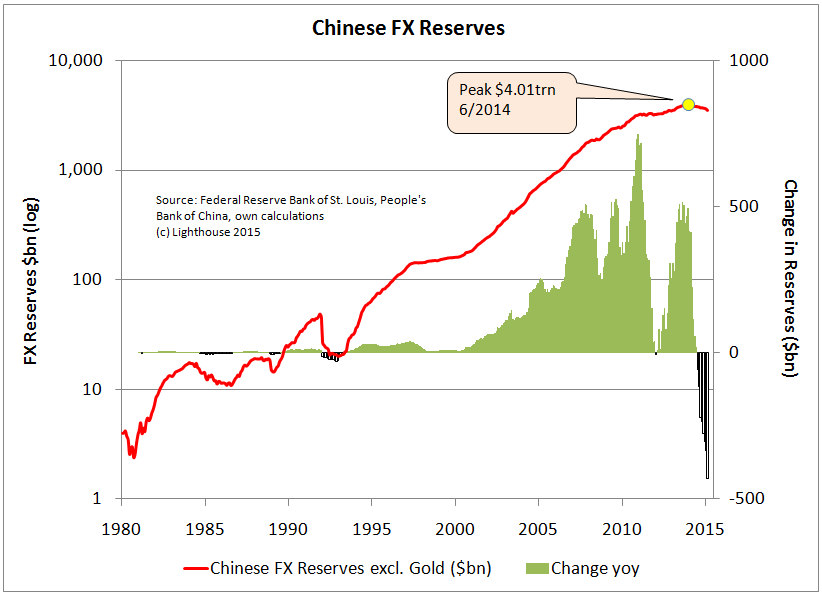

All signs point towards a repeat of a larger devaluation. Not because the PBoC wants to devalue, but rather because it cannot prevent the Yuan from falling. Take a look at foreign currency reserves (mostly USD) at the PBoC:

Reserves peaked at a little over $4 trillion in June 2014. Since then, reserves declined by over $450bn. August alone saw a decline of $94bn. So with a slightly positive trade balance, capital outflows must be even larger. The PCoC is intervening to support the Yuan (buying Yuan, selling Dollars). This causes Dollar reserves to fall.

The PBoC will not watch its reserves flying out of the door for too long. Eventually, the pressure will become too high. So how do you devalue? Trying a pro-rated withdrawal just invites speculators to bet on further weakness. You have to do it overnight. Go large or go home. Carry traders will lose their shirt.

The PBoC is at the other end of the carry trade. It is long the (low-yielding) Dollar, and short (higher-yielding) Yuan. A negative interest spread on $4trn of reserves is costing the PBoC $200bn a year. By devaluing its currency by, say, 25%, the central bank “makes” roughly $1trn (as its remaining Dollar reserves appreciate in Yuan).

Chinese Prime Minister Li recently complained that the decline in commodity prices lowered China’s income from tariffs, putting its finances under pressure. He also stated that the Yuan devaluation was prompted by weakness in other currencies.

In July, China switched towards reporting FX reserves (and gold, by the way) on a monthly basis (previously: quarterly). The PBoC has adopted the IMF’s “Special Data Dissemination Standard” (SDDS), a step likely done in good faith.

The Chinese have refrained from competitive devaluation for more than 20 years, motivated by WTO accession and potential inclusion of the Yuan in the SDR (Special Drawing Rights) currency basket. This was expected to happen the end of 2015. However, on August 4th, the IMF announced the Yuan would not be included at this time (allegedly since SDR users have requested more time to prepare for such a move – a bogus excuse in my view). With the IMF removing the SDR “carrot” at the last moment, China does no longer feel obligated to adhere to fairplay. A new round of competitive devaluations in Asia and Latin America seems unavoidable.

Possible ramifications for Emerging Markets:

- Emerging Market (EM) central banks try to defend their currencies by selling dollars and rising interest rates, thereby throwing their economies into recession

- A drop in EM currency leads to bankruptcy of companies with unhedged debt in foreign currency (usually US Dollar)

- Drop in EM currency leads to imported inflation, cutting into domestic demand, possibly leading to social unrest

- EM borrowers lose access to bond markets. Even otherwise

- Exports from Developed Markets (DM) into EM suffer. DM Companies close loss-making foreign subsidiaries, take write-downs

- DM banks have to write-down EM loans

- A global recession ensues

Privilege of Reserve Currency

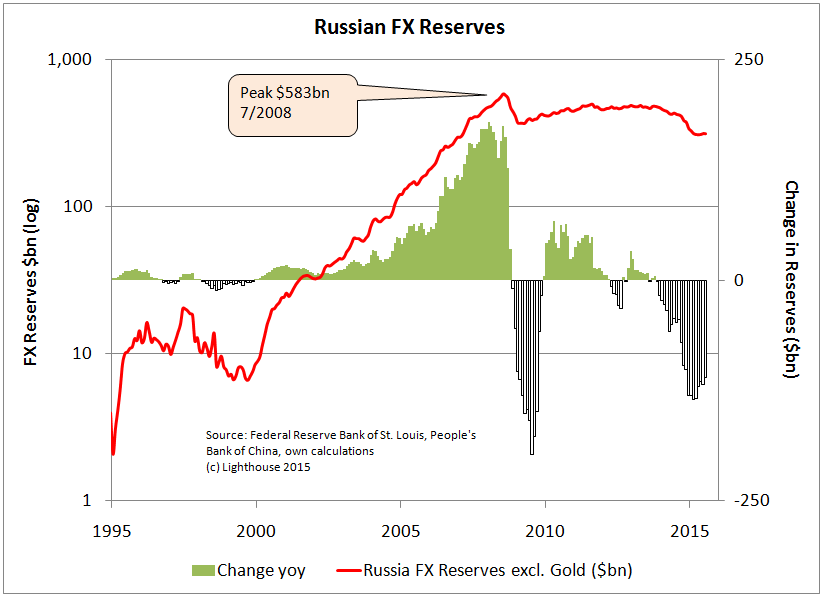

- China is not alone in losing FX reserves; Russia has lost about half (from roughly $600bn to 300bn):

- Foreign exchange reserves are falling everywhere; even Algeria is down to $159bn at the end of June from 179bn at the end of 2014.

- Some of the decline, at least for oil-exporting countries, seems to be linked to the decline in oil prices. Less Dollars coming in while same amount of Dollars going out for essential imports.

- One theory goes as far as saying that the US is not interested in low, but rather high oil prices, as this would boost foreign demand for US Dollars. This in turn would enable the US to run a large current account deficit without negative repercussions on its exchange rate.

- The game would be over once oil-exporting countries stop pricing oil exports in US Dollars. China plans to introduce a Yuan-based oil price benchmark, which will compete with Brent and West Texas Intermediate (WTI).

It is no secret China (and many others) are not happy with the US Dollar (and therefore the US) dominating our monetary system. Almost all commodities are exclusively priced in US Dollars. What at first sight seems like a convenience turns out to be one of the keys to world dominance. Advantages of the US Dollar being the world’s reserve currency:

- The US will always be able to buy commodities, as it can print the currency to be delivered in exchange

- Countries not using the US Dollar will have to acquire US Dollars first before being able to pay for, say, crude oil. This creates a demand for Dollars of around four billion dollars per day alone from oil consumption (assumed consumption in non-USD countries of 80m barrels per day x $50 per barrel).

- Central banks of oil-exporting countries are forced to absorb those Dollars and become captive investors in US Treasury securities.

- Countries pegging their currencies to the US Dollar are forced to buy Dollars if the US runs an expansive monetary policy and floods markets with Dollars. Buying Dollars means selling its own currency. This expands monetary supply, which can lead to inflation. The US thereby can export inflation. Detrimental effects of US monetary policy pop up abroad.

- Algeria, for example, is not able to sell its oil in its own currency. Where would, say, Italy get those Dinars from? The market in Algerian Dinar is not big enough. Hence Algeria prices its oil in Dollars, and accumulates them at the central bank. Why not in Euros? Most countries that tried to price their oil in anything other than the Dollar have experienced sudden appearance of F-16’s in their skies.

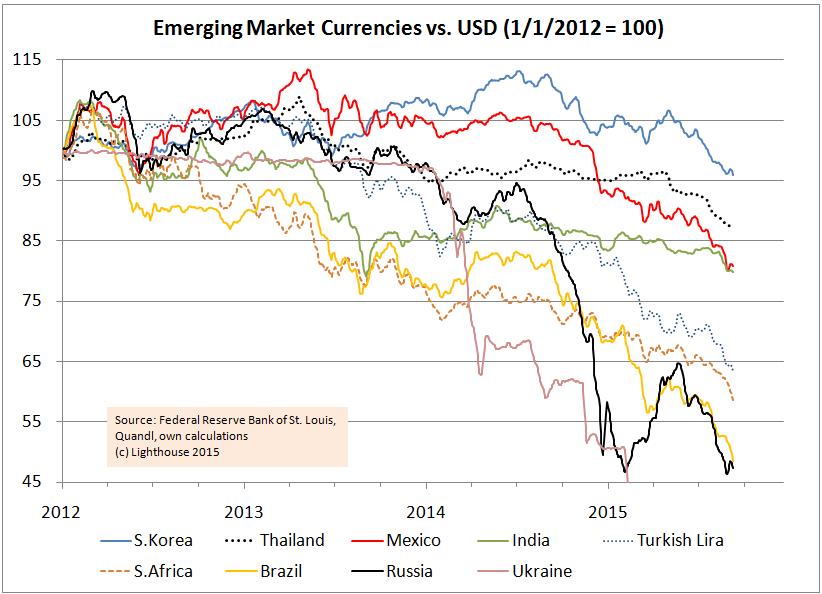

- US goods make up only six percent of Turkish imports. However, 60% of its imports are priced in US Dollars. Since the end of 2012, the Turkish Lira dropped 35% against the Dollar. From the perspective of a Turkish importer, the Dollar rose from 1.78 to 3.03, or 70%. If 60% of your imports go up by 70% will get you inflation (around 7% for now). Turkey’s consumer price index went from 200 in 2012 to 260 (+30%). This (normally) forces the central bank to raise interest rates, just at a time when the economy slows down. If the central bank tries to support the exchange rate by purchasing Turkish Lira (and selling Dollars) it make matters worse by shrinking the monetary base. Should it run out of Dollars to sell, the country may become unable to pay for imports or service any Dollar-denominated debt. Turkish companies with (unhedged) foreign currency debt positions will see their credit rating downgraded and might default on their debt. In short: total mayhem.

Emerging Markets in Turmoil

- Look at Emerging Markets currencies:

- This is a full-blown Emerging Market crisis. Strangely enough, the crisis has not yet reached those nations’ foreign currency government bonds.

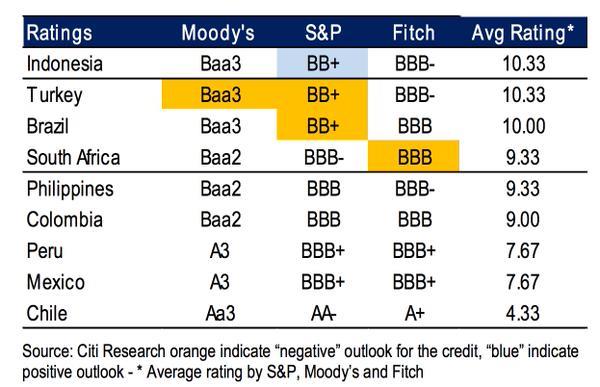

- Meanwhile, sovereign ratings are under pressure:

- USD-denominated Brazil government bond yields jumped from 5.5% to 6% after the country’s rating was reduced to ‘junk’ by S&P on September 9th.

- How low can the Turkish Lira fall? There is no limit. The Turkish Lira, as all other currencies, are not backed by anything but trust (in the country’s central bank, political and social stability, demographics, foreign debt, overall debt, current account, capital flows, etc).

- Russia, the US’s old foe, is not only forced to accumulate Dollars. Those Dollars remain on an account as a US bank (in the name of the Russian Central Bank). In order to earn a tiny bit on those Dollars, Russia invests in US Treasury securities, thereby helping to finance the US budget deficit (and the most expensive military in the world).

- Russia is selling oil and gas in exchange for IOU’s (“I owe you”) from its greatest enemy. It can’t even sell its Treasury securities all at once. The Federal Reserve could simply refuse to execute their sell order.

- Compare this to the effect of a strong or weak Dollar on the US: only 16% of US GDP are imports. It pays to be large. Avocados sold from California to New York do not constitute external trade.

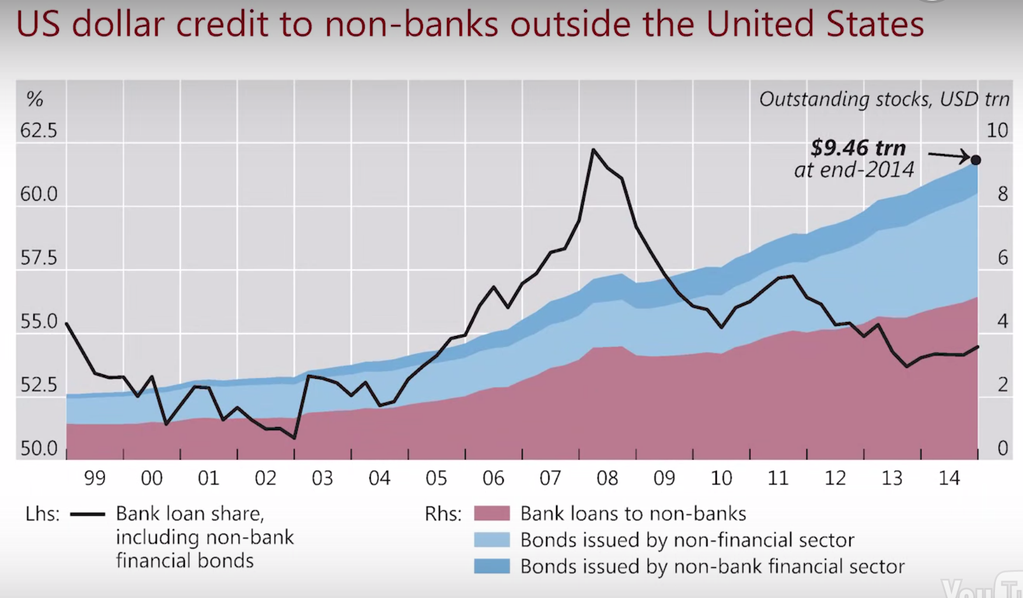

- Since the last crisis (1998) EM borrowing in USD has grown exponentially from $2 trillion to almost $10 trillion:

- EM bulls point towards large foreign exchange reserves as reason why this crisis will not be a repeat of 1997/98. However, those reserves are melting away fast. The build-up in debt eclipses central bank FX reserves by far.

- In the past, elevated debt levels in EM were able to be “cured” by strong GDP growth. With population growth and productivity growth slowing down, there is no such hope.

Future Monetary System

- Many non-US countries are fed up with the dominance of the US Dollar (and, as a consequence, the USA).

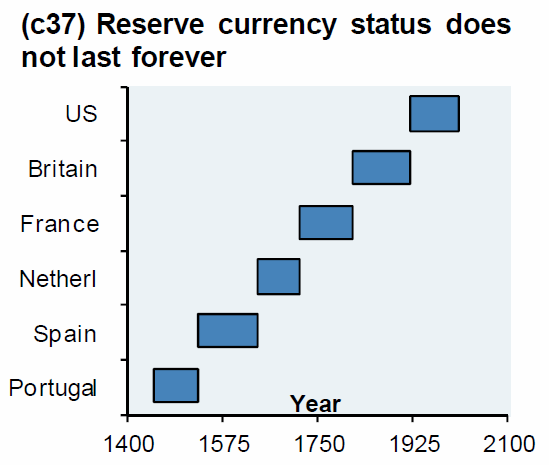

- The past has seen many world reserve currency come and go, like empires:

- According to one theory, a reserve currency eventually destroys itself as large current account deficits are required to supply the world with currency.

- Once the US Dollar loses its role as reserve currency, who could take over? The Euro?

- The Euro-zone counts 333 million citizens and a GDP of $13 trillion (US: 321m / $17trn). The EU has grown towards 508 million citizens and more than $18 trillion in GDP. It has eclipsed the US in potential economic power (but lacks military power).

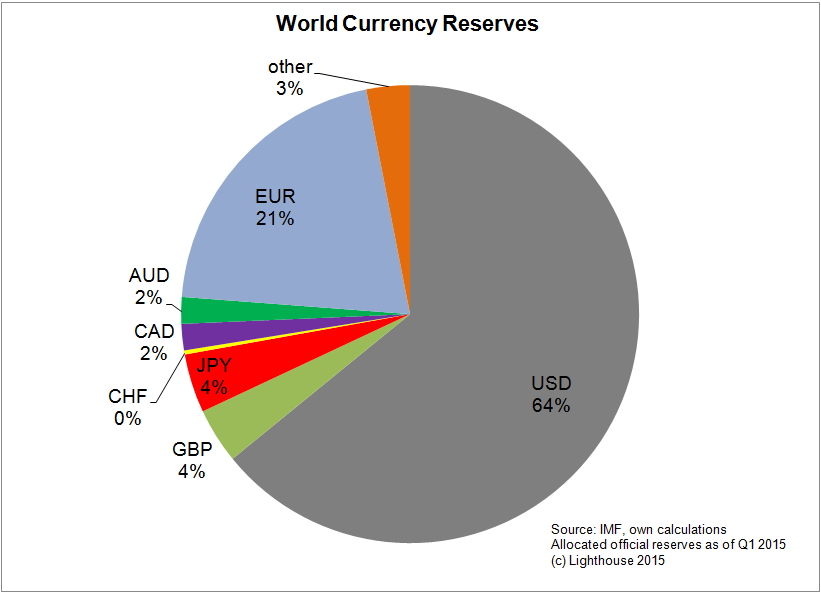

- US Dollar and Euro make up 85% of all world reserve currencies. There is no other currency left large enough to assume that function:

- I initially assumed the Euro could assume the role of reserve currency. However, the Euro area has a current account surplus, meaning more money is coming in then going out (at least at current exchange rates). That would make it difficult to provide enough Euros to the rest of the world. There would be a constant shortage of Euros. Unless the ECB started buying foreign assets in exchange for Euros (which I doubt).

- The future of our international monetary system is unclear. According to a plan by the IMF, all domestic currencies would be abolished and replaced by its currency, the SDR. Control of the monetary system would be completely out of reach of any democratically elected governments.

- China seems to expect significant changes in the near future. It encourages its citizens to buy gold. According to Peter Hambro, Petropavlovsk Chairman and co-founder, 1,700 tonnes of gold worth USD 65 billion have been physically withdrawn from the Shanghai Gold Exchange in the twelve months leading to August 2015. The amount is more than half of the world’s annual gold mine supply. According to one theory, this is to protect its citizens from a large devaluation of the Yuan (gold price would rise in Yuan).

Can the Federal Reserve Raise Rates?

- The Federal Open Market Committee (FOMC, the body that decides over monetary policy) will meet September 16-17. Fed watchers are divided over what will be the outcome.

- After years of zero-interest-rate policy the Federal Reserve urgently wants to raise interest rates. Why? If and when the next recession hits, the Fed cannot lower rates if rates are already at zero percent.

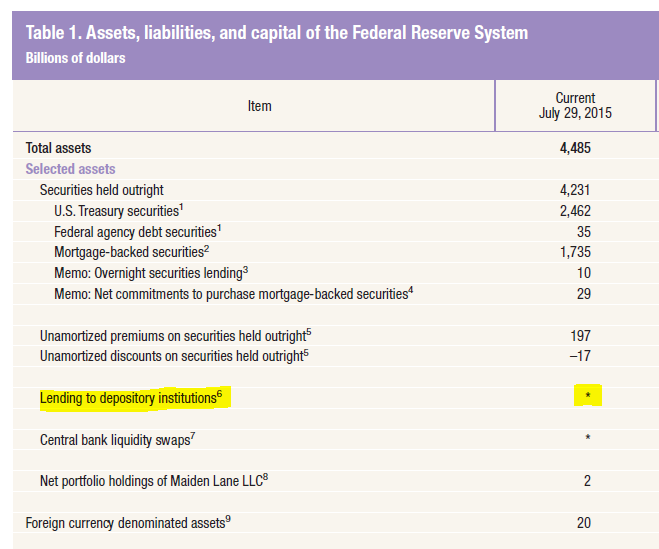

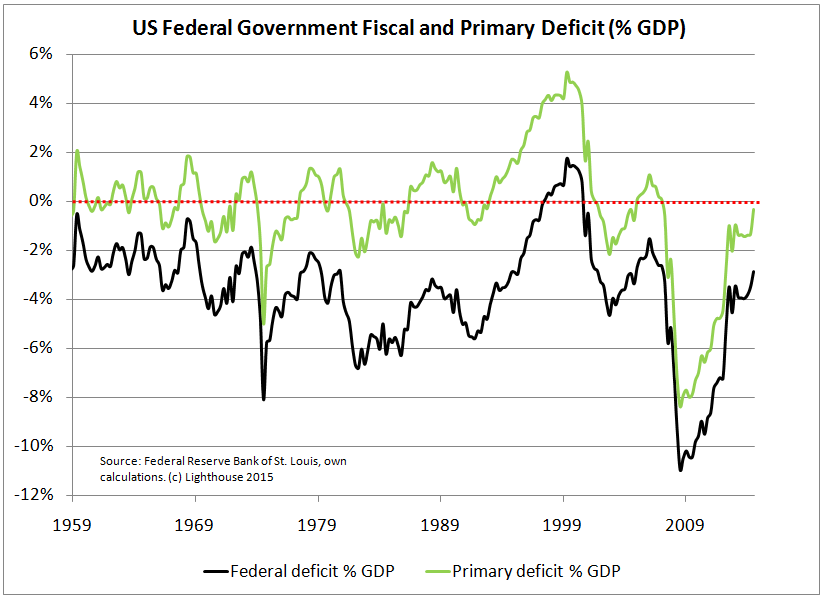

- Can the Fed raise rates? Of course it can. But would it matter? Only if some banks were actually borrowing from the Fed, right? Look at the latest balance sheet:

(The * indicates amounts of less than 500 million; 241m to be exact)

- Nobody is borrowing from the Fed. So how does it want to influence interest rates?

- The Fed determines an upper and lower limit for the Fed Funds Rate (currently 0% and 0.25%). Banks trade reserve balances at the Fed among each other. They negotiate the rate at which one bank with excess reserves lends some of its balance to a bank in need of reserves. The weighted average across all transactions is the so-called “Federal Funds Effective Rate” (currently at 0.14%).

- Before US banks borrow from the Fed they will use their excess reserves parked at the Fed. Look at the Fed’s liabilities (and its meagre capital of 58bn or 1.3% of total assets, resulting in leverage of 76 times):

- Banks have deposited $2.6 trillion with the Fed. Of those, $2.5 trillion are in excess of reserve requirements. The Fed does not pay any interest on those reserves (and earns a huge spread by investing those funds into Treasury securities).

- Given that much excess supply, why would the Effective Fed Funds Rate go up?

- The Fed is aware of this problem. It created a few new tools (reverse repo; would take too much time to explain).

- As the Fed has over-supplied the market with liquidity it might find itself now unable to control short-term interest rates via a lending rate. It might have to try to do so via a deposit rate. However, offering interest on deposits at the Fed would compete with other institutions (like Money Market Mutual Funds). It could lead to unwanted side-effects.

Should the Fed Raise Rates?

- IMF and World bank publicly urge the Fed to postpone rate hikes. That is remarkable. They would have had the option to do so privately. But they chose to go public. This makes it more difficult for the Fed to postpone, because it could be seen as giving in to political pressure. On the other hand, the situation in Emerging Markets must be really dire for IMF and World Bank to resort to public pressure.

- There are two fears: 1 – raising rates would make the Dollar even stronger and escalate weakness of EM currencies (unless their central banks raise rates, too), and 2 – global debt has reached a level where higher interest rates cannot be extracted from productive assets without bankrupting the system.

- However, a lot of Dollar strength has already been anticipated, as seen in this chart of the Dollar Index (a mix of major currencies):

- My personal view is the Fed should not hike rates as the US economy seems to be slowing down. If the Fed raised rates now it might be forced to back down a few months later and reverse course, hurting credibility.

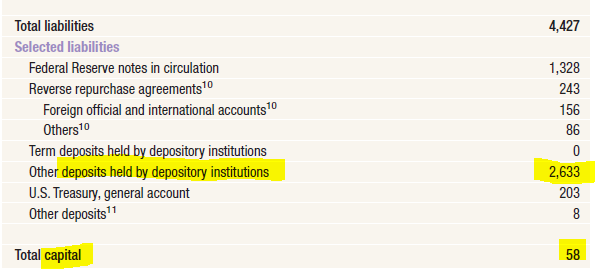

- The ECB infamously raised rates just before the financial crisis 2008. The rate hikes in 2011 had to be corrected shortly thereafter, too:

What Will the Fed Do?

- Probably some combination of a limited increase in short-term rates combined with another round of “Quantitative Easing” (bond purchases).

- The Fed might also give guidance on what it plans to do with maturing bonds in its portfolio. Reinvesting those assets or letting the portfolio “run off”? At a minimum, I would expect reinvestment.

- More extreme versions would include the declaration of a yield cap on Treasury bonds (“we will buy any bonds with yields of 2% or higher). Treasury bond yields would immediately drop below 2%, probably without much buying needed by the Fed. But the Fed wants to buy a lot of assets (in order to pump money into the economy), so this might not be the best approach.

- The Fed could begin buying foreign assets, although this would be considered a hostile act by other central banks and constitute an escalation of currency wars.

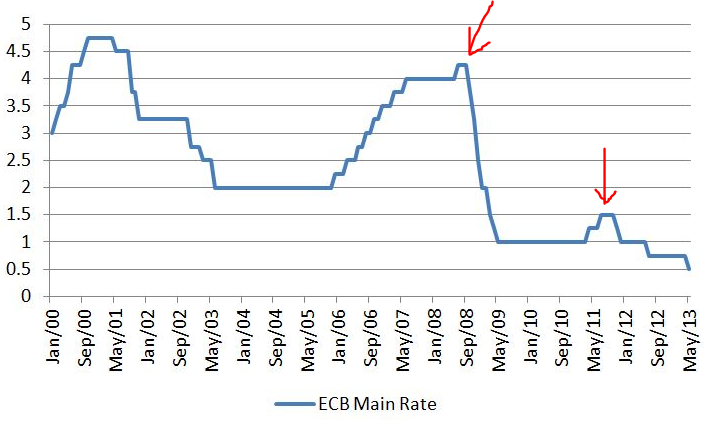

- The federal government could announce another fiscal stimulus plan (just in time for the 2016 presidential election). Believe it or not, the federal fiscal primary deficit has shrunk to 0.3% of GDP:

How will markets react?

- It might not even matter what the Fed announces next week, as long as market participants believe that the Fed has their back and will prevent the economy from falling apart (despite the fact the Fed wasn’t able to do so in 2008/9).

- According to rumors, the Fed helped create a certain “Plunge Protection Team” (PPT), a non-recourse credit line given to a stealth buyer of stocks at the lows of the market in 2009. The PPT could have been selling stocks ahead of FOMC meetings, leading to a drop, then buying back after the news release.

- Market participants, seeing rising stock and bond prices, assume that what the Fed does was “good” for stocks / bonds (even if it might do nothing for the real economy). It’s all about perception.

Longer-term Outlook

- Once the dust settles, problems in Emerging Markets, currency devaluations and downgrades of sovereign and corporate credits will take the upper hand again.

- Volatility and market crashes are like earthquakes – very hard to predict. Long periods of calm suddenly erupt into mayhem. It almost seems as if during long periods of calm stress builds up, almost silently. People get used to the calm, and erect fragile buildings. ZIRP (zero-interest-rate policy) by central banks has suppressed volatility over the past years. Handing out cheap loans to almost anyone with a pulse is all but a guarantee for things blowing up once conditions turn less favorable.

- Was the spike in volatility (to 53, highest in past 20 years with exception of 2008/9) already this year’s earthquake, or simply a tremor ahead of the “big one”? Impossible to tell. Given the state of Emerging Markets I believe the “big one” is yet to come. If the Fed hikes, a crisis will follow. If it doesn’t, the inevitable will only be delayed.