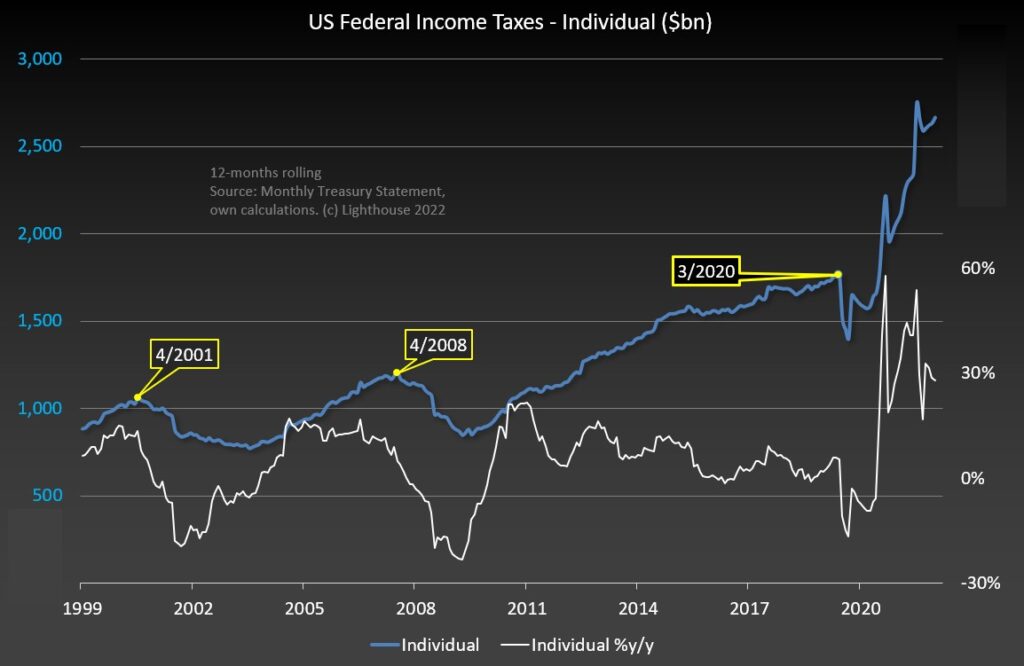

The good news: Individual federal income taxes are STILL growing, and growing at a good clip:

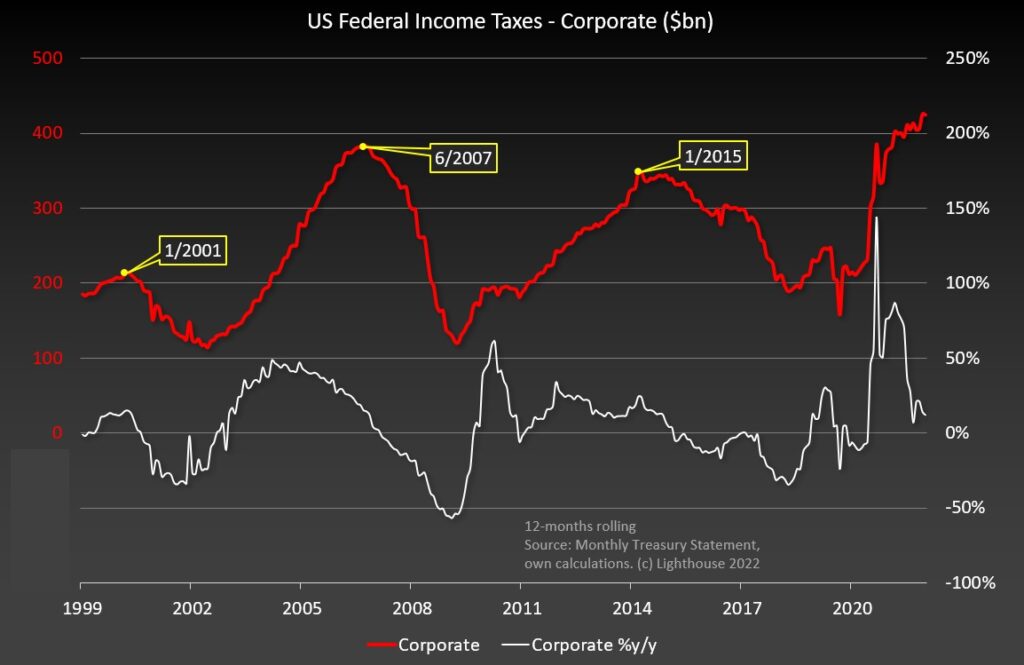

Corporate income taxes are also growing, but barely:

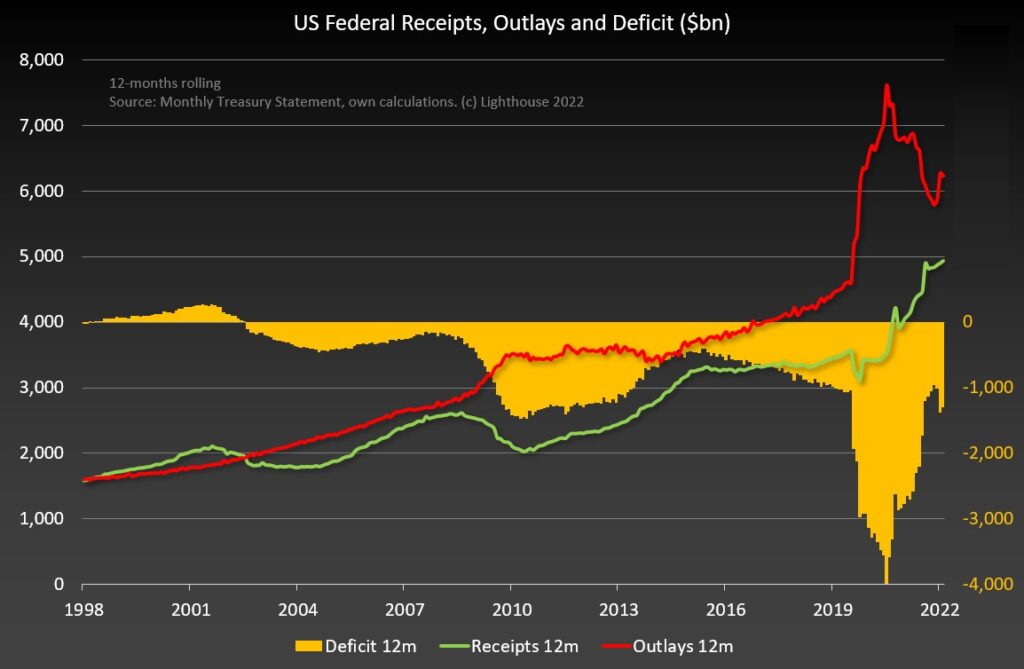

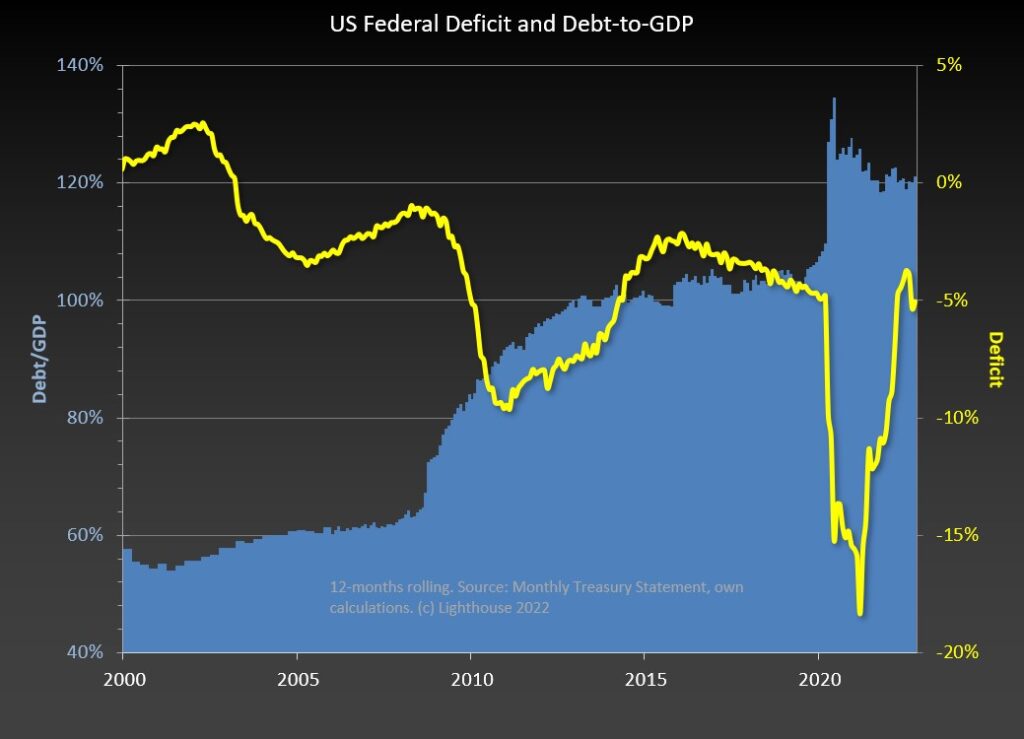

Unfortunately, the gap between receipts and outlays is widening again, and so is the deficit:

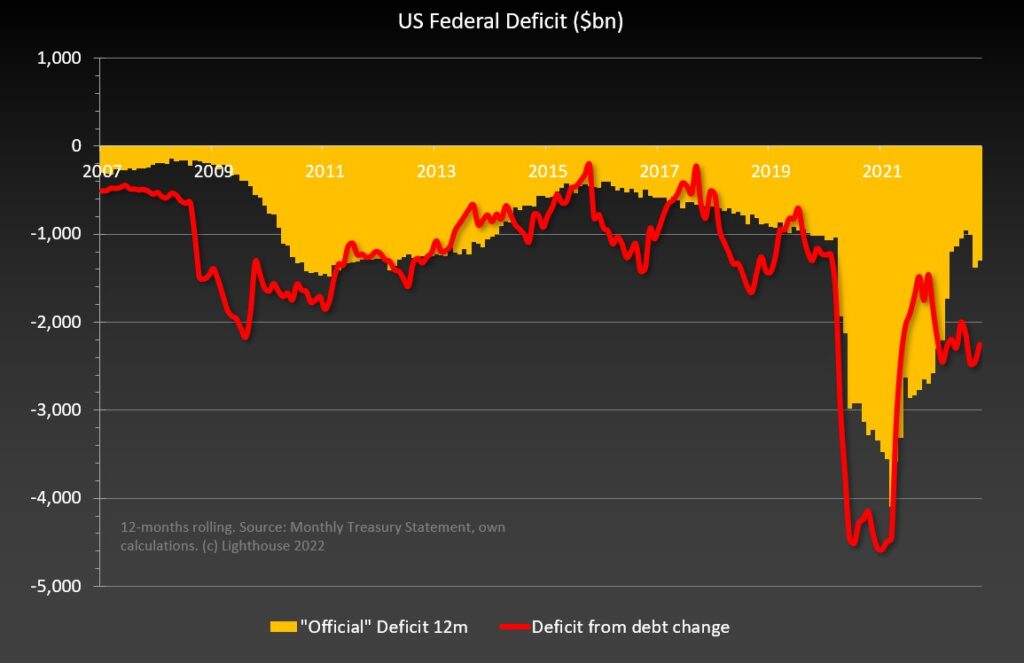

The “official” deficit (last 12 months) stands at $1.3 trillion. However, the actual deficit, as calculated from the change in debt outstanding, amounted to almost twice as high: $2.25 trillion. (The difference between “official” and “actual” is usually not that high – but debt issuance was temporarily restricted by the debt ceiling theatre last year).

In relation to GDP, the deficit stands between 5.1% (official) and 8.8% (actual), result in a debt-to-GDP ratio of 121% (the level where Greece stated blowing up):

CONLCUSION: The US are not Greece, but 120% of GDP times 4% interest rates require close to 5% of GDP just for interest payment. And these deficits are achieved with close to full employment. There better not be a recession or those numbers could get really ugly quickly.