Derivatives are not bad per se. They can help transfer risk. Transfer in time or to a different holder or both. But risk never goes away.

In May 2022, the CBOE (Chicago Board of Options Exchange) introduced options on the S&P 500 stock index with expiration on every single day of the week. Meaning traders now have, on any given day, options available expiring on the same day.

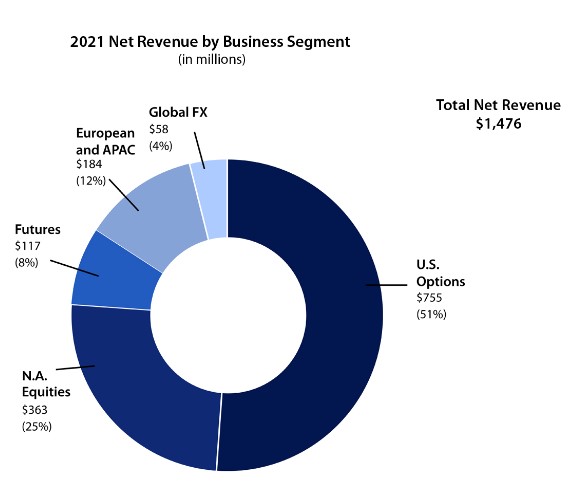

This has led to an insane increase of volume traded (which is intentional, as increased trading leads to increased fee income for exchanges). More than half of revenue of CBOE is generated by trading in US options, which also happens to be the fastest growing segment:

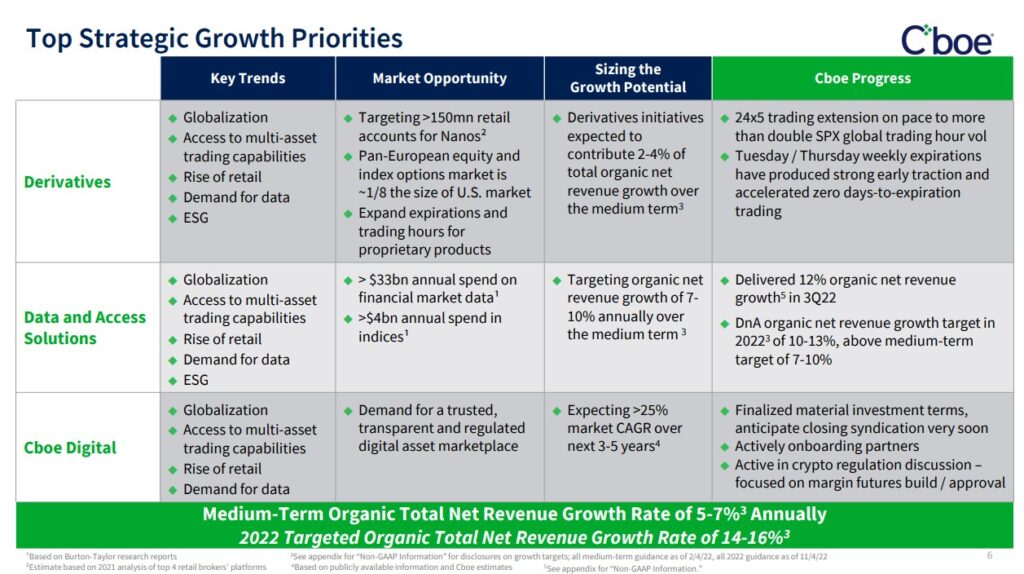

According to “top strategic growth priorities” of CBOE are targeting retail (small investors) and increasing trading in short-lived options (so-called ‘zero days to expiration’ options):

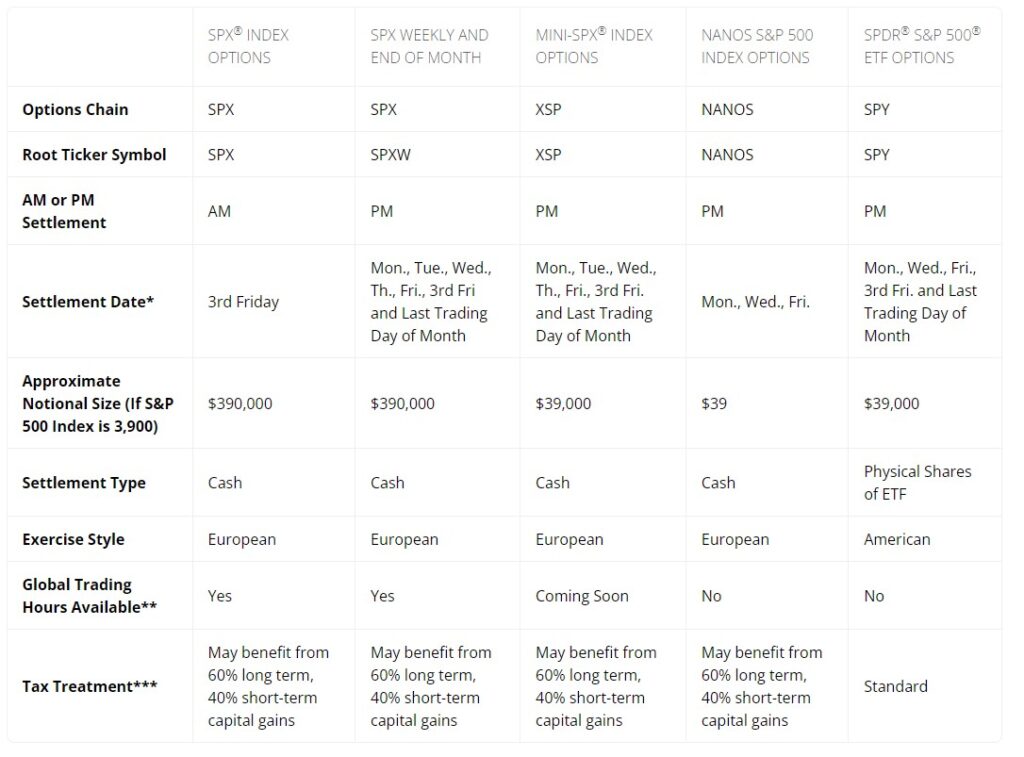

“Nano’s” are retail-sized derivative contracts. The underlying for standard S&P 500 index options are based on 100 times the index value, or currently $390,000 (100 x 3,900). SPX-mini’s are 1/10th of the size ($39,000). Nano’s have been reduced to 1/10,000th of the original size to make it attractive for retail customers. On top of that, there are options on an ETF replicating the S&P 500 index (“SPY”):

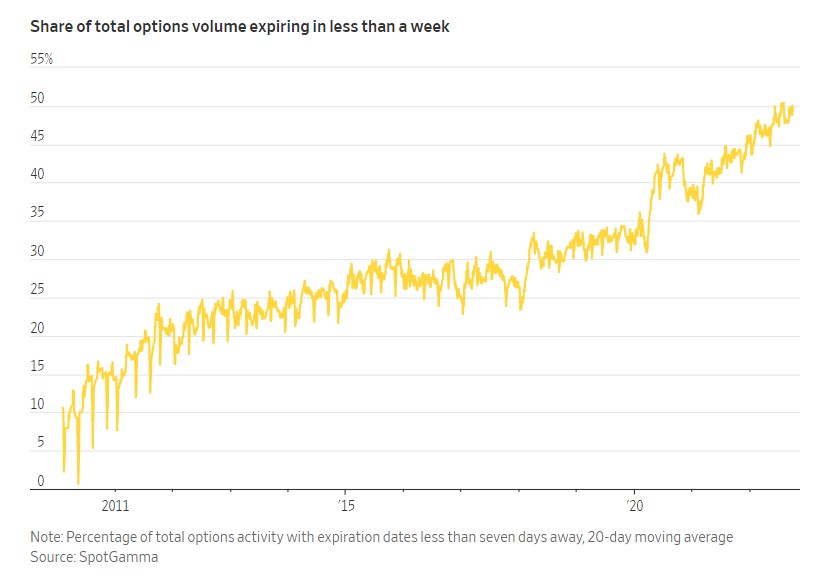

It will not come as a surprise that this has led to an increase in trading in short-dated options. Contracts expiring in 5 days or less now make up more than half of all option trading:

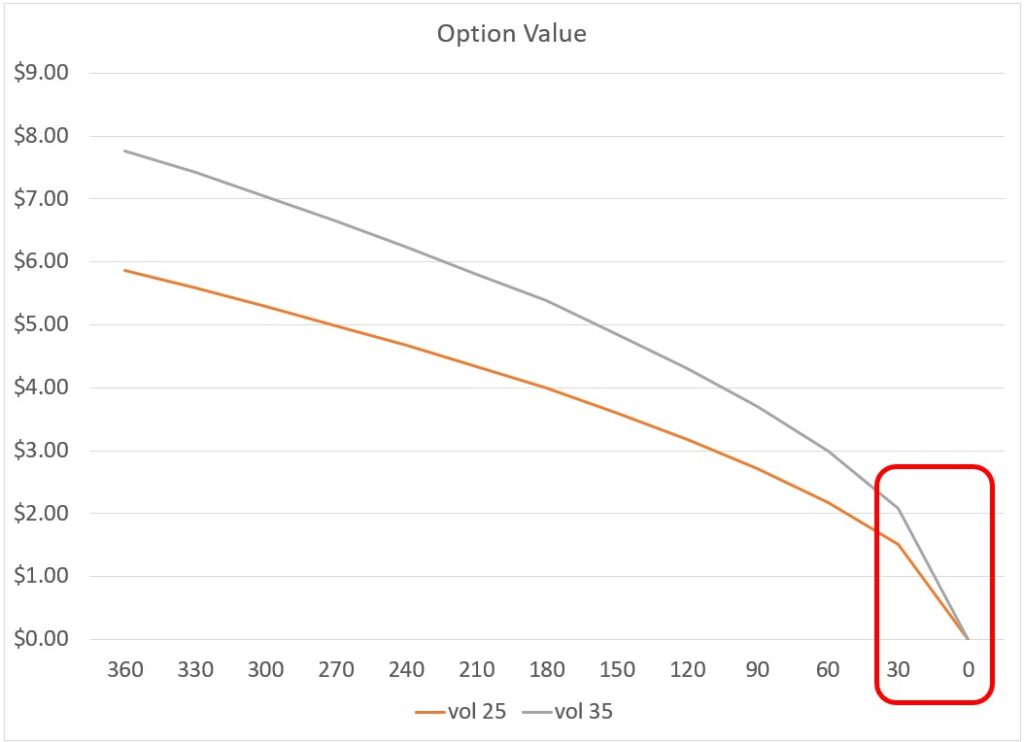

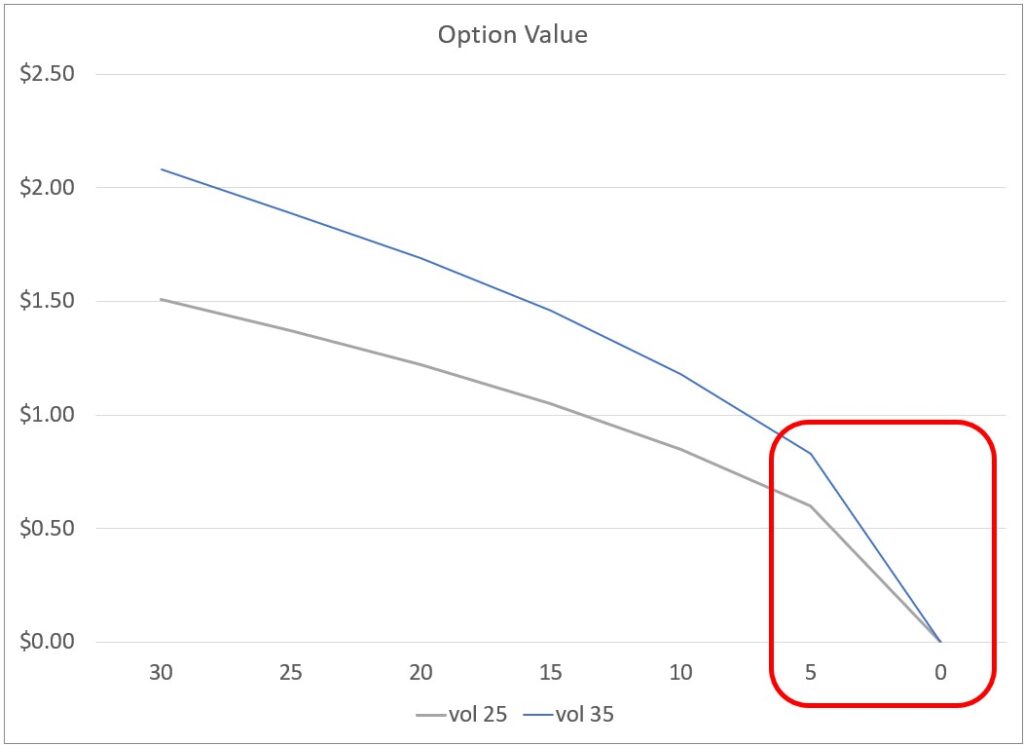

An interesting feature of options is the accelerating decay of time value as expiration approaches. An option with an original life of 12 months will still have left 25-35% of its original value after 11 months (or 92% of time) have passed:

If we zoom into the last 30 days, we get the same picture. After 25 days, with 83% of time passed, these options still have 40% of their value (they had at 30 days) left:

And so on. That’s why short-dated options are so attractive to option sellers. The time decay per time unit is the fastest compared to longer-dated options. Statistically, most options expire worthless. But, if priced correctly, the few options that have intrinsic value at expiration will make up for those losses. If you are a seller of options, you want them to expire worthlessly. But the losses you have to “eat” in case they do not expire are unlimited.

Usually, when you trade options, a market maker is on the “other” side of the trade. The MM (market maker) is not taking any risk, so he will hedge by doing an opposite transaction in the underlying security. Example: you buy Apple calls from a MM. The MM is now short calls, and will buy Apple shares in the market. Option buying in big volumes can therefore move the price of the underlying (Apple shares). As Apple shares go up, the delta of the (call) option increases, forcing the MM to buy more shares. Increasing option trading has therefore an amplifying effect on market swings.

If an option expires worthlessly, the shares bought as a hedge are not needed anymore and must be disposed of, or the MM would have a one-sided position. If, in the hours preceding expiration, the underlying fluctuates around the strike (exercise price) of the option, the MM might be forced to buy and sell large amounts of underlying. This could trigger other MM’s / traders having to do the same, leading to a destabilizing and chaotic situation.

The big option expirations remain the third Friday of the last month of the quarter, and, especially, the December expiration. Most of the option values are concentrated in “round” strike prices, like 4,000 or 3,800. Certain MM’s or traders with large short positions in options with those strikes could try to “pin” the underlying price at that strike, so that these options expire worthless. Other market participants could sniff out those attempted pins and try to steer the underlying price towards a different strike price. One could imagine two “whales” (holders of very big positions) fighting over price during the last minutes (or even seconds) of trading, causing, at worst, trading halts.

The advent of 24-hour trading of options (S&P 500 index and VIX volatility index) bears additional potential for sudden price moves, as the volume in underlying instruments is only a fraction during the overnight hours.

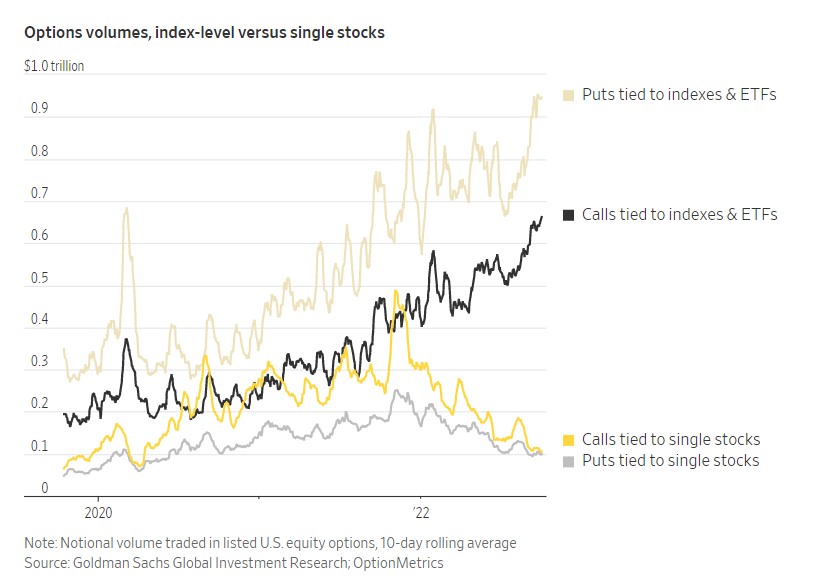

The sheer volume of trading in options is mindboggling. According to data provider OptionMetrics, options on underlying indices and ETF worth roughly $1.6 trillion change hands on an average day:

Derivatives usually mean leverage, and leverage leads to amplification and destabilization. Increasing amounts of trading in ultra-short-dated derivatives are an accident waiting to happen. A flash-crash or sudden rally, without any fundamental explanation, are becoming increasingly likely and more frequent. It is unfortunate that retail investors are being specifically targeted to participate in these games.