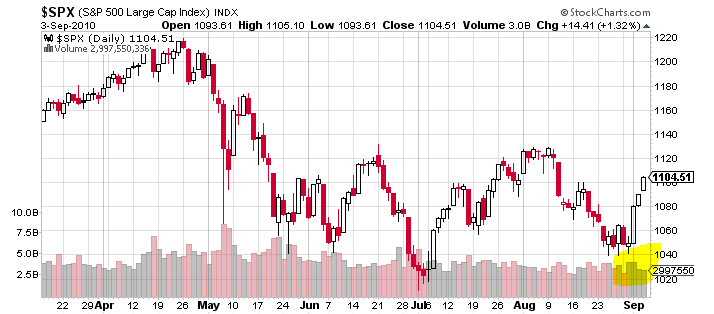

Last week’s 6% bounce in the S&P 500 index was not convincing. There was no volume increase associated with the price increase (usually needed to confirm the uptrend).

Source: StockCharts.com

Many pundits were claiming the market “had” to go up since too many investors were bearish (pessimistic). But as John Hussmann (of Hussmann Funds) pointed out (see below) the percentage of bearish investors hasn’t even reached 40%. But it is increasing, while the VIX (= volatility index; a measurement on expected future price fluctuations) has lagged.

Source: Hussmann Funds Weekly Market Comment, September 6, 2010

Anyway, does investors’ sentiment matter? What if investors polled state they were bearish, but were actually still holding shares? Or what if he was bullish, but forced to sell?

A fund manager, for example, might have by-laws stating he must at all times have at least 95% of funds invested in the stock market (this is to avoid him having all funds lying around in cash or risk-free assets but collecting the fee nevertheless). If the fund faces redemptions (as currently happening for 17 consecutive weeks in US domestic equity funds) and the fund is low on cash the fund manager has to sell – even if he is very bullish for the market.

And what about all this hog-wash on “too much cash on the sidelines” and “investors being under- (or over-) invested”? If an investor has too much cash, and wishes to buy stocks, he has to buy them from someone. That someone then owns the cash (and becomes the one who is “under-invested”). The cash never disappears. Neither do stocks (excluding share buy-backs and IPOs). Someone owns them at the top, and someone owns them at the bottom.